- United Kingdom

- /

- Metals and Mining

- /

- LSE:RIO

Rio Tinto (LSE:RIO) Valuation in Focus Following Steady Multi-Year Share Performance

Reviewed by Simply Wall St

Rio Tinto Group Stock: Is There Value Waiting to Be Unlocked?

It’s easy to see why Rio Tinto Group (LSE:RIO) is on investors’ radar these days. There may not be one splashy headline or game-changing announcement moving the markets this week; however, the steady performance of the shares has caught the eye of those weighing up resource sector giants. Sometimes, it is not a ground-shaking event that prompts investors to revisit their holdings, but rather a consistent drumbeat of returns and the ever-present question of whether a blue-chip miner remains a hidden bargain.

Taking a step back, Rio Tinto Group’s share price movements over the past year capture a steady, almost quietly resilient story. Returns for the year are just under 9%, building on a three-year climb of close to 15% and a five-year gain of 42%. While its year-to-date performance has dipped slightly, the past three months have shown a solid 7% uptick, reinforcing the idea that momentum is not lost. Recent quarters have featured modest revenue and net income growth, but no major strategic shakeups or surprises in headlines. This leaves valuation and underlying business trends in focus for anyone trying to judge where the stock heads next.

So after a year of measured performance, is the market underestimating Rio Tinto Group’s potential, or is all the future growth already baked into the price?

Most Popular Narrative: 8.8% Undervalued

The prevailing narrative suggests Rio Tinto Group is undervalued, with the stock trading below consensus fair value as analysts weigh future growth prospects and execution risks.

Diversification into battery metals (lithium, copper) through acquisitions and organic project delivery positions Rio Tinto to capture rising demand in electric vehicles, stationary energy storage, and grid infrastructure. These areas are expected to have structurally higher pricing and margins than mature bulk commodities, which could drive earnings and improve margin resilience.

Wondering what’s behind this optimistic fair value? The secret sauce is a unique mix of cautious growth forecasts and ambitious profit assumptions, set against industry benchmarks that may surprise you. Discover the exact growth rates and margin shifts that form the backbone of this valuation.

Result: Fair Value of £51.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, longer-term risks such as persistent resource depletion in key mines or unexpectedly weak iron ore pricing could challenge the bullish outlook for Rio Tinto.

Find out about the key risks to this Rio Tinto Group narrative.Another View: What Does the SWS DCF Model Say?

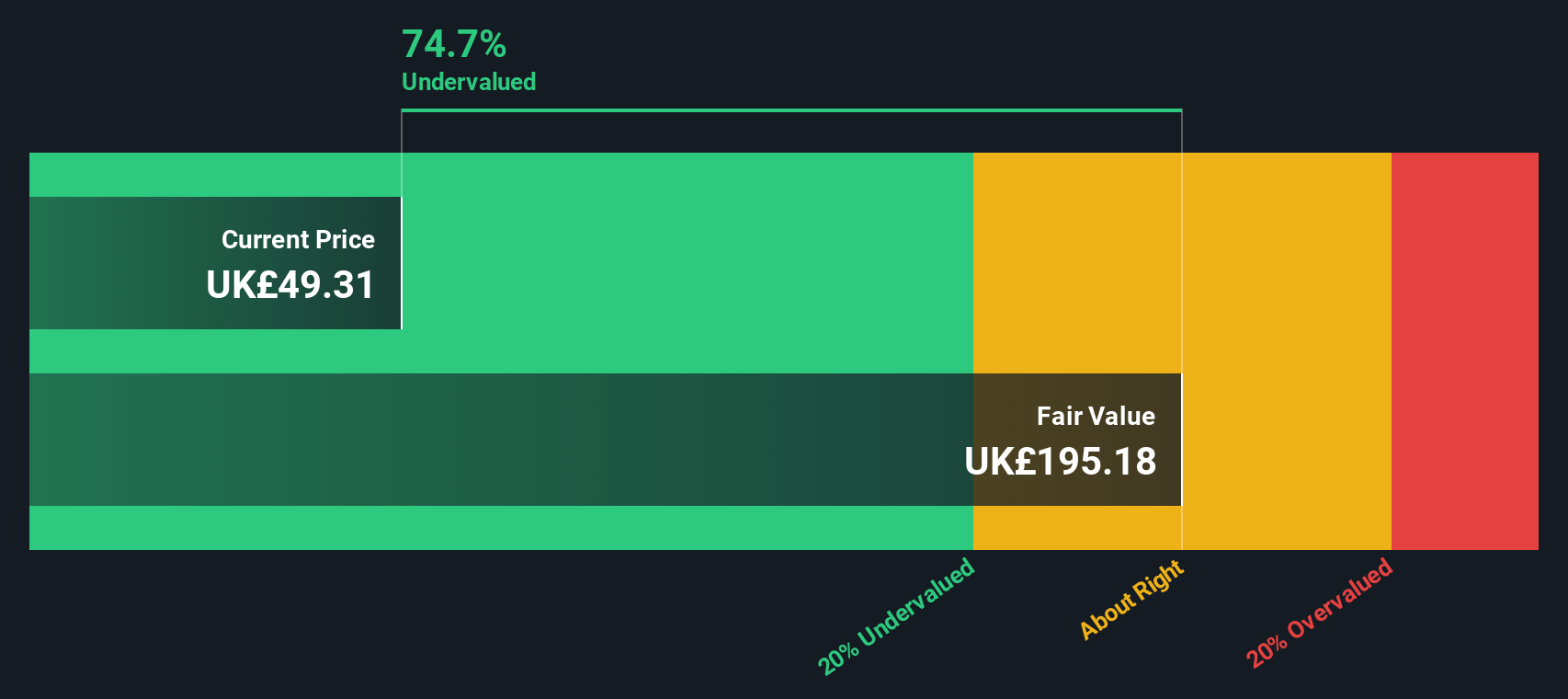

Looking from another angle, our DCF model also sees Rio Tinto Group as undervalued and supports the initial fair value case. However, every model relies on assumptions, so could hidden risks still be lurking?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Rio Tinto Group Narrative

If you see the story differently or enjoy hands-on analysis, exploring the data firsthand and building your own perspective takes just a few minutes. Do it your way.

A great starting point for your Rio Tinto Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock new opportunities by targeting industries and trends most investors overlook. Take the lead. These investment avenues are waiting for you to act and stay ahead of the crowd.

- Supercharge your portfolio with reliable passive income by tapping into dividend stocks with yields > 3%, featuring stocks with generous yields and proven payout histories.

- Ride the momentum in artificial intelligence innovation when you harness AI penny stocks to uncover emerging leaders in automation and smart technology.

- Make your money work harder by pursuing undervalued stocks based on cash flows, which trade below their true potential based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About LSE:RIO

Rio Tinto Group

Engages in exploring, mining, and processing mineral resources worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives