- United Kingdom

- /

- Basic Materials

- /

- LSE:RHIM

Shareholders May Find It Hard To Justify A Pay Rise For RHI Magnesita N.V.'s (LON:RHIM) CEO This Year

Performance at RHI Magnesita N.V. (LON:RHIM) has been reasonably good and CEO Stefan Borgas has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 10 June 2021. We present our case of why we think CEO compensation looks fair.

See our latest analysis for RHI Magnesita

How Does Total Compensation For Stefan Borgas Compare With Other Companies In The Industry?

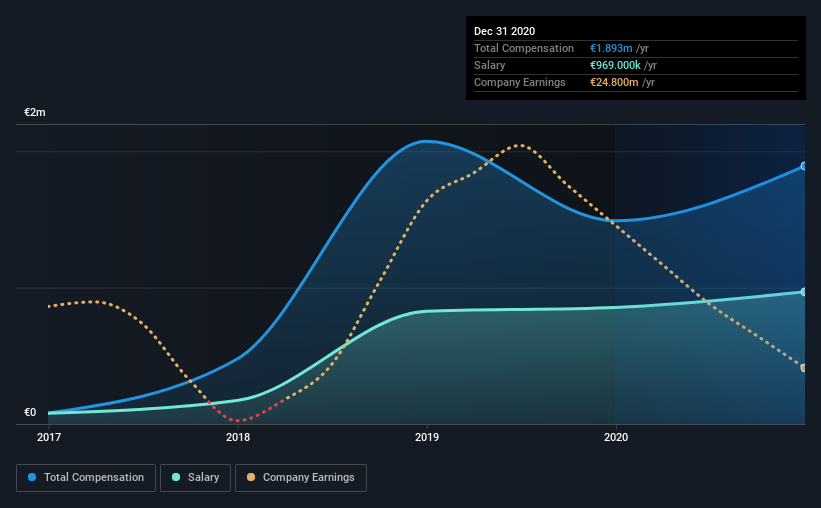

According to our data, RHI Magnesita N.V. has a market capitalization of UK£2.2b, and paid its CEO total annual compensation worth €1.9m over the year to December 2020. That's a notable increase of 27% on last year. In particular, the salary of €969.0k, makes up a fairly large portion of the total compensation being paid to the CEO.

On comparing similar companies from the same industry with market caps ranging from UK£1.4b to UK£4.5b, we found that the median CEO total compensation was €1.7m. This suggests that RHI Magnesita remunerates its CEO largely in line with the industry average. What's more, Stefan Borgas holds UK£805k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €969k | €855k | 51% |

| Other | €924k | €635k | 49% |

| Total Compensation | €1.9m | €1.5m | 100% |

Talking in terms of the industry, salary represented approximately 53% of total compensation out of all the companies we analyzed, while other remuneration made up 47% of the pie. RHI Magnesita is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

RHI Magnesita N.V.'s Growth

Over the past three years, RHI Magnesita N.V. has seen its earnings per share (EPS) grow by 14% per year. Its revenue is down 23% over the previous year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has RHI Magnesita N.V. Been A Good Investment?

With a total shareholder return of 0.1% over three years, RHI Magnesita N.V. has done okay by shareholders, but there's always room for improvement. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 4 warning signs for RHI Magnesita that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade RHI Magnesita, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:RHIM

RHI Magnesita

Develops, produces, sells, installs, and maintains refractory products and systems used in industrial high-temperature processes worldwide.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success