- United Kingdom

- /

- Metals and Mining

- /

- LSE:HOC

October 2024 UK Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting the interconnectedness of global economies. As investors navigate these turbulent times, identifying stocks that may be trading below their estimated value can offer potential opportunities for those seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| GlobalData (AIM:DATA) | £1.985 | £3.72 | 46.6% |

| Tracsis (AIM:TRCS) | £5.45 | £9.95 | 45.2% |

| Informa (LSE:INF) | £8.16 | £16.15 | 49.5% |

| Redcentric (AIM:RCN) | £1.26 | £2.42 | 47.8% |

| Mpac Group (AIM:MPAC) | £4.625 | £9.03 | 48.8% |

| Videndum (LSE:VID) | £2.45 | £4.54 | 46% |

| BATM Advanced Communications (LSE:BVC) | £0.1905 | £0.37 | 48.4% |

| Foxtons Group (LSE:FOXT) | £0.644 | £1.21 | 46.7% |

| SysGroup (AIM:SYS) | £0.325 | £0.65 | 49.9% |

| Genel Energy (LSE:GENL) | £0.782 | £1.51 | 48.2% |

Let's dive into some prime choices out of the screener.

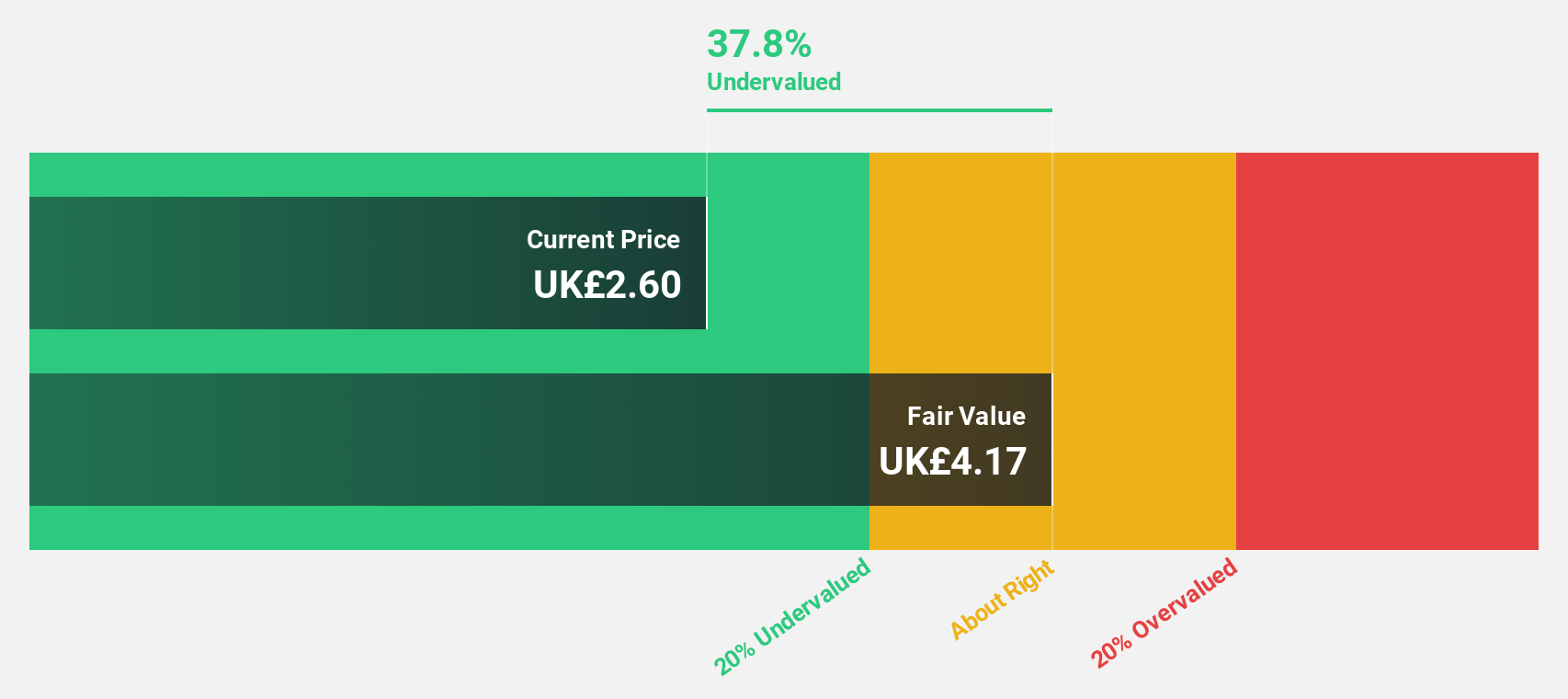

Restore (AIM:RST)

Overview: Restore plc, with a market cap of £338.89 million, offers services to offices and workplaces in both the public and private sectors primarily in the United Kingdom.

Operations: The company's revenue is derived from Secure Lifecycle Services, generating £104.40 million, and Digital & Information Management, contributing £172.50 million.

Estimated Discount To Fair Value: 42.6%

Restore is trading 42.6% below its estimated fair value of £4.31, suggesting it may be undervalued based on cash flows. Despite revenue growth forecasts of 4.4% annually, earnings are expected to grow significantly at 48.7% per year, surpassing UK market averages. Recent financial results show a return to profitability with net income of £6.4 million for H1 2024 compared to a loss last year, though interest payments and dividends remain poorly covered by earnings.

- Our expertly prepared growth report on Restore implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Restore.

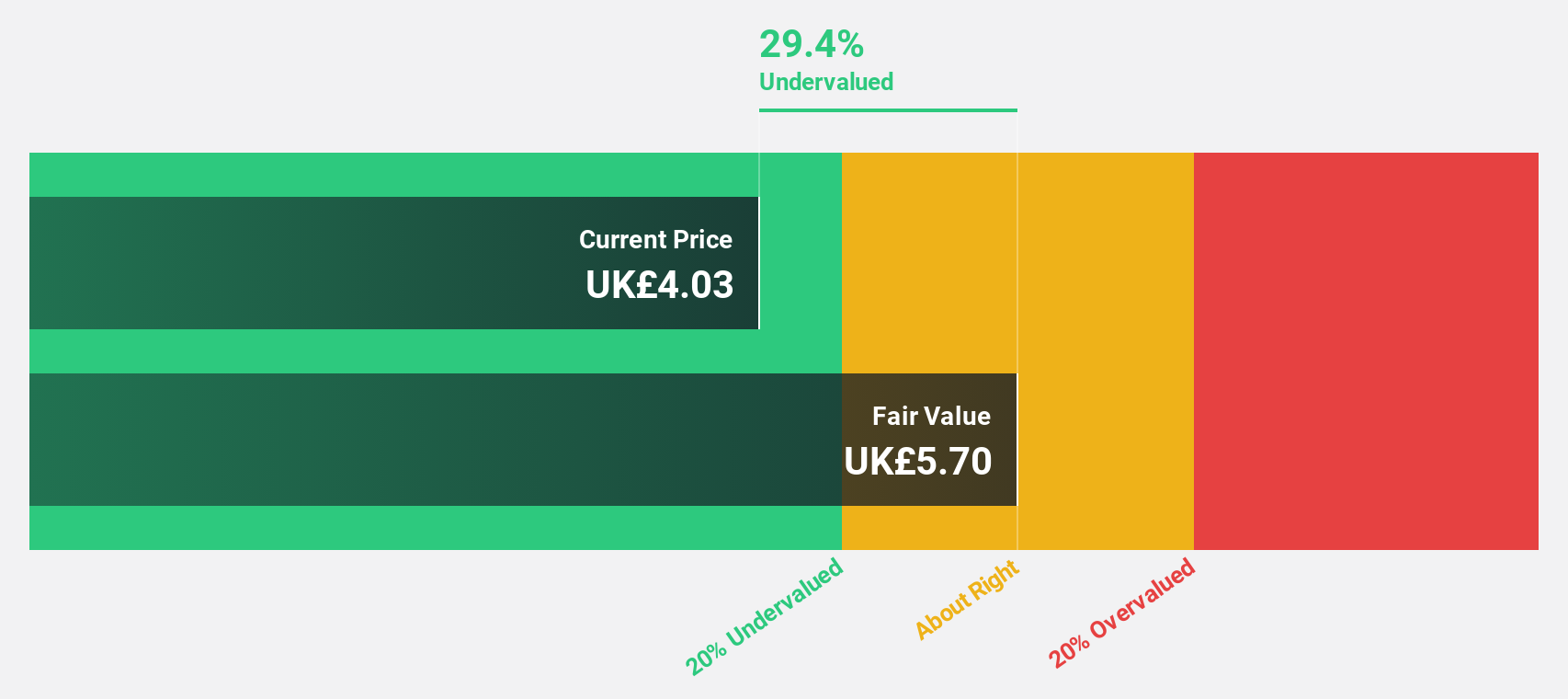

Foresight Group Holdings (LSE:FSG)

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £579.11 million.

Operations: The company's revenue segments include Infrastructure (£84.17 million), Private Equity (£47.35 million), and Foresight Capital Management (£9.80 million).

Estimated Discount To Fair Value: 33%

Foresight Group Holdings is trading 33% below its estimated fair value of £7.49, highlighting potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 27.9% annually, outpacing the UK market average, while revenue is expected to increase by 11.3% per year. However, the dividend yield of 4.42% isn't well covered by earnings, presenting a risk factor despite strong profit growth and high future return on equity projections at 43.6%.

- According our earnings growth report, there's an indication that Foresight Group Holdings might be ready to expand.

- Dive into the specifics of Foresight Group Holdings here with our thorough financial health report.

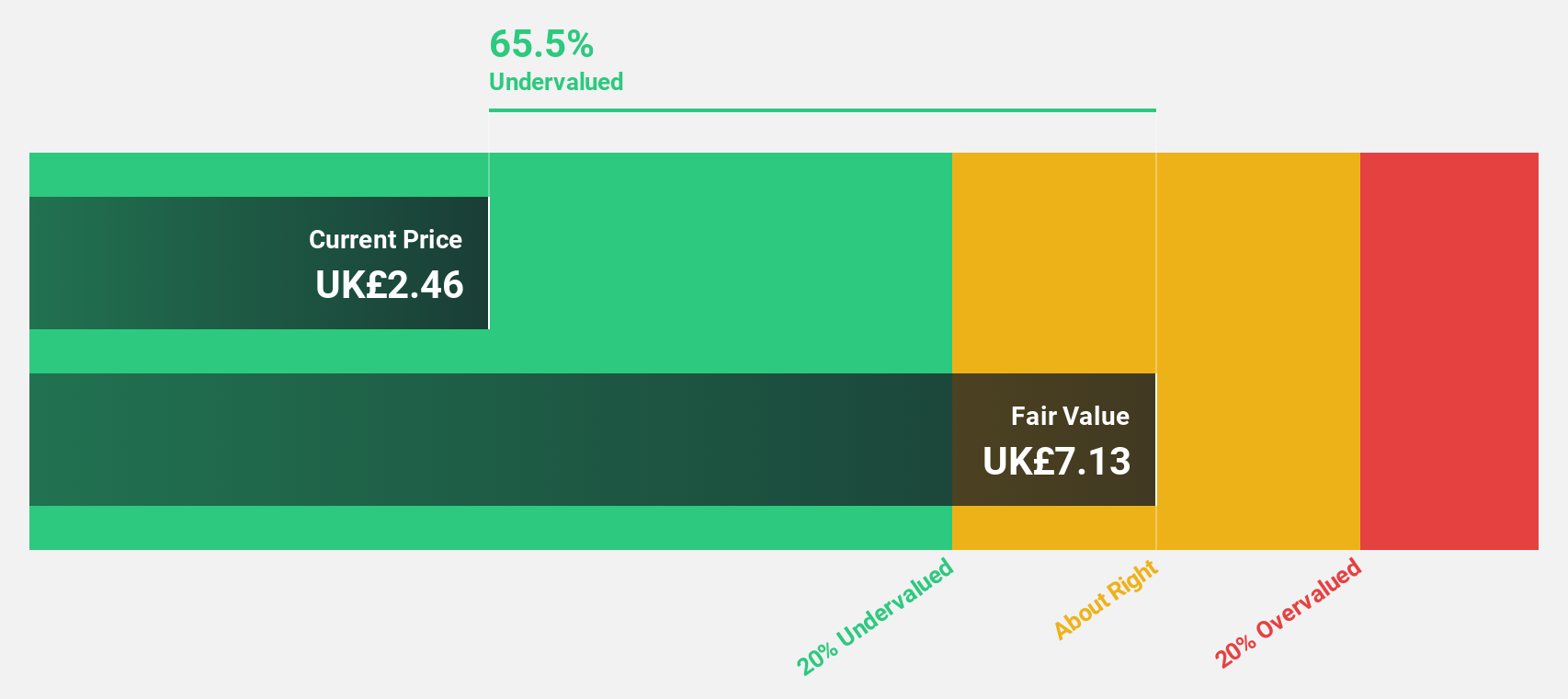

Hochschild Mining (LSE:HOC)

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £979.53 million.

Operations: The company's revenue primarily comes from its San Jose and Inmaculada segments, generating $266.70 million and $451.91 million respectively.

Estimated Discount To Fair Value: 39.2%

Hochschild Mining is trading 39.2% below its estimated fair value of £3.13, indicating potential undervaluation based on cash flows. The company recently returned to profitability with a net income of US$39.52 million for H1 2024 and has forecasted earnings growth of 47.4% annually, surpassing the UK market average. Despite high debt levels and share price volatility, revenue is expected to grow faster than the market at 6.3% per year.

- Our comprehensive growth report raises the possibility that Hochschild Mining is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Hochschild Mining's balance sheet health report.

Summing It All Up

- Discover the full array of 61 Undervalued UK Stocks Based On Cash Flows right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hochschild Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HOC

Hochschild Mining

A precious metals company, engages in the exploration, mining, processing, and sale of gold and silver deposits in Peru, Argentina, the United Kingdom, Canada, Brazil, and Chile.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives