- United Kingdom

- /

- Diversified Financial

- /

- AIM:MAB1

3 UK Growth Companies With Up To 38% Insider Ownership

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting the interconnectedness of global economies. Amid these broader market fluctuations, growth companies with substantial insider ownership can often be seen as resilient options, as significant insider stakes may indicate confidence in the company's long-term potential and alignment of interests with shareholders.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Foresight Group Holdings (LSE:FSG) | 31.8% | 27.9% |

| LSL Property Services (LSE:LSL) | 10.8% | 28.2% |

| Judges Scientific (AIM:JDG) | 11% | 23% |

| Enteq Technologies (AIM:NTQ) | 20% | 53.8% |

| Facilities by ADF (AIM:ADF) | 22.7% | 144.7% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.6% |

| Evoke (LSE:EVOK) | 20.5% | 104.9% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 80.6% |

Here's a peek at a few of the choices from the screener.

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mortgage Advice Bureau (Holdings) plc, with a market cap of £411.49 million, provides mortgage advice services through its subsidiaries in the United Kingdom.

Operations: The company generates revenue of £243.31 million from its financial services segment in the UK.

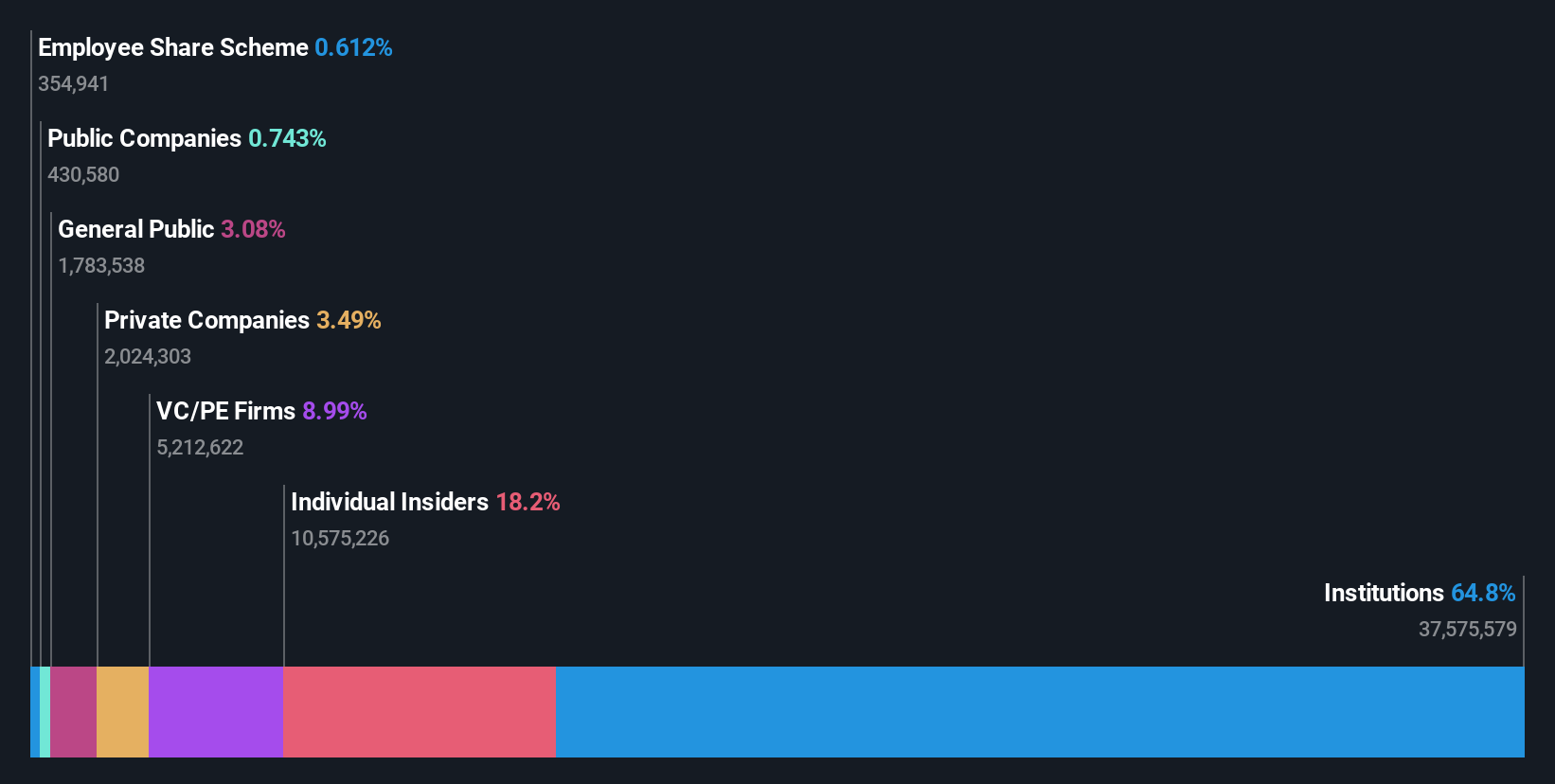

Insider Ownership: 19.8%

Mortgage Advice Bureau (Holdings) exhibits strong growth potential with expected revenue and earnings growth rates surpassing the UK market averages. Despite recent earnings declines, insider confidence remains high as substantial shares have been bought over the past three months. However, its dividend yield of 3.96% is not well covered by current earnings, posing a risk to income-focused investors. The company's Return on Equity is forecasted to be robust in three years, supporting its growth narrative.

- Click to explore a detailed breakdown of our findings in Mortgage Advice Bureau (Holdings)'s earnings growth report.

- In light of our recent valuation report, it seems possible that Mortgage Advice Bureau (Holdings) is trading beyond its estimated value.

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gulf Keystone Petroleum Limited focuses on the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £276.53 million.

Operations: The company's revenue is primarily derived from its oil and gas exploration and production activities in the Kurdistan Region of Iraq, amounting to $115.15 million.

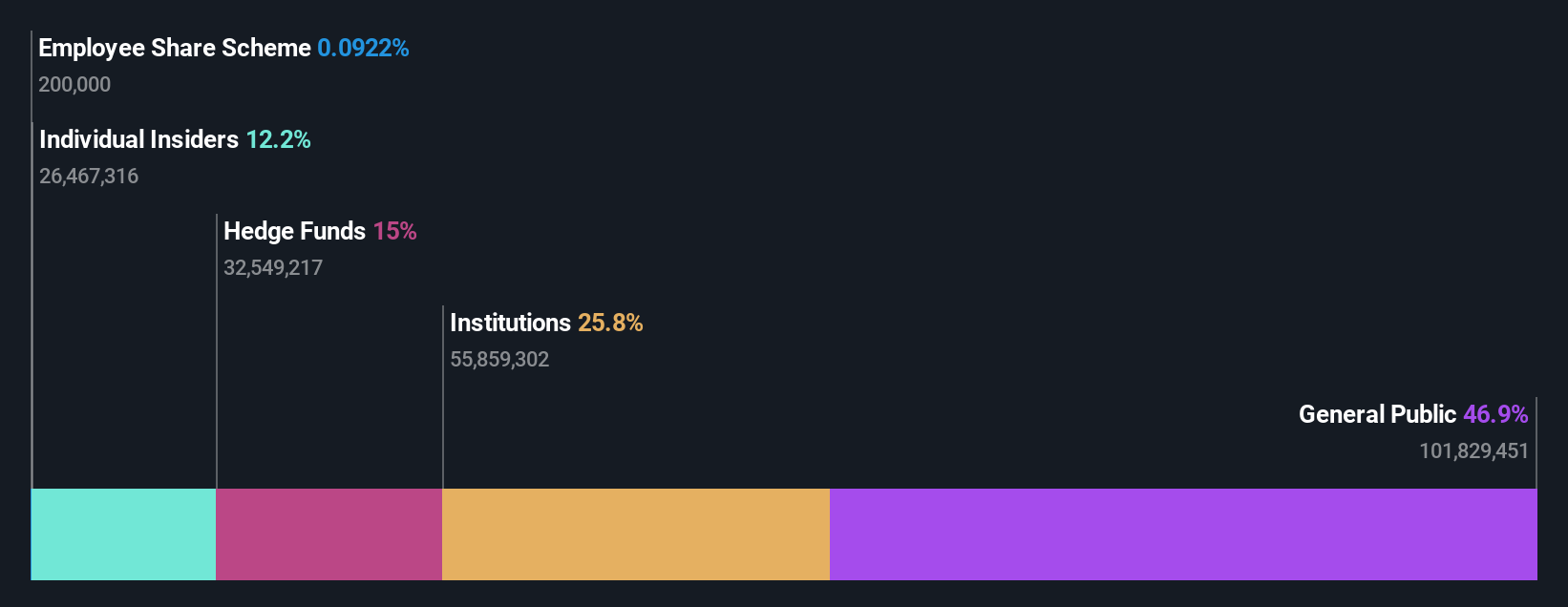

Insider Ownership: 12.2%

Gulf Keystone Petroleum demonstrates significant growth potential, with forecasted revenue growth of 42.8% annually, outpacing the UK market. The company is expected to become profitable within three years, and insiders have shown confidence by purchasing more shares recently. Despite a challenging H1 2024 with sales at $71.19 million, profitability improved compared to last year’s loss. Recent board changes include appointing two experienced Non-Executive Directors, enhancing strategic oversight amidst leadership transitions.

- Take a closer look at Gulf Keystone Petroleum's potential here in our earnings growth report.

- According our valuation report, there's an indication that Gulf Keystone Petroleum's share price might be on the expensive side.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of approximately £972.33 million.

Operations: The company's revenue segments include $266.70 million from San Jose and $451.91 million from Inmaculada, with a segment adjustment of $79.60 million.

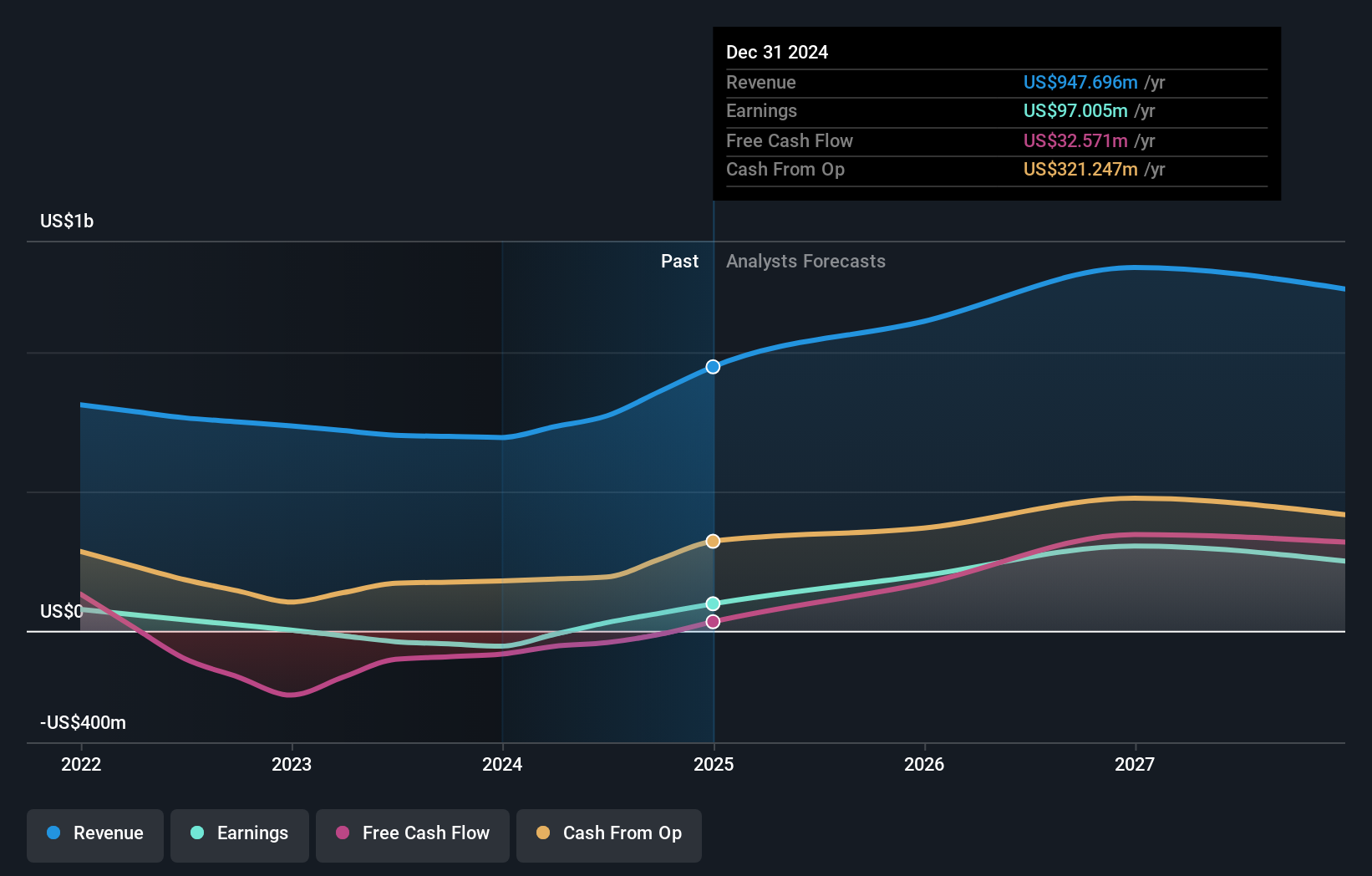

Insider Ownership: 38.4%

Hochschild Mining's recent return to profitability, with a net income of $39.52 million for H1 2024, marks a significant turnaround from last year's loss. While revenue growth is modest at 5.9% annually, it surpasses the UK market average and aligns with strong earnings growth forecasts of 44.6% per year. Despite high debt levels and no recent insider trading activity, the stock trades significantly below its estimated fair value, suggesting potential upside as analysts anticipate price increases.

- Navigate through the intricacies of Hochschild Mining with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Hochschild Mining is trading behind its estimated value.

Make It Happen

- Gain an insight into the universe of 65 Fast Growing UK Companies With High Insider Ownership by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MAB1

Mortgage Advice Bureau (Holdings)

Provides mortgage advice services in the United Kingdom.

High growth potential with mediocre balance sheet.