Essentra plc (LON:ESNT) is reducing its dividend to £0.008 on the 24th of Octoberwhich is 36% less than last year's comparable payment of £0.0125. However, the dividend yield of 2.7% still remains in a typical range for the industry.

Essentra's Payment Could Potentially Have Solid Earnings Coverage

We aren't too impressed by dividend yields unless they can be sustained over time. Before making this announcement, Essentra's was paying out quite a large proportion of earnings and 83% of free cash flows. This indicates that the company is more focused on returning cash to shareholders than growing the business, but it is still in a reasonable range to continue with.

Looking forward, earnings per share is forecast to rise by 94.4% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 29% by next year, which is in a pretty sustainable range.

See our latest analysis for Essentra

Dividend Volatility

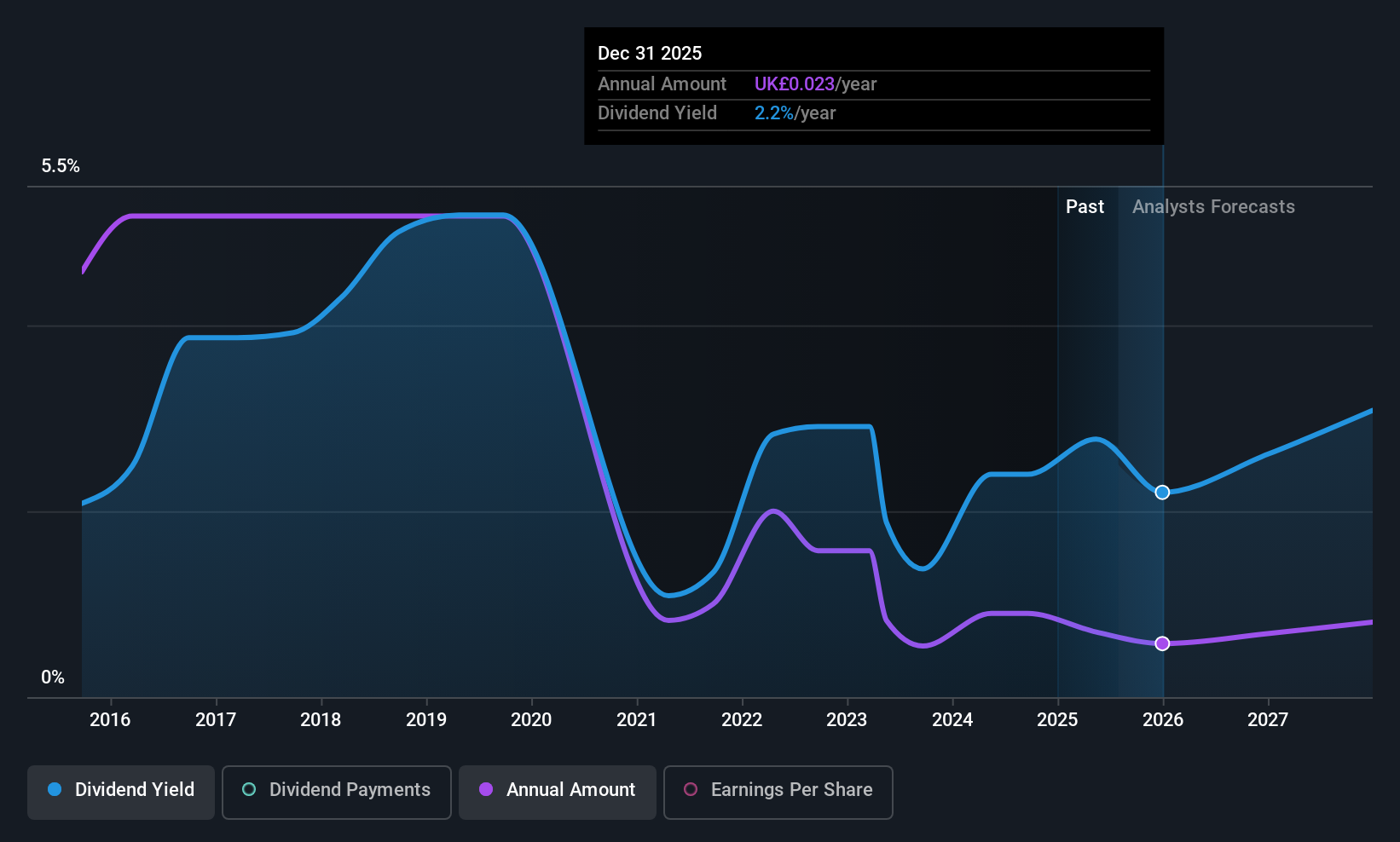

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2015, the dividend has gone from £0.183 total annually to £0.028. The dividend has fallen 85% over that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Dividend Growth May Be Hard To Come By

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. In the last five years, Essentra's earnings per share has shrunk at approximately 9.2% per annum. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

Our Thoughts On Essentra's Dividend

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The low payout ratio is a redeeming feature, but generally we are not too happy with the payments Essentra has been making. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 2 warning signs for Essentra that investors need to be conscious of moving forward. Is Essentra not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Essentra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ESNT

Essentra

Engages in the manufacturing and distribution of plastic injection moulded, vinyl dip moulded, and metal items in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026