Essentra plc (LON:ESNT) will pay a dividend of £0.0155 on the 3rd of July. However, the dividend yield of 2.7% still remains in a typical range for the industry.

Essentra's Payment Could Potentially Have Solid Earnings Coverage

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. The last dividend was quite easily covered by Essentra's earnings. This means that a large portion of its earnings are being retained to grow the business.

The next year is set to see EPS grow by 77.6%. Assuming the dividend continues along recent trends, we think the payout ratio could be 32% by next year, which is in a pretty sustainable range.

Check out our latest analysis for Essentra

Dividend Volatility

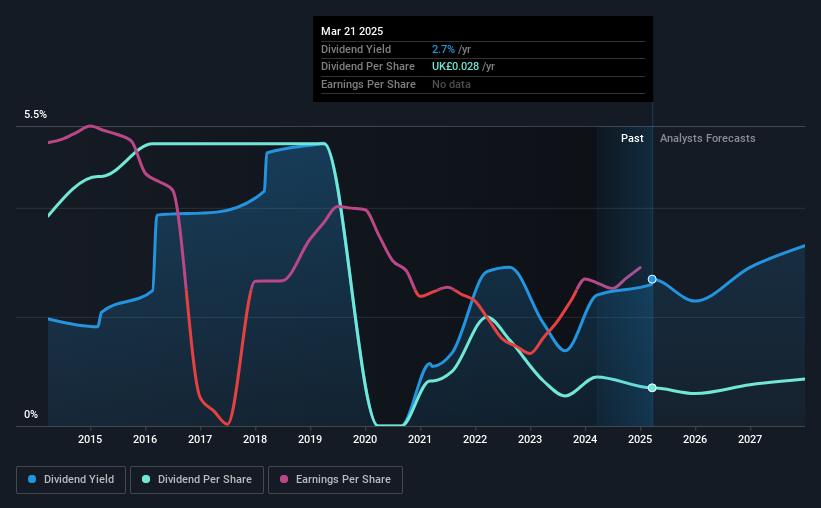

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2015, the dividend has gone from £0.154 total annually to £0.028. This works out to a decline of approximately 82% over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Dividend Growth Potential Is Shaky

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. Essentra's earnings per share has shrunk at 23% a year over the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

Our Thoughts On Essentra's Dividend

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 2 warning signs for Essentra that investors should know about before committing capital to this stock. Is Essentra not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Essentra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ESNT

Essentra

Engages in the manufacturing and distribution of plastic injection moulded, vinyl dip moulded, and metal items in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026