- United Kingdom

- /

- Chemicals

- /

- LSE:CAR

Market Might Still Lack Some Conviction On Carclo plc (LON:CAR) Even After 27% Share Price Boost

Carclo plc (LON:CAR) shares have continued their recent momentum with a 27% gain in the last month alone. The last month tops off a massive increase of 141% in the last year.

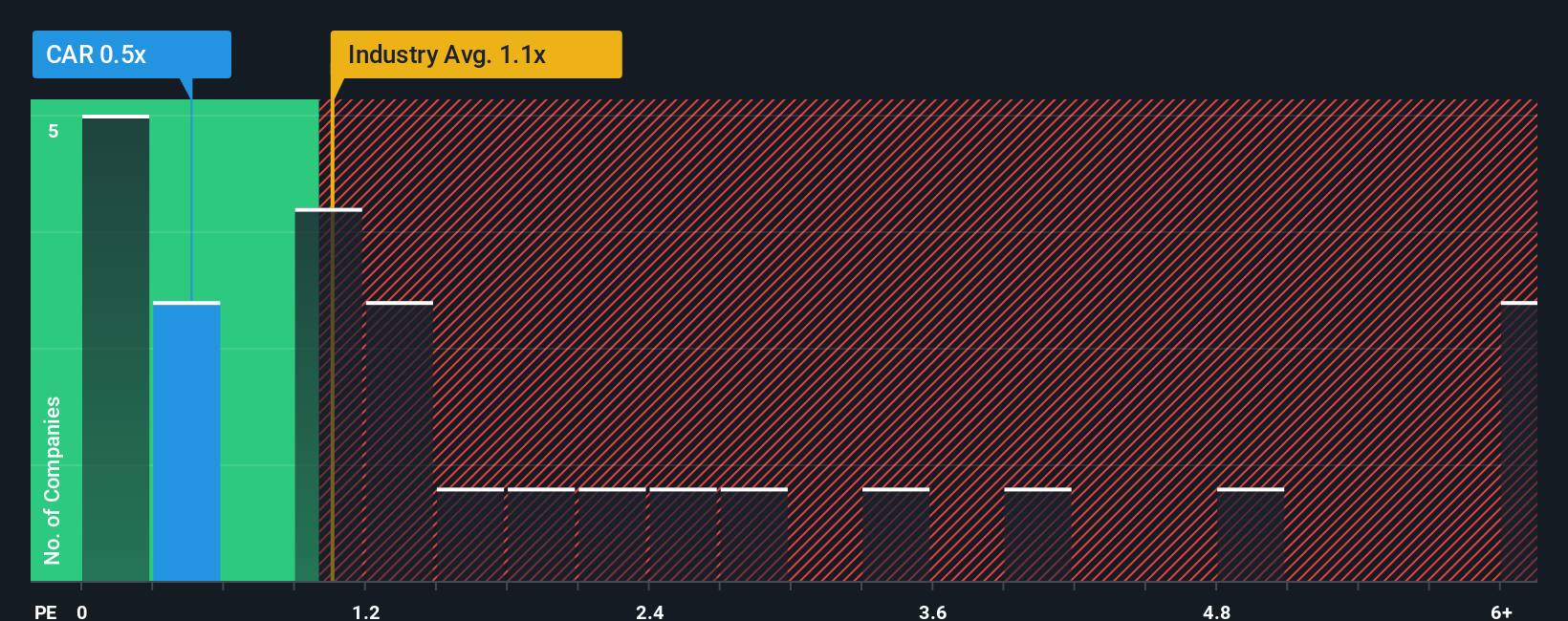

Although its price has surged higher, given about half the companies operating in the United Kingdom's Chemicals industry have price-to-sales ratios (or "P/S") above 1.5x, you may still consider Carclo as an attractive investment with its 0.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Carclo

What Does Carclo's Recent Performance Look Like?

Carclo has been struggling lately as its revenue has declined faster than most other companies. The P/S ratio is probably low because investors think this poor revenue performance isn't going to improve at all. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Carclo will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Carclo?

The only time you'd be truly comfortable seeing a P/S as low as Carclo's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.6%. As a result, revenue from three years ago have also fallen 5.7% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 5.7% per annum during the coming three years according to the lone analyst following the company. With the rest of the industry predicted to shrink by 8.9% each year, that would be a fantastic result.

In light of this, it's quite peculiar that Carclo's P/S sits below the majority of other companies. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

The Bottom Line On Carclo's P/S

Despite Carclo's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Carclo currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Carclo (at least 2 which are a bit unpleasant), and understanding these should be part of your investment process.

If you're unsure about the strength of Carclo's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CAR

Carclo

Provides plastic components for the life sciences, aerospace, and advanced industries in the United Kingdom, France, the Czech Republic, China, India, rest of Europe, North America, and internationally.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives