- United Kingdom

- /

- Chemicals

- /

- LSE:CAR

Further Upside For Carclo plc (LON:CAR) Shares Could Introduce Price Risks After 80% Bounce

Carclo plc (LON:CAR) shares have continued their recent momentum with a 80% gain in the last month alone. The last month tops off a massive increase of 140% in the last year.

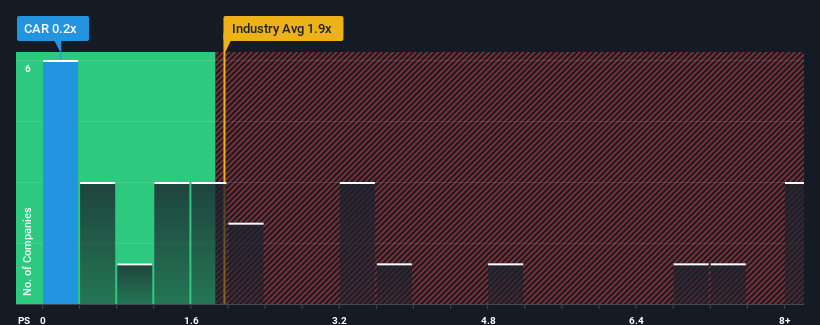

Even after such a large jump in price, Carclo may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Chemicals industry in the United Kingdom have P/S ratios greater than 1.9x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Carclo

What Does Carclo's P/S Mean For Shareholders?

With only a limited decrease in revenue compared to most other companies of late, Carclo has been doing relatively well. It might be that many expect the comparatively superior revenue performance to degrade substantially, which has repressed the P/S. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. But at the very least, you'd be hoping that revenue doesn't fall off a cliff completely if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Carclo.How Is Carclo's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Carclo's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 7.5% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 23% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 6.1% per annum during the coming three years according to the one analyst following the company. That would be an excellent outcome when the industry is expected to decline by 1.2% per year.

With this in mind, we find it intriguing that Carclo's P/S falls short of its industry peers. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

What We Can Learn From Carclo's P/S?

The latest share price surge wasn't enough to lift Carclo's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Carclo currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

Having said that, be aware Carclo is showing 3 warning signs in our investment analysis, and 2 of those shouldn't be ignored.

If these risks are making you reconsider your opinion on Carclo, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CAR

Carclo

Provides plastic components for the life sciences, aerospace, and advanced industries in the United Kingdom, France, the Czech Republic, China, India, rest of Europe, North America, and internationally.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives