- United Kingdom

- /

- Food and Staples Retail

- /

- AIM:KITW

Spotlight On 3 Undervalued European Small Caps With Insider Buying

Reviewed by Simply Wall St

Amid concerns about global growth and a stronger euro, the pan-European STOXX Europe 600 Index recently edged down by 0.17%, reflecting mixed performances across major European stock indexes. In this environment, identifying promising small-cap stocks can be crucial for investors seeking opportunities, especially those with strong fundamentals and potential insider confidence.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Boozt | 15.1x | 0.7x | 45.57% | ★★★★★☆ |

| Foxtons Group | 10.7x | 1.0x | 38.97% | ★★★★★☆ |

| Bytes Technology Group | 18.6x | 4.7x | 6.67% | ★★★★☆☆ |

| Kitwave Group | 12.2x | 0.3x | 40.14% | ★★★★☆☆ |

| Renold | 10.6x | 0.7x | 2.90% | ★★★★☆☆ |

| CVS Group | 46.2x | 1.3x | 36.64% | ★★★★☆☆ |

| Stelrad Group | 41.1x | 0.7x | 37.01% | ★★★☆☆☆ |

| Nyab | 22.4x | 1.0x | 35.20% | ★★★☆☆☆ |

| Hoist Finance | 9.9x | 2.0x | 19.92% | ★★★☆☆☆ |

| FastPartner | 16.1x | 4.1x | -25.28% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Kitwave Group (AIM:KITW)

Simply Wall St Value Rating: ★★★★☆☆

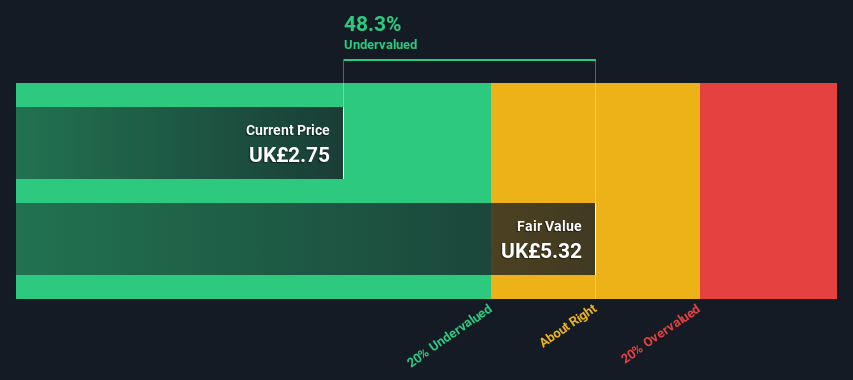

Overview: Kitwave Group is a UK-based independent wholesaler that supplies ambient, frozen, and chilled foods as well as foodservice products, with a market cap of £0.23 billion.

Operations: Kitwave Group generates revenue from three primary segments: Ambient, Foodservice, and Frozen & Chilled. The company's gross profit margin has shown an upward trend, reaching 22.78% by April 2025. Operating expenses have consistently impacted profitability, with significant allocations to sales and marketing as well as general and administrative expenses.

PE: 12.2x

Kitwave Group, a small company in Europe, is experiencing insider confidence with recent share purchases by Olga Young totaling £200,000. Despite a high debt level and volatile share price over the past three months, the company's earnings are projected to grow 17.25% annually. Recent fiscal changes aim to balance reporting periods better. For H1 2025, Kitwave reported sales of £376 million but saw a drop in net income to £4 million from last year’s £5 million.

- Navigate through the intricacies of Kitwave Group with our comprehensive valuation report here.

Review our historical performance report to gain insights into Kitwave Group's's past performance.

Breedon Group (LSE:BREE)

Simply Wall St Value Rating: ★★★★★★

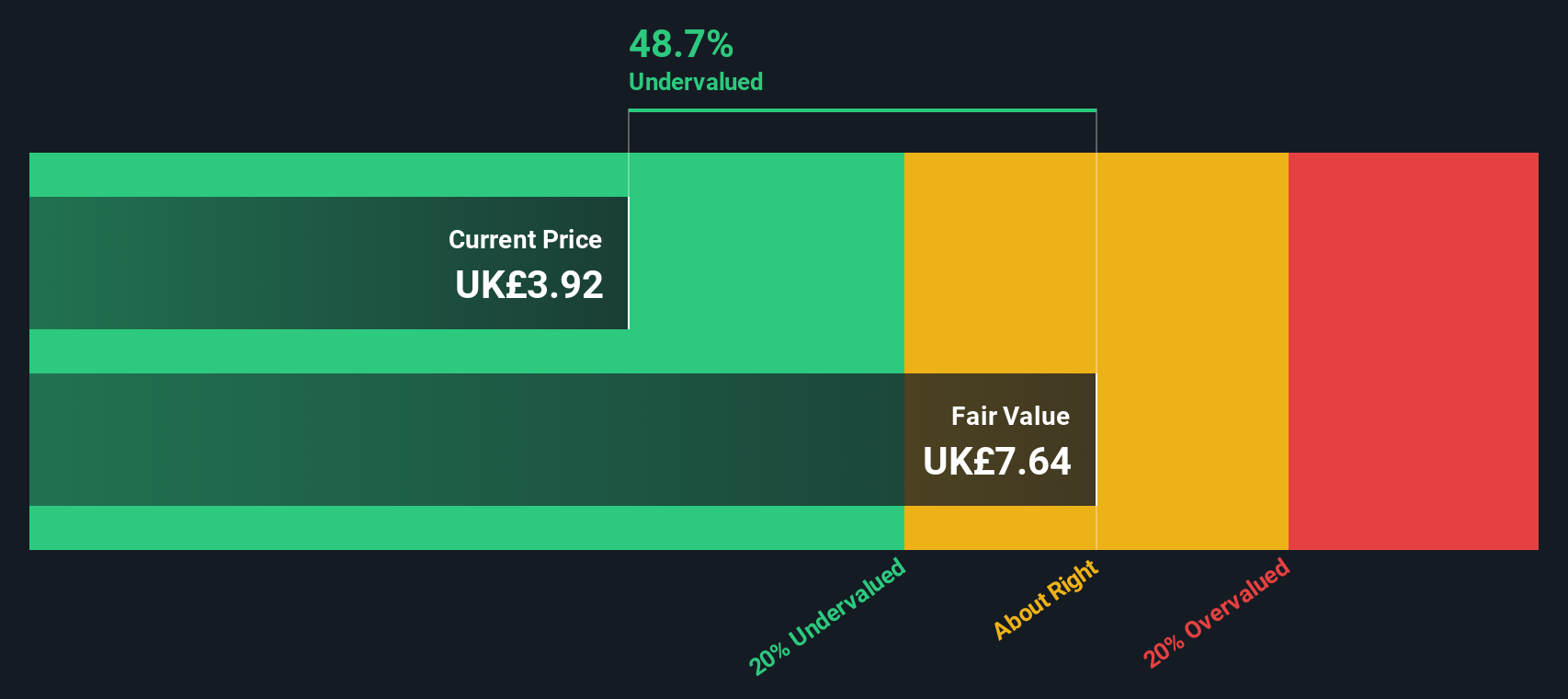

Overview: Breedon Group is a construction materials company with operations in cement, aggregates, and asphalt across Great Britain, Ireland, and the United States, with a market capitalization of approximately £1.25 billion.

Operations: The company generates revenue primarily from its operations in Great Britain, Ireland, the United States, and its Cement segment. Its gross profit margin has shown significant fluctuations, reaching 82.31% by the end of 2024. Operating expenses include notable costs such as general and administrative expenses and non-operating expenses.

PE: 14.3x

Breedon Group, known for its construction materials, has recently shown insider confidence with share purchases in the last six months. Despite a high debt level and reliance on external borrowing, the company reported sales of £815.9 million for H1 2025, up from £764.6 million in the previous year. However, net income dropped to £27.5 million from £34.1 million a year ago. The interim dividend increased to 4.75 pence per share, indicating financial resilience amidst challenges and potential growth prospects driven by forecasted earnings growth of 16% annually.

- Get an in-depth perspective on Breedon Group's performance by reading our valuation report here.

Gain insights into Breedon Group's historical performance by reviewing our past performance report.

MilDef Group (OM:MILDEF)

Simply Wall St Value Rating: ★★★☆☆☆

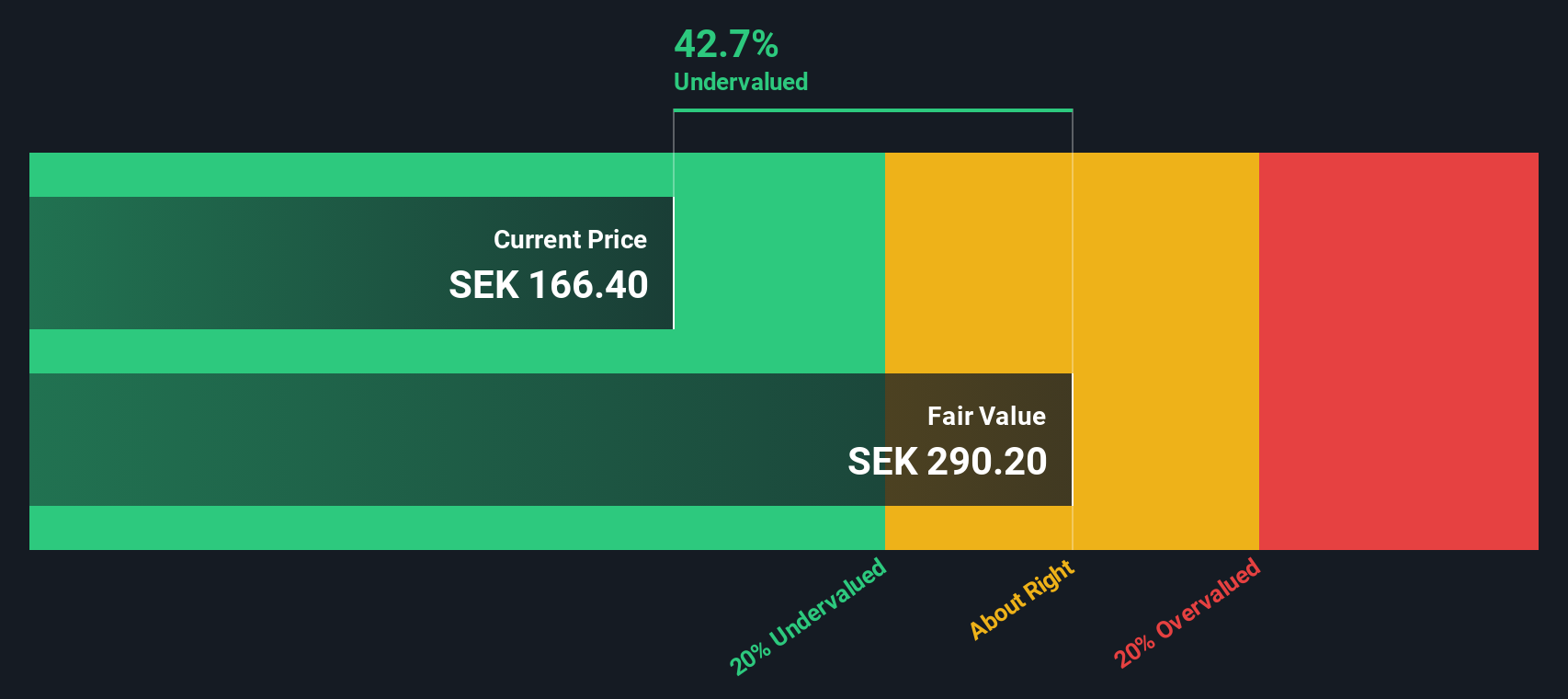

Overview: MilDef Group is a company that specializes in providing rugged IT solutions and computer hardware, with a market cap of SEK 1.52 billion.

Operations: MilDef Group's revenue primarily comes from the computer hardware segment, with recent figures showing SEK 1.39 billion in this category. The company's gross profit margin has shown variability, reaching up to 49.40% at certain points. Operating expenses have been significant, with sales and marketing being the largest component among them. Net income margins have fluctuated over time, reflecting changes in profitability and non-operating expenses impacting overall financial outcomes.

PE: -34.9x

MilDef Group, a European defense technology company focusing on ruggedized IT solutions, recently showcased advanced systems at DSEI 2025 in London. They secured notable contracts with NATO's NSPA and the Swedish Defense Materiel Administration, enhancing their presence in military digitalization. Despite a dip in net income for Q2 2025 compared to last year, sales increased to SEK 383 million from SEK 301 million. Insider confidence is evident with recent share purchases, signaling potential value perception within the company.

- Unlock comprehensive insights into our analysis of MilDef Group stock in this valuation report.

Examine MilDef Group's past performance report to understand how it has performed in the past.

Taking Advantage

- Click through to start exploring the rest of the 45 Undervalued European Small Caps With Insider Buying now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kitwave Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:KITW

Kitwave Group

Engages in the food and drink wholesale business in the United Kingdom.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives