- United Kingdom

- /

- Basic Materials

- /

- LSE:BREE

Here's Why Breedon Group (LON:BREE) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Breedon Group (LON:BREE), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Breedon Group

How Fast Is Breedon Group Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Breedon Group grew its EPS by 13% per year. That's a good rate of growth, if it can be sustained.

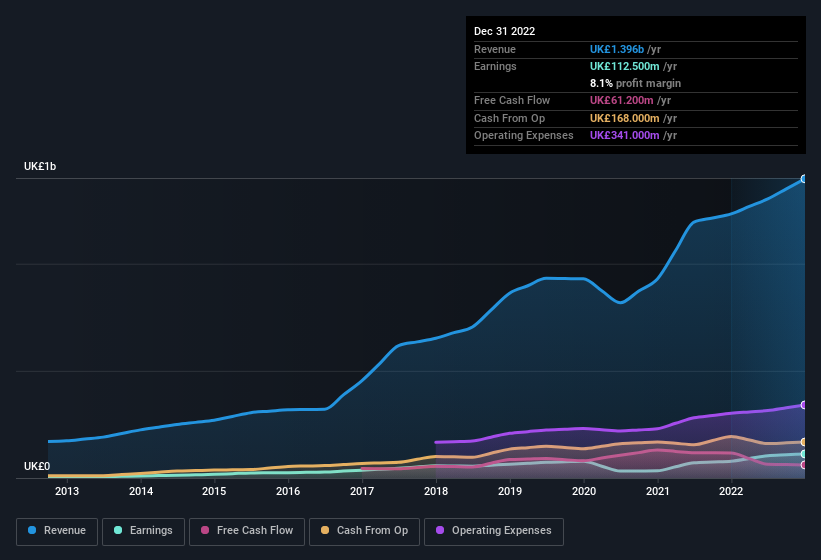

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Breedon Group maintained stable EBIT margins over the last year, all while growing revenue 13% to UK£1.4b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Breedon Group's forecast profits?

Are Breedon Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Breedon Group shares, in the last year. So it's definitely nice that Senior Independent Director Clive Watson bought UK£25k worth of shares at an average price of around UK£3.42. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

Is Breedon Group Worth Keeping An Eye On?

As previously touched on, Breedon Group is a growing business, which is encouraging. While some companies are struggling to grow EPS, Breedon Group seems free from that morose affliction. Despite there being a solitary insider adding to their holdings, it's enough to consider adding this to the watchlist. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Breedon Group that you should be aware of.

The good news is that Breedon Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Breedon Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BREE

Breedon Group

Engages in the quarrying, manufacture, and sale of construction materials and building products primarily in the United Kingdom and internationally.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives