- United Kingdom

- /

- Metals and Mining

- /

- LSE:ATYM

Atalaya Mining Copper, S.A.'s (LON:ATYM) Subdued P/E Might Signal An Opportunity

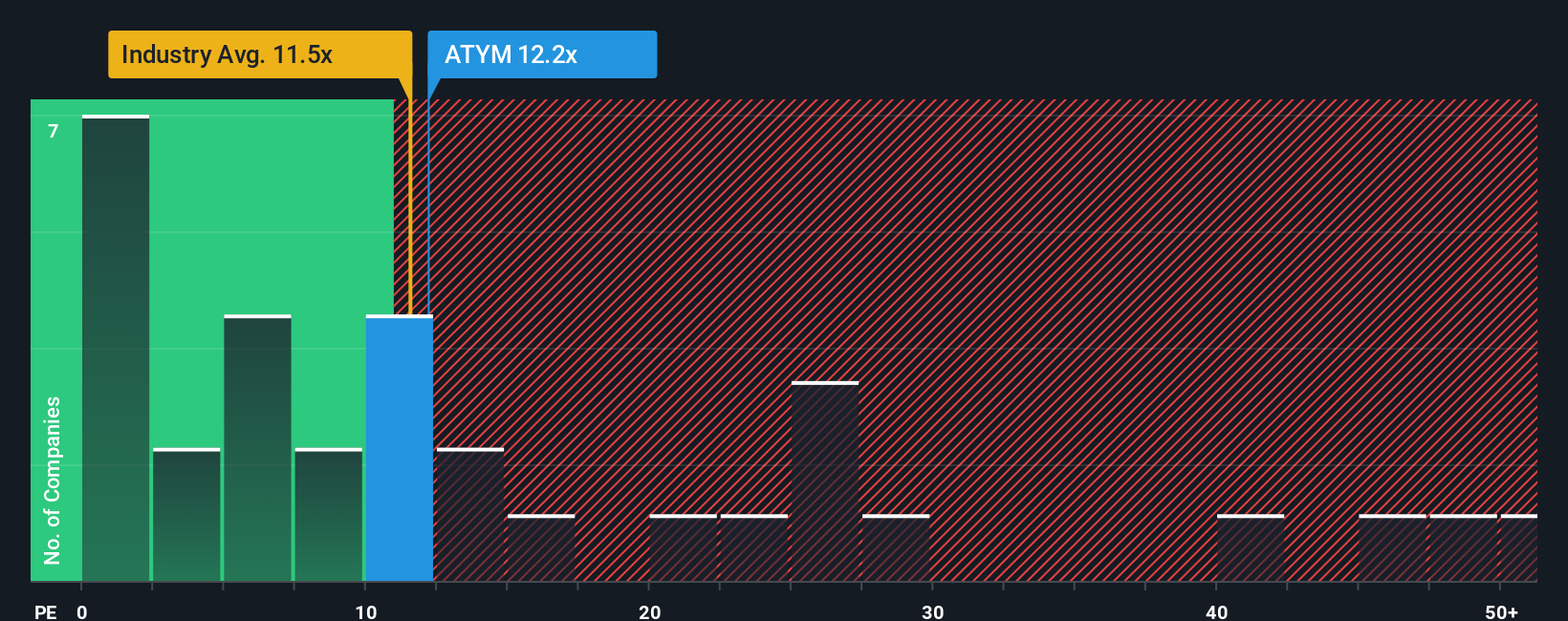

With a price-to-earnings (or "P/E") ratio of 12.2x Atalaya Mining Copper, S.A. (LON:ATYM) may be sending bullish signals at the moment, given that almost half of all companies in the United Kingdom have P/E ratios greater than 17x and even P/E's higher than 30x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's superior to most other companies of late, Atalaya Mining Copper has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Atalaya Mining Copper

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Atalaya Mining Copper's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 112% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 25% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 16% each year over the next three years. With the market predicted to deliver 15% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that Atalaya Mining Copper's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Atalaya Mining Copper's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Atalaya Mining Copper with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Atalaya Mining Copper, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ATYM

Atalaya Mining Copper

Engages in the mineral exploration and development in Spain.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives