Woodbois Limited's (LON:WBI) CEO Might Not Expect Shareholders To Be So Generous This Year

Shareholders will probably not be too impressed with the underwhelming results at Woodbois Limited (LON:WBI) recently. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 23 June 2021. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. From our analysis, we think CEO compensation may need a review in light of the recent performance.

Check out our latest analysis for Woodbois

Comparing Woodbois Limited's CEO Compensation With the industry

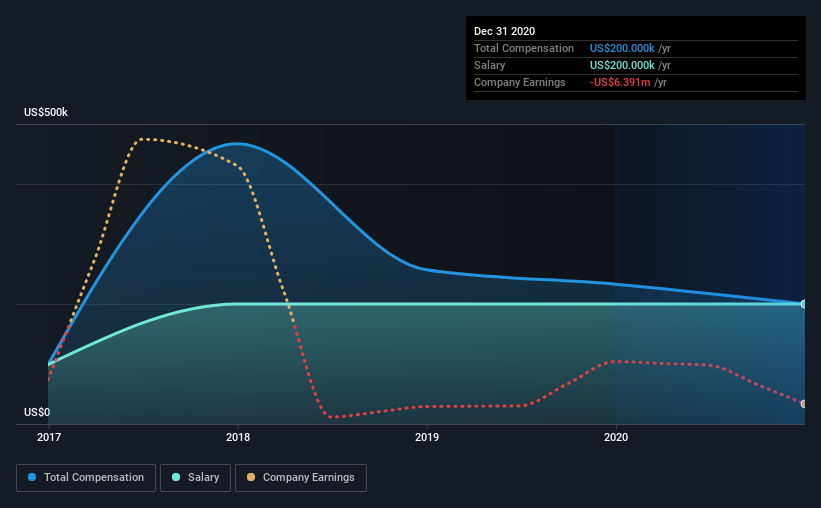

According to our data, Woodbois Limited has a market capitalization of UK£100m, and paid its CEO total annual compensation worth US$200k over the year to December 2020. That's a notable decrease of 14% on last year. It is worth noting that the CEO compensation consists entirely of the salary, worth US$200k.

In comparison with other companies in the industry with market capitalizations under UK£142m, the reported median total CEO compensation was US$212k. This suggests that Woodbois remunerates its CEO largely in line with the industry average. What's more, Paul Dolan holds UK£4.1m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$200k | US$200k | 100% |

| Other | - | US$33k | - |

| Total Compensation | US$200k | US$233k | 100% |

On an industry level, around 68% of total compensation represents salary and 32% is other remuneration. On a company level, Woodbois prefers to reward its CEO through a salary, opting not to pay Paul Dolan through non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Woodbois Limited's Growth

Over the last three years, Woodbois Limited has shrunk its earnings per share by 30% per year. Its revenue is down 22% over the previous year.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Woodbois Limited Been A Good Investment?

The return of -38% over three years would not have pleased Woodbois Limited shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Woodbois pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 3 warning signs for Woodbois (of which 2 are significant!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Woodbois, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Woodbois might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:WBI

Woodbois

Engages in the forestry, timber trading, and carbon solutions in Guernsey, Denmark, Mozambique, and the United Kingdom.

Moderate risk with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success