- United Kingdom

- /

- Chemicals

- /

- AIM:SYM

How Much Is Symphony Environmental Technologies plc (LON:SYM) CEO Getting Paid?

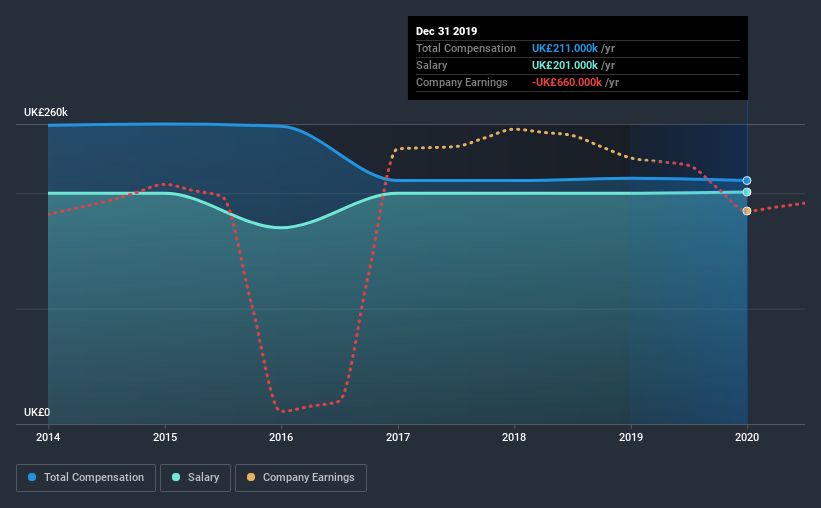

The CEO of Symphony Environmental Technologies plc (LON:SYM) is Michael Laurier, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Symphony Environmental Technologies pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for Symphony Environmental Technologies

Comparing Symphony Environmental Technologies plc's CEO Compensation With the industry

Our data indicates that Symphony Environmental Technologies plc has a market capitalization of UK£39m, and total annual CEO compensation was reported as UK£211k for the year to December 2019. That's mostly flat as compared to the prior year's compensation. In particular, the salary of UK£201.0k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under UK£150m, the reported median total CEO compensation was UK£217k. This suggests that Symphony Environmental Technologies remunerates its CEO largely in line with the industry average. Moreover, Michael Laurier also holds UK£5.0m worth of Symphony Environmental Technologies stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | UK£201k | UK£200k | 95% |

| Other | UK£10k | UK£13k | 5% |

| Total Compensation | UK£211k | UK£213k | 100% |

On an industry level, around 69% of total compensation represents salary and 31% is other remuneration. Symphony Environmental Technologies is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Symphony Environmental Technologies plc's Growth Numbers

Over the last three years, Symphony Environmental Technologies plc has shrunk its earnings per share by 114% per year. Its revenue is up 1.3% over the last year.

Few shareholders would be pleased to read that EPS have declined. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Symphony Environmental Technologies plc Been A Good Investment?

Most shareholders would probably be pleased with Symphony Environmental Technologies plc for providing a total return of 76% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Symphony Environmental Technologies pays its CEO a majority of compensation through a salary. As we touched on above, Symphony Environmental Technologies plc is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. This isn't great when you look at it against the backdrop of EPS growth, which has been negative for the past three years. But on the bright side, shareholder returns have moved northward during the same period. We do not think CEO compensation is a problem, but shrinking EPS is undoubtedly an issue that will have to be addressed.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 4 warning signs for Symphony Environmental Technologies that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Symphony Environmental Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:SYM

Symphony Environmental Technologies

Engages in the development and supply of environmental plastic additives and masterbatches in the United Kingdom, rest of Europe, North America, Central and South America, the Middle East, and Asia.

Slight risk with imperfect balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026