Stock Analysis

- United Kingdom

- /

- Metals and Mining

- /

- AIM:SRB

Serabi Gold's (LON:SRB) 213% YoY earnings expansion surpassed the shareholder returns over the past year

Unless you borrow money to invest, the potential losses are limited. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the Serabi Gold plc (LON:SRB) share price has soared 110% in the last 1 year. Most would be very happy with that, especially in just one year! On top of that, the share price is up 49% in about a quarter. Unfortunately the longer term returns are not so good, with the stock falling 5.9% in the last three years.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

See our latest analysis for Serabi Gold

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Serabi Gold grew its earnings per share, moving from a loss to a profit.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

Revenue was pretty flat year on year, but maybe a closer look at the data can explain the market optimism.

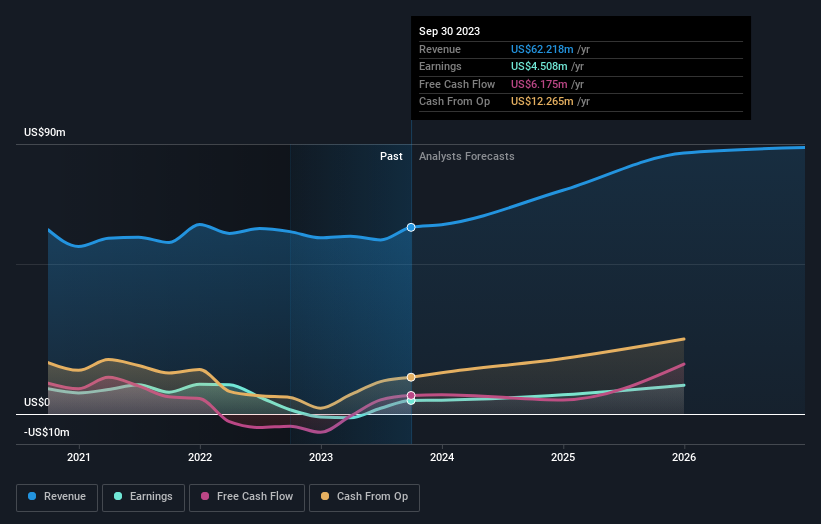

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Serabi Gold has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Serabi Gold in this interactive graph of future profit estimates.

A Different Perspective

We're pleased to report that Serabi Gold shareholders have received a total shareholder return of 110% over one year. That gain is better than the annual TSR over five years, which is 10%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Serabi Gold better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Serabi Gold you should be aware of.

Of course Serabi Gold may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Serabi Gold is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SRB

Serabi Gold

Serabi Gold plc engages in the evaluation, exploration, and development of gold and other metals mining projects in Brazil.

Flawless balance sheet with solid track record.