When Scotgold Resources Limited (LON:SGZ) reported its results to June 2022 its auditors, BDO LLP could not be sure that it would be able to continue as a going concern in the next year. Thus we can say that, based on the results to that date, the company should raise capital or otherwise raise cash, without much delay.

If the company does have to issue more shares, potential investors will be sure to consider how desperate it is for capital. So current risks on the balance sheet could have a big impact on how shareholders fare from here. Debt is always a risk factor in these cases, as creditors could be in a position to wind up the company, in the worst case scenario.

View our latest analysis for Scotgold Resources

What Is Scotgold Resources's Debt?

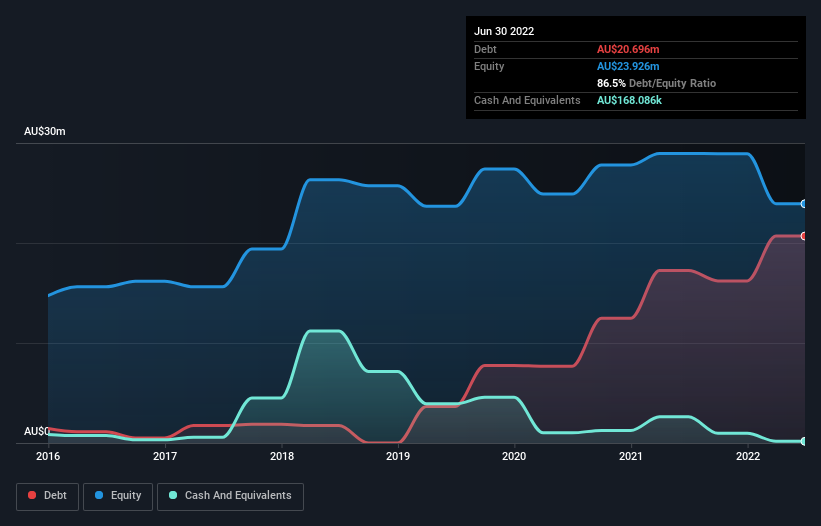

As you can see below, at the end of June 2022, Scotgold Resources had AU$20.7m of debt, up from AU$17.3m a year ago. Click the image for more detail. Net debt is about the same, since the it doesn't have much cash.

How Strong Is Scotgold Resources' Balance Sheet?

According to the last reported balance sheet, Scotgold Resources had liabilities of AU$6.28m due within 12 months, and liabilities of AU$23.0m due beyond 12 months. Offsetting this, it had AU$168.1k in cash and AU$4.69m in receivables that were due within 12 months. So it has liabilities totalling AU$24.5m more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Scotgold Resources has a market capitalization of AU$55.1m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Scotgold Resources can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Scotgold Resources reported revenue of AU$18m, which is a gain of 5,831%, although it did not report any earnings before interest and tax. When it comes to revenue growth, that's like nailing the game winning 3-pointer!

Caveat Emptor

Even though Scotgold Resources managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Its EBIT loss was a whopping AU$6.8m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through AU$6.3m of cash over the last year. So suffice it to say we consider the stock very risky. We're too cautious to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. That's because companies should always make sure the auditor has confidence that the company will continue as a going concern, in our view. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example Scotgold Resources has 3 warning signs (and 2 which are concerning) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SGZ

Scotgold Resources

Scotgold Resources Limited engages in the mine development and mineral exploration businesses in Australia, Scotland, France, and Portugal.

Slightly overvalued with weak fundamentals.

Market Insights

Community Narratives