- United Kingdom

- /

- Metals and Mining

- /

- AIM:MTL

UK Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting global economic uncertainties. In such a volatile environment, growth companies with high insider ownership can be appealing as they often demonstrate strong commitment from those who know the business best, potentially aligning management interests with shareholder value.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 16.3% | 57.8% |

| QinetiQ Group (LSE:QQ.) | 13.3% | 67.7% |

| Metals Exploration (AIM:MTL) | 10.4% | 85.9% |

| Manolete Partners (AIM:MANO) | 38.1% | 29.5% |

| LSL Property Services (LSE:LSL) | 10.4% | 21.2% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 21% |

| Evoke (LSE:EVOK) | 20.6% | 81.9% |

| B90 Holdings (AIM:B90) | 22.1% | 157.2% |

| Anglo Asian Mining (AIM:AAZ) | 39.7% | 134.7% |

| ActiveOps (AIM:AOM) | 19.5% | 40.7% |

Let's review some notable picks from our screened stocks.

Metals Exploration (AIM:MTL)

Simply Wall St Growth Rating: ★★★★★★

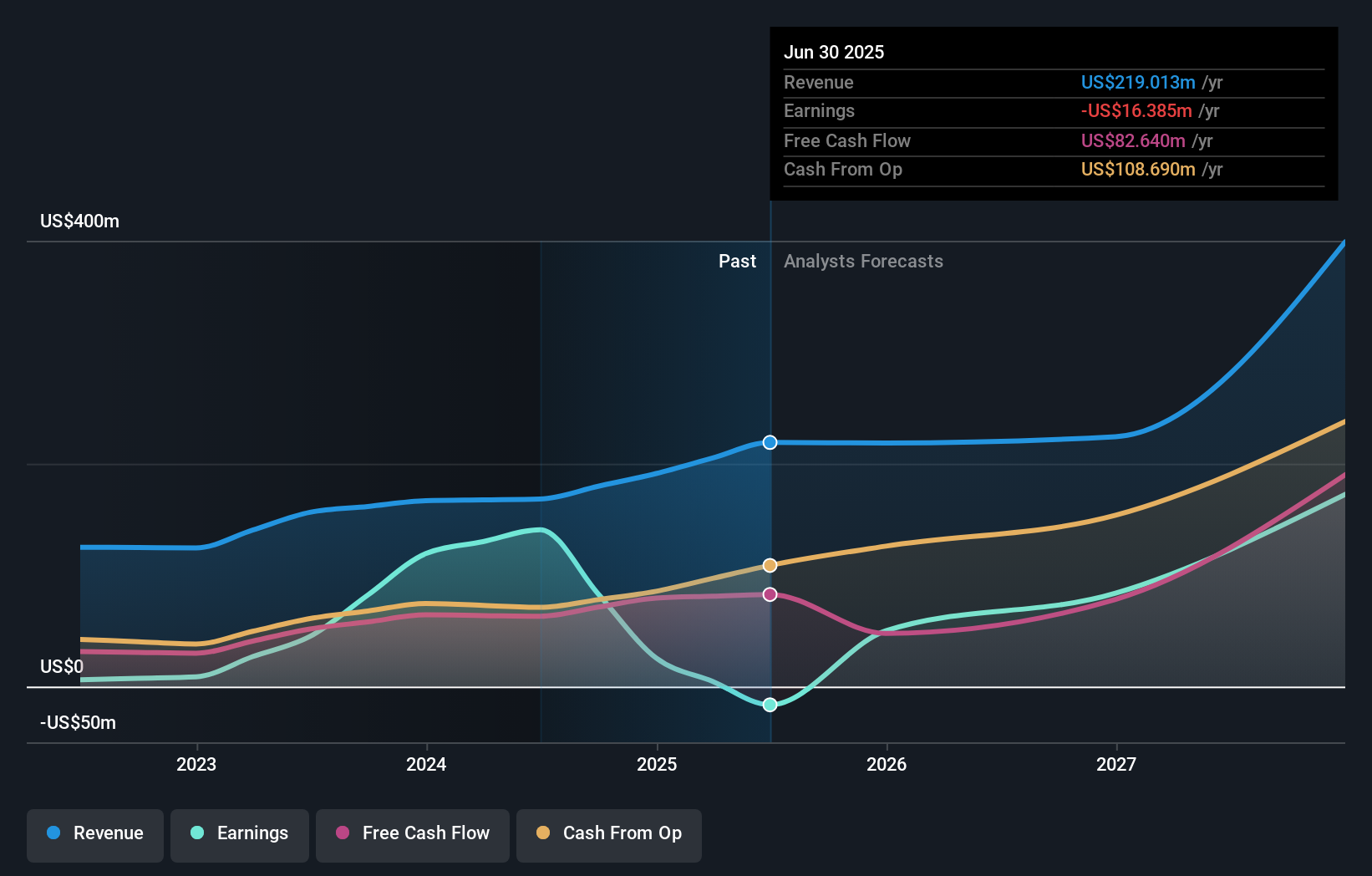

Overview: Metals Exploration plc is involved in identifying, acquiring, exploring, and developing mining and processing properties in the United Kingdom and the Philippines, with a market cap of £365.99 million.

Operations: The company's revenue is primarily derived from its Metals & Mining segment, specifically in Gold & Other Precious Metals, amounting to $219.01 million.

Insider Ownership: 10.4%

Earnings Growth Forecast: 85.9% p.a.

Metals Exploration exhibits characteristics of a growth company with high insider ownership, despite recent operational challenges. The company is trading significantly below its estimated fair value and is expected to see substantial revenue growth of 25.5% annually, outpacing the UK market. While earnings have been impacted by cyanide contamination issues at Runruno, production guidance remains stable within the lower range of expectations. Development at La India continues as planned, supporting future growth prospects amidst volatile share price movements.

- Click here and access our complete growth analysis report to understand the dynamics of Metals Exploration.

- In light of our recent valuation report, it seems possible that Metals Exploration is trading behind its estimated value.

LSL Property Services (LSE:LSL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LSL Property Services plc, with a market cap of £251.33 million, operates in the United Kingdom providing business-to-business services to mortgage intermediaries and estate agent franchisees, as well as valuation services to lenders.

Operations: The company's revenue is derived from three main segments: Financial Services (£48.33 million), Surveying and Valuation (£102.08 million), and Estate Agency excluding Financial Services (£27.04 million).

Insider Ownership: 10.4%

Earnings Growth Forecast: 21.2% p.a.

LSL Property Services demonstrates growth potential with earnings forecasted to increase significantly at 21.2% annually, surpassing the UK market average. Despite a slight decline in net income for H1 2025, revenue rose to £89.67 million. The company trades well below its estimated fair value and has completed a share buyback program worth £6.15 million. However, the dividend yield of 4% is not fully covered by free cash flows, indicating potential sustainability concerns.

- Take a closer look at LSL Property Services' potential here in our earnings growth report.

- The analysis detailed in our LSL Property Services valuation report hints at an deflated share price compared to its estimated value.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★★☆

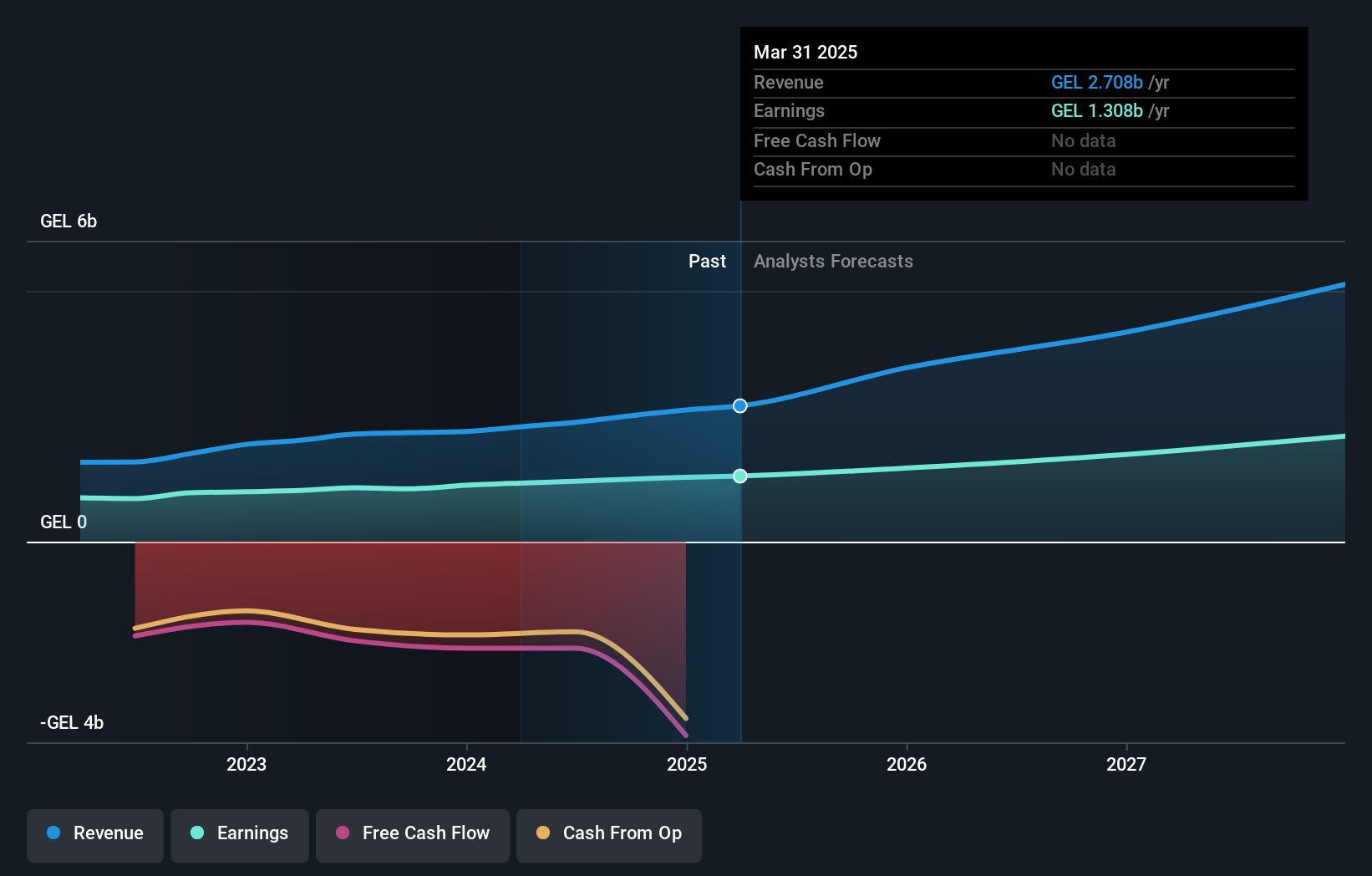

Overview: TBC Bank Group PLC, with a market cap of £2.12 billion, offers banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan through its subsidiaries.

Operations: The company's revenue from Georgian Financial Services amounts to GEL 2.40 billion.

Insider Ownership: 17.9%

Earnings Growth Forecast: 18.3% p.a.

TBC Bank Group shows promising growth potential, with earnings forecasted to grow 18.3% annually, outpacing the UK market. The company trades at a significant discount to its estimated fair value and reports strong revenue growth of 23.5% per year, surpassing industry averages. Recent earnings showed increased net interest income and net income for Q3 2025. However, challenges include a high level of bad loans at 2.8%, and an unstable dividend track record despite recent affirmations of payouts.

- Get an in-depth perspective on TBC Bank Group's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility TBC Bank Group's shares may be trading at a discount.

Summing It All Up

- Click this link to deep-dive into the 58 companies within our Fast Growing UK Companies With High Insider Ownership screener.

- Ready To Venture Into Other Investment Styles? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MTL

Metals Exploration

Metals Exploration plc identifies, acquires, explores for, and develops mining and processing properties in the United Kingdom and the Philippines.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives