- United Kingdom

- /

- Chemicals

- /

- AIM:DCTA

Why We're Not Concerned Yet About Directa Plus Plc's (LON:DCTA) 27% Share Price Plunge

Unfortunately for some shareholders, the Directa Plus Plc (LON:DCTA) share price has dived 27% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 72% loss during that time.

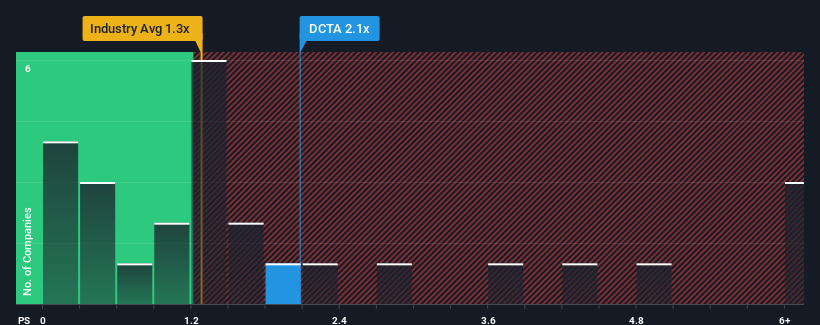

In spite of the heavy fall in price, when almost half of the companies in the United Kingdom's Chemicals industry have price-to-sales ratios (or "P/S") below 1.3x, you may still consider Directa Plus as a stock probably not worth researching with its 2.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Directa Plus

What Does Directa Plus' Recent Performance Look Like?

There hasn't been much to differentiate Directa Plus' and the industry's retreating revenue lately. Perhaps the market is expecting the company to reverse its fortunes and beat out a struggling industry in the future, elevating the P/S. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Directa Plus will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Directa Plus?

In order to justify its P/S ratio, Directa Plus would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.3%. Even so, admirably revenue has lifted 119% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 47% during the coming year according to the dual analysts following the company. With the rest of the industry predicted to shrink by 17%, that would be a fantastic result.

In light of this, it's understandable that Directa Plus' P/S sits above the majority of other companies. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

What We Can Learn From Directa Plus' P/S?

Despite the recent share price weakness, Directa Plus' P/S remains higher than most other companies in the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Directa Plus' analyst forecasts revealed that its superior revenue outlook against a shaky industry is contributing to its high P/S. Outperforming the industry in this manner looks to have provided investors with a bit of confidence that the future will be bright, bolstering the P/S. We still remain cautious about the company's ability to keep swimming against the current of the broader industry turmoil. Although, if the company's prospects don't change they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Directa Plus you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:DCTA

Directa Plus

Manufactures and sells graphene-based products for industrial and commercial applications in Italy, Romania, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion