Stock Analysis

- United Kingdom

- /

- Basic Materials

- /

- AIM:BRCK

3 UK Penny Stocks With Market Caps Under £300M To Consider

Reviewed by Simply Wall St

Over the last 7 days, the UK market has remained flat, though it is up 11% over the past year with earnings forecast to grow by 14% annually. For those looking to invest in smaller or newer companies, penny stocks—despite their somewhat outdated term—can still offer surprising value when they are backed by solid financial foundations. This article highlights three such stocks that demonstrate financial strength and potential for long-term growth.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.875 | £189.41M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.04 | £791.19M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.095 | £402.8M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.55 | £177.83M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.325 | £316.35M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.50 | £192.3M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.53 | £227.33M | ★★★★★☆ |

| Ultimate Products (LSE:ULTP) | £1.395 | £118.72M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.935 | £68.62M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.45 | $269.74M | ★★★★★★ |

Click here to see the full list of 467 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Brickability Group (AIM:BRCK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Brickability Group Plc, with a market cap of £201.97 million, supplies, distributes, and imports building products in the United Kingdom through its subsidiaries.

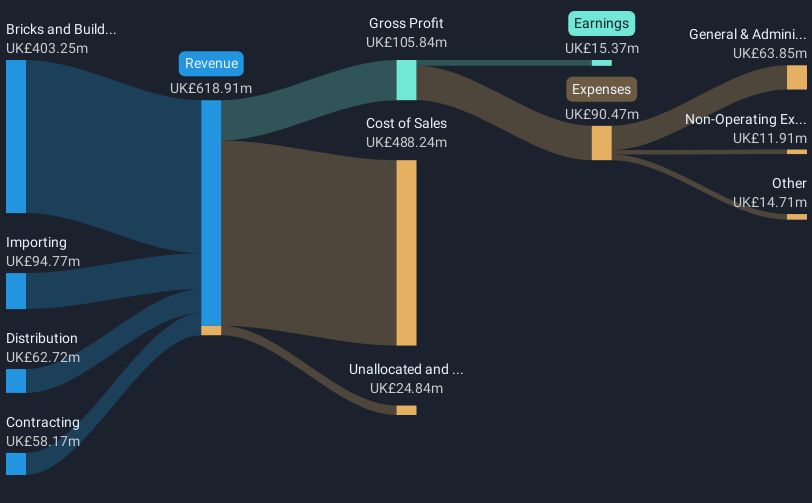

Operations: The company's revenue is primarily derived from its Bricks and Building Materials segment (£403.25 million), followed by Importing (£94.77 million), Distribution (£62.72 million), and Contracting (£58.17 million).

Market Cap: £201.97M

Brickability Group Plc, with a market cap of £201.97 million, operates in the building products sector and has shown mixed financial performance. Despite negative earnings growth (-44.6%) over the past year, its earnings are forecasted to grow 34.6% annually. The company's interest payments are well covered by EBIT (6.9x), and it maintains a satisfactory net debt to equity ratio (29.2%). However, profit margins have decreased from 4.1% to 2.6%, and shareholders experienced dilution with shares outstanding growing by 6.8%. Recent guidance indicates revenue exceeding £330 million for six months ending September 2024, marking a modest increase from the previous year.

- Click here to discover the nuances of Brickability Group with our detailed analytical financial health report.

- Explore Brickability Group's analyst forecasts in our growth report.

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gulf Keystone Petroleum Limited focuses on the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £288.35 million.

Operations: The company generates revenue of $115.15 million from its exploration and production activities in the oil and gas sector.

Market Cap: £288.35M

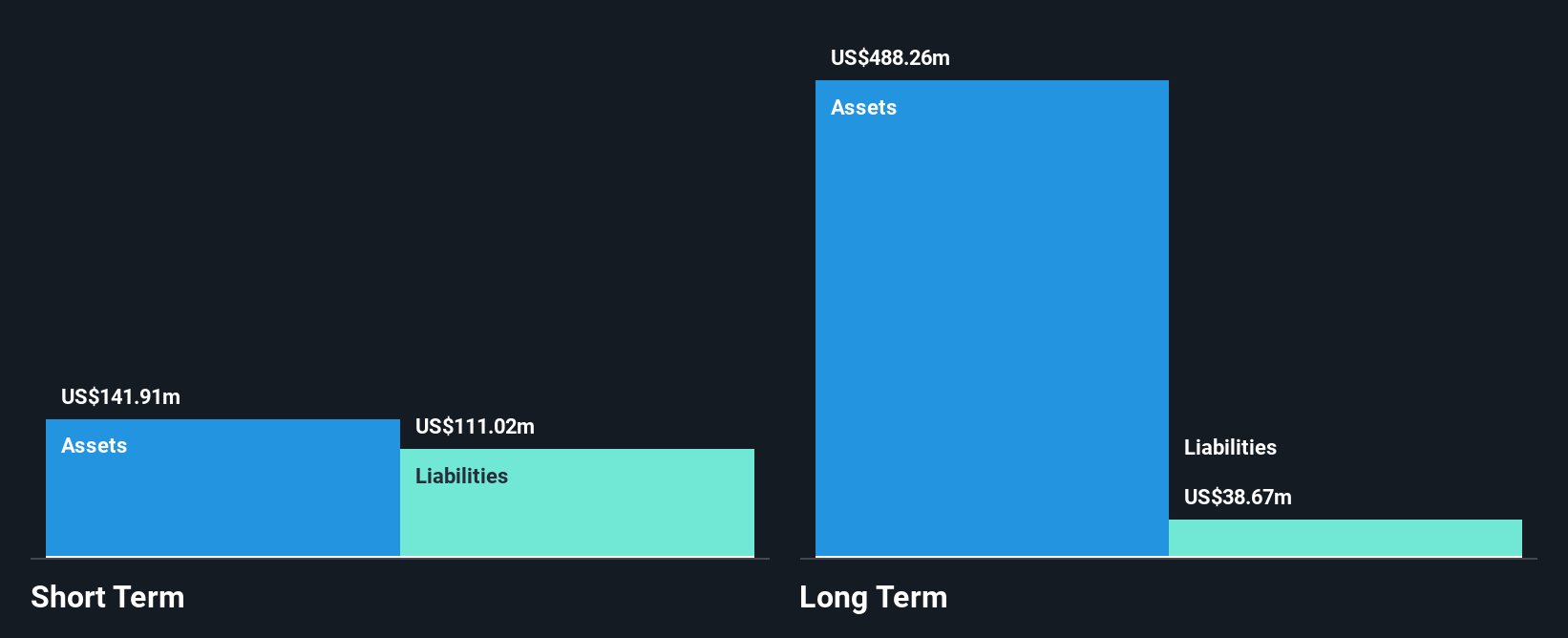

Gulf Keystone Petroleum, with a market cap of £288.35 million, operates in the oil and gas sector in Iraq's Kurdistan region. Despite being debt-free and trading below its estimated fair value, the company faces challenges such as unprofitability and short-term liabilities exceeding assets by US$3.3 million. Recent leadership changes include David Thomas assuming Chair responsibilities amidst board restructuring. The company announced a $20 million interim dividend despite its negative return on equity (-1.55%). Earnings are forecasted to grow significantly at 76.3% annually, but past profit margins remain weak amidst stable weekly volatility over the past year (5%).

- Unlock comprehensive insights into our analysis of Gulf Keystone Petroleum stock in this financial health report.

- Gain insights into Gulf Keystone Petroleum's future direction by reviewing our growth report.

Symphony International Holdings (LSE:SIHL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Symphony International Holdings Limited is a private equity and venture capital firm focusing on early-stage investments, management buy-outs, emerging growth, and special situations, with a market cap of $152.47 million.

Operations: Symphony International Holdings Limited does not report specific revenue segments.

Market Cap: $152.47M

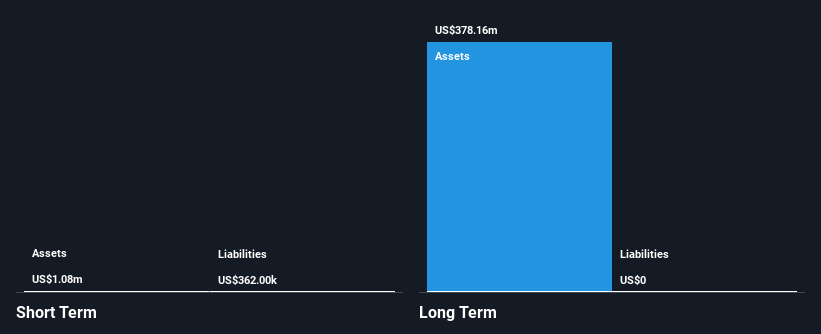

Symphony International Holdings Limited, with a market cap of US$152.47 million, remains unprofitable and pre-revenue, reporting a net loss of US$2.52 million for the half-year ended June 2024. Despite having no debt and seasoned board members with an average tenure of 17.3 years, the company faces challenges such as high volatility compared to UK stocks and declining earnings over the past five years at 6.8% annually. While its short-term assets (US$1.1 million) comfortably cover liabilities (US$362K), its dividend yield of 8.42% is not sustainable through current earnings or cash flows.

- Click to explore a detailed breakdown of our findings in Symphony International Holdings' financial health report.

- Examine Symphony International Holdings' past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Gain an insight into the universe of 467 UK Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brickability Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BRCK

Brickability Group

Supplies, distributes, and imports building products in the United Kingdom.