- United Kingdom

- /

- Metals and Mining

- /

- AIM:BMN

The Market Doesn't Like What It Sees From Bushveld Minerals Limited's (LON:BMN) Revenues Yet As Shares Tumble 30%

The Bushveld Minerals Limited (LON:BMN) share price has fared very poorly over the last month, falling by a substantial 30%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 76% loss during that time.

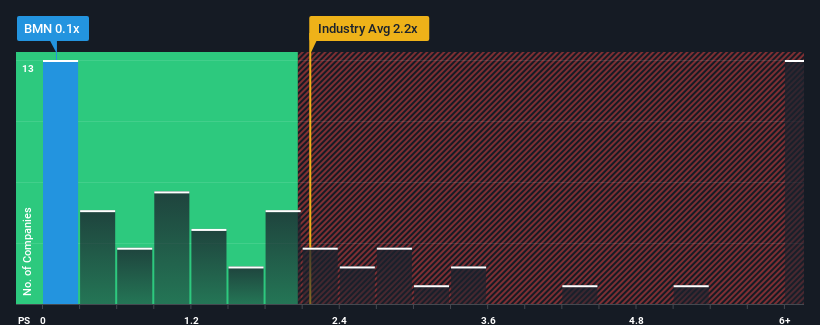

After such a large drop in price, Bushveld Minerals' price-to-sales (or "P/S") ratio of 0.1x might make it look like a strong buy right now compared to the wider Metals and Mining industry in the United Kingdom, where around half of the companies have P/S ratios above 2.2x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Bushveld Minerals

How Has Bushveld Minerals Performed Recently?

Bushveld Minerals could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Bushveld Minerals' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Bushveld Minerals' is when the company's growth is on track to lag the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.4%. Still, the latest three year period has seen an excellent 53% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 7.5% each year as estimated by the only analyst watching the company. Meanwhile, the broader industry is forecast to expand by 1.4% each year, which paints a poor picture.

With this information, we are not surprised that Bushveld Minerals is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Having almost fallen off a cliff, Bushveld Minerals' share price has pulled its P/S way down as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that Bushveld Minerals maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Bushveld Minerals (at least 3 which don't sit too well with us), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Bushveld Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:BMN

Bushveld Minerals

Operates as an integrated primary vanadium and energy storage solutions provider for the steel, energy, and chemical industries in South Africa, Europe, Asia, the United States, and internationally.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives