- United Kingdom

- /

- Metals and Mining

- /

- AIM:AAZ

Is Anglo Asian Mining PLC's (LON:AAZ) CEO Paid At A Competitive Rate?

Mohammed Vaziri became the CEO of Anglo Asian Mining PLC (LON:AAZ) in 2008. First, this article will compare CEO compensation with compensation at similar sized companies. Next, we'll consider growth that the business demonstrates. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

Check out our latest analysis for Anglo Asian Mining

How Does Mohammed Vaziri's Compensation Compare With Similar Sized Companies?

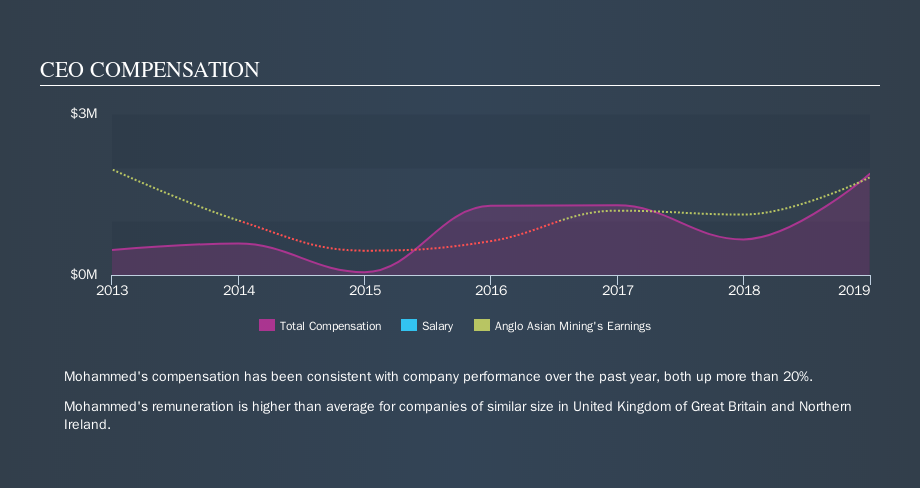

Our data indicates that Anglo Asian Mining PLC is worth UK£198m, and total annual CEO compensation was reported as US$1.9m for the year to December 2018. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at . Importantly, there may be performance hurdles relating to the non-salary component of the total compensation. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of US$100m to US$400m. The median total CEO compensation was US$628k.

Thus we can conclude that Mohammed Vaziri receives more in total compensation than the median of a group of companies in the same market, and of similar size to Anglo Asian Mining PLC. However, this doesn't necessarily mean the pay is too high. We can get a better idea of how generous the pay is by looking at the performance of the underlying business.

The graphic below shows how CEO compensation at Anglo Asian Mining has changed from year to year.

Is Anglo Asian Mining PLC Growing?

Anglo Asian Mining PLC has increased its earnings per share (EPS) by an average of 118% a year, over the last three years (using a line of best fit). In the last year, its revenue is up 26%.

This demonstrates that the company has been improving recently. A good result. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business.

Has Anglo Asian Mining PLC Been A Good Investment?

I think that the total shareholder return of 1107%, over three years, would leave most Anglo Asian Mining PLC shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

We examined the amount Anglo Asian Mining PLC pays its CEO, and compared it to the amount paid by similar sized companies. We found that it pays well over the median amount paid in the benchmark group.

Importantly, though, the company has impressed with its earnings per share growth, over three years. Even better, returns to shareholders have been plentiful, over the same time period. So, considering this good performance, the CEO compensation may be quite appropriate. Shareholders may want to check for free if Anglo Asian Mining insiders are buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:AAZ

Anglo Asian Mining

Owns and operates gold, silver, and copper producing properties in the Republic of Azerbaijan.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives