- United Kingdom

- /

- Metals and Mining

- /

- AIM:AAZ

Anglo Asian Mining PLC (LON:AAZ) Might Not Be As Mispriced As It Looks After Plunging 28%

Anglo Asian Mining PLC (LON:AAZ) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 41% share price drop.

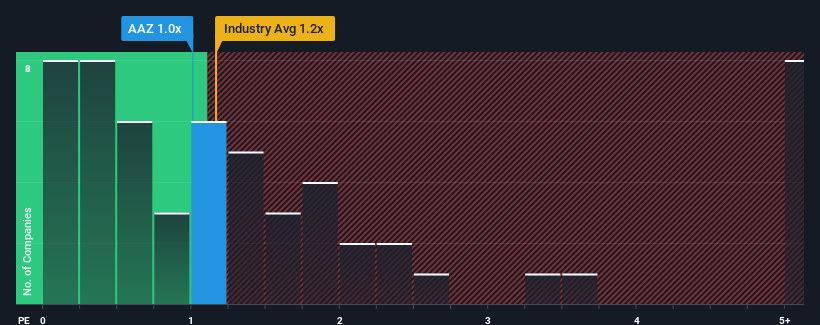

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Anglo Asian Mining's P/S ratio of 1x, since the median price-to-sales (or "P/S") ratio for the Metals and Mining industry in the United Kingdom is also close to 1.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Anglo Asian Mining

What Does Anglo Asian Mining's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Anglo Asian Mining has been doing quite well of late. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Anglo Asian Mining.Is There Some Revenue Growth Forecasted For Anglo Asian Mining?

The only time you'd be comfortable seeing a P/S like Anglo Asian Mining's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.3% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 11% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 22% as estimated by the sole analyst watching the company. That would be an excellent outcome when the industry is expected to decline by 1.5%.

With this information, we find it odd that Anglo Asian Mining is trading at a fairly similar P/S to the industry. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Key Takeaway

Following Anglo Asian Mining's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Anglo Asian Mining currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. It appears some are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

It is also worth noting that we have found 4 warning signs for Anglo Asian Mining (2 can't be ignored!) that you need to take into consideration.

If you're unsure about the strength of Anglo Asian Mining's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:AAZ

Anglo Asian Mining

Owns and operates gold, silver, and copper producing properties in the Republic of Azerbaijan.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026