- United Kingdom

- /

- Insurance

- /

- LSE:LGEN

We Ran A Stock Scan For Earnings Growth And Legal & General Group (LON:LGEN) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Legal & General Group (LON:LGEN). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Legal & General Group

Legal & General Group's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Legal & General Group managed to grow EPS by 4.4% per year, over three years. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. We note that while EBIT margins have improved from 10% to 31%, the company has actually reported a fall in revenue by 46%. That's not a good look.

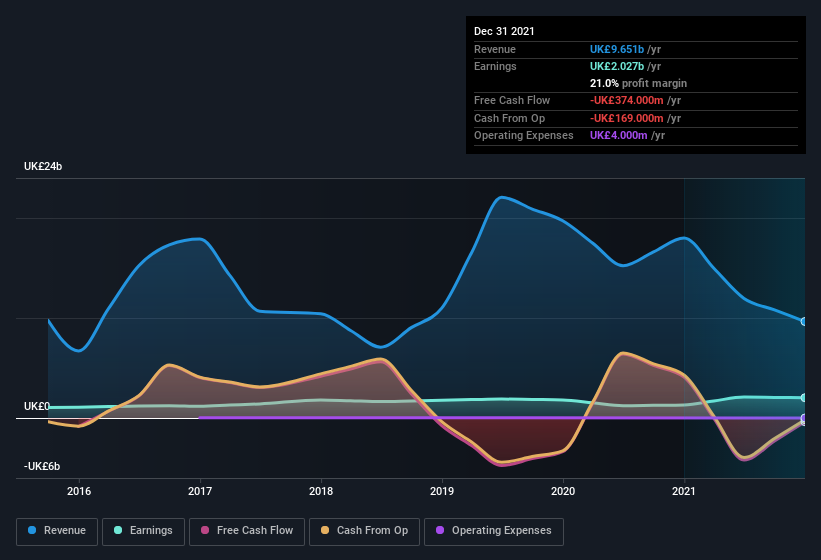

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Legal & General Group?

Are Legal & General Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's good to see Legal & General Group insiders walking the walk, by spending UK£170k on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. We also note that it was the Independent Non-Executive Director, Nilufer von Bismarck, who made the biggest single acquisition, paying UK£9.5k for shares at about UK£2.89 each.

Along with the insider buying, another encouraging sign for Legal & General Group is that insiders, as a group, have a considerable shareholding. As a matter of fact, their holding is valued at UK£16m. This considerable investment should help drive long-term value in the business. Even though that's only about 0.1% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add Legal & General Group To Your Watchlist?

As previously touched on, Legal & General Group is a growing business, which is encouraging. Better yet, insiders are significant shareholders, and have been buying more shares. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. Even so, be aware that Legal & General Group is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

Keen growth investors love to see insider buying. Thankfully, Legal & General Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:LGEN

Legal & General Group

Provides various insurance products and services in the United Kingdom, the United States, and internationally.

High growth potential established dividend payer.