- United Kingdom

- /

- Insurance

- /

- LSE:AV.

Is Aviva’s Valuation Justified After Recent Strategic Partnerships and a 58.6% Price Surge?

Reviewed by Bailey Pemberton

- Ever wondered if Aviva is still a smart buy, or if recent gains mean it is priced for perfection? Here is a breakdown of what really matters for value-focused investors.

- Aviva's stock price has surged, climbing 58.6% over the last year and 213.4% over the past five years, with a 1.0% increase this past week.

- Several recent announcements, including Aviva's expansion into new markets and its major strategic partnership deals, have caught investor attention. These moves are helping to reshape the company's growth profile and could signal a new phase for the business.

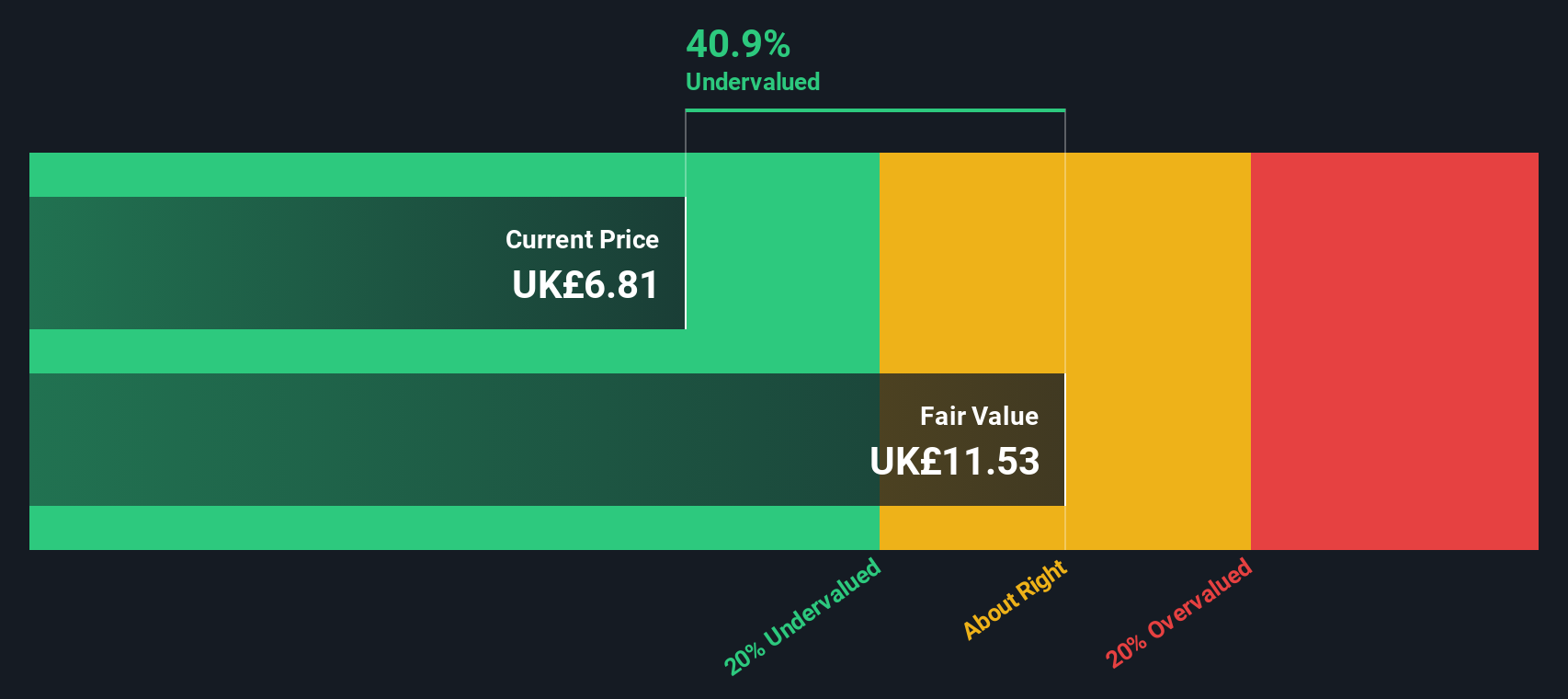

- The company's current valuation score is 2 out of 6, suggesting there might be some hidden opportunities or risks in the numbers. Next, we will look at how Aviva compares to traditional valuation methods. Stay tuned for a fresh perspective on finding true value at the end of the article.

Aviva scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Aviva Excess Returns Analysis

The Excess Returns model evaluates a company's ability to generate returns above its cost of capital. By looking at how much profit Aviva produces relative to the capital invested by shareholders, this approach offers an insightful measure of whether the company's growth can translate into real value for investors.

According to analyst estimates, Aviva’s Book Value stands at £3.16 per share, while its stable Earnings Per Share (EPS) is £0.55 per share. The average Return on Equity is a solid 16.28%, and the Stable Book Value is £3.38 per share, based on projections from five analysts. Against a Cost of Equity of £0.24 per share, the model calculates an excess return of £0.31 per share, signaling efficient deployment of shareholder funds.

The intrinsic value estimated using this model is £11.02 per share. With the stock currently trading well below this figure, the Excess Returns model implies Aviva is trading at a significant 38.7% discount to its intrinsic value, suggesting the shares are undervalued by a notable margin.

Result: UNDERVALUED

Our Excess Returns analysis suggests Aviva is undervalued by 38.7%. Track this in your watchlist or portfolio, or discover 874 more undervalued stocks based on cash flows.

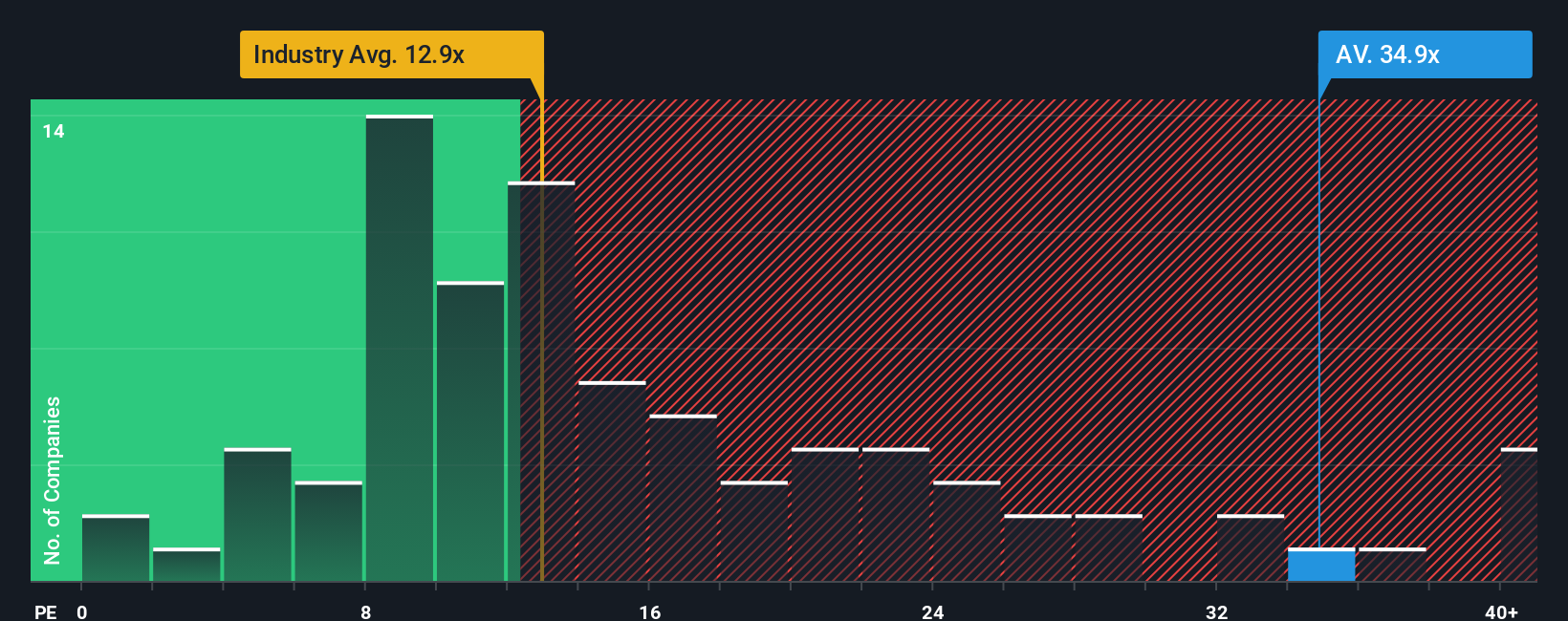

Approach 2: Aviva Price vs Earnings

The Price-to-Earnings (PE) ratio is the preferred multiple for evaluating profitable companies like Aviva because it directly relates the company’s share price to its earnings per share. This metric enables investors to easily compare how much they are paying for a pound of current earnings, making it a practical gauge of market expectations and profitability.

Growth prospects and risk profiles play a significant role in what is considered a “normal” or “fair” PE ratio. Companies expected to deliver strong future earnings growth or that operate with less risk typically warrant higher PE multiples. Slower-growing or riskier businesses will command lower ratios.

Currently, Aviva trades at a PE ratio of 34.6x. This is notably higher than both the insurance industry average of 11.8x and the peer group average of 20.4x. This suggests the market is assigning Aviva a significant premium. However, Simply Wall St’s proprietary Fair Ratio, which adjusts for the company’s unique growth outlook, profit margins, industry dynamics, market cap, and risk profile, sits at 21.6x.

The Fair Ratio is generally more insightful than a simple comparison to peers or the industry because it considers not just where Aviva sits today but also what makes the business distinct. It reflects not only expected growth, but operational strengths, quality of earnings, and inherent risks, which can all meaningfully affect what a fair multiple should be.

With Aviva’s actual PE multiple standing well above its Fair Ratio, the shares currently appear overvalued relative to what would be justified given its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

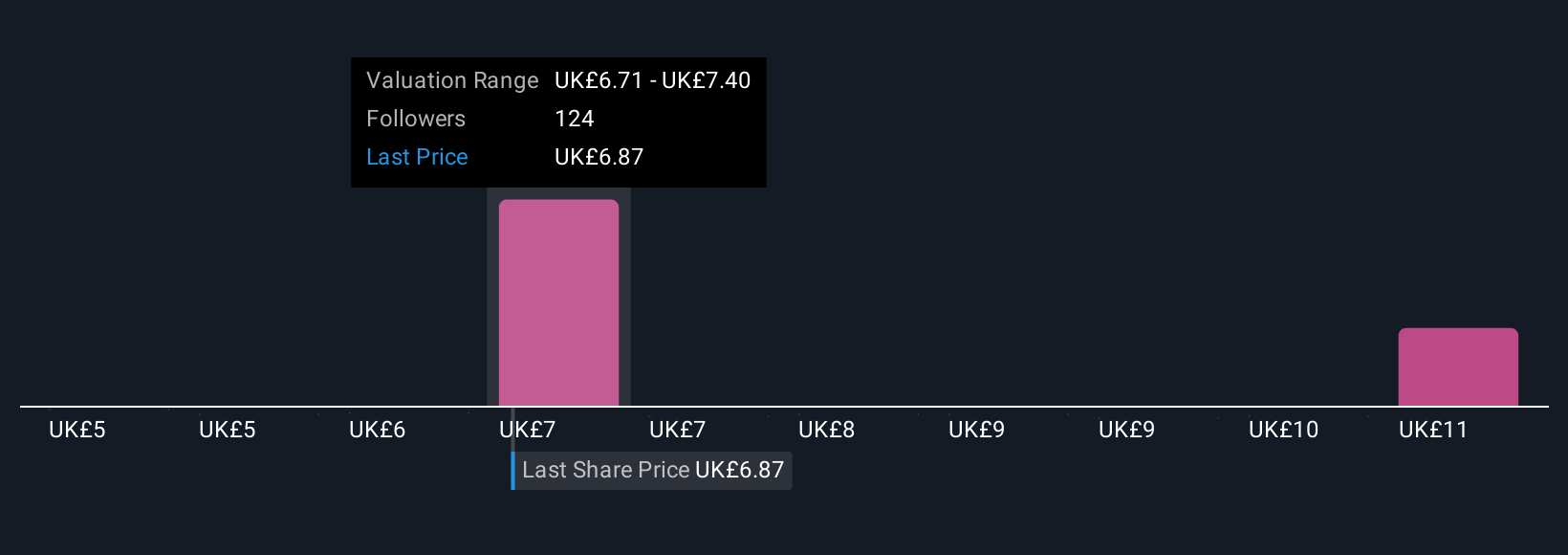

Upgrade Your Decision Making: Choose your Aviva Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your own story about where Aviva is headed. It is a perspective that links your assumptions about the company’s future (such as revenue, earnings, profit margins, and fair value) with what you believe is driving its success or posing risks.

Narratives bridge the gap between headlines and hard numbers, helping you connect Aviva’s business outlook with personalized financial forecasts and ultimately your own fair value estimate. On Simply Wall St's Community page, Narratives are easy to create or follow, empowering millions of investors to test their views alongside the latest data.

This tool lets you stay ahead, because Narratives dynamically update as new information (news, earnings releases, strategy changes) becomes available. This ensures your view is always in sync with today’s realities. Narratives help you decide when to buy or sell Aviva by directly comparing your Fair Value to the current market price, making your decisions clearer and more actionable.

For example, one investor might build a bullish Narrative, forecasting Aviva’s earnings to reach £2.1 billion and setting a target price of £7.40. A more cautious investor could assume just £1.4 billion in earnings and a fair value of £5.43. This shows that Narratives adapt to your unique outlook and are vital for smarter portfolio moves.

Do you think there's more to the story for Aviva? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AV.

Aviva

Provides various insurance, retirement, and wealth products in the United Kingdom, Ireland, Canada, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives