- United Kingdom

- /

- Insurance

- /

- LSE:AV.

Aviva (LSE:AV.) — A Fresh Look at Valuation as Shares Climb Quietly

Reviewed by Simply Wall St

Aviva (LSE:AV.) has been catching the eye of investors lately, with the stock’s recent moves raising reasonable questions about where it goes next. There's no single event sparking this attention right now, but sometimes a stretch of calm can be just as telling as a big announcement. For anyone watching the insurance sector or income-focused stocks, Aviva's recent steadiness and the relative lack of new headlines might actually signal a pause before the market decides on the company's next chapter.

Looking at the bigger picture, Aviva’s share price momentum has quietly picked up over the past year, up roughly 42% as new growth stories and steady results have drawn interest. Gains of 7% over the past month and nearly 7% over the past three months add to a strong showing, though the past day has seen a slight dip. Pair that with Aviva’s annual revenue growth of 8% and net income rising 17%, and it’s clear the business has been running with solid fundamentals even as the news cycle goes quiet.

Given the muted headlines and such a steady upward march in the numbers, is the market underestimating Aviva’s potential, or are investors already factoring in another year of growth?

Most Popular Narrative: 1.4% Undervalued

The prevailing narrative sees Aviva as almost fairly valued at today’s price, with only a slight discount to calculated fair value after factoring in future earnings growth and risks.

Accelerating the shift to 'capital-light' businesses (now over 66% of earnings and targeting 70% or more after the Direct Line integration) is driving improved group profit margins, lower capital requirements, and better return on equity. This creates a strong forward-looking outlook for net earnings and cash generation.

Want to know the ingredients for this near-fair value call? The narrative hinges on bold forecasts for revenue, profit margins, and a projected jump in annual earnings. What are analysts really expecting in terms of growth and market positioning? Get the inside track on the surprising numbers behind this calculated fair value and why it could signal an important inflection point for Aviva’s future.

Result: Fair Value of £6.64 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued reliance on the UK market and integration risks with Direct Line could challenge Aviva’s growth expectations more quickly than many anticipate.

Find out about the key risks to this Aviva narrative.Another View: Looking Beyond Fair Value

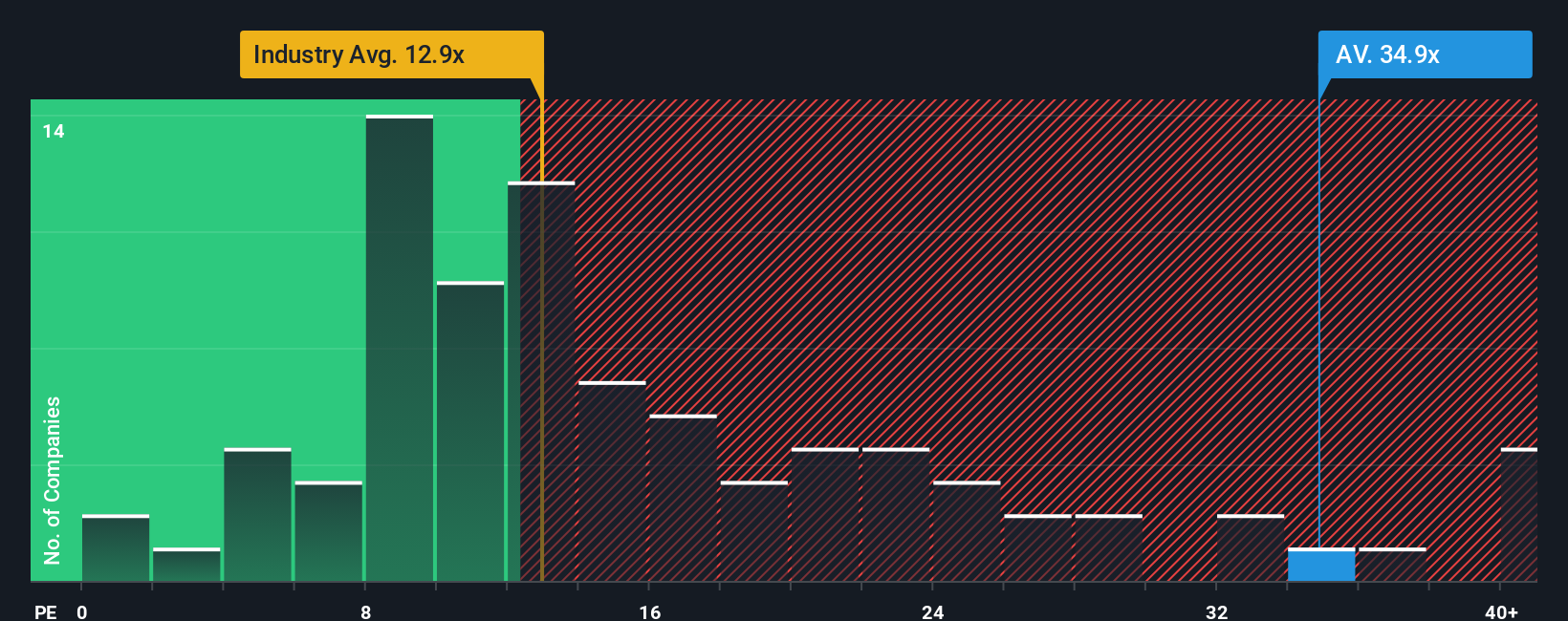

When we look at Aviva through the lens of market valuation ratios, the picture shifts. Relative to European peers, Aviva appears on the expensive side. Could market optimism be running ahead of fundamentals here?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Aviva to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Aviva Narrative

Keep in mind, if you see the numbers differently or want to dig deeper yourself, you can piece together your own perspective in just a few minutes with our tools. Do it your way.

A great starting point for your Aviva research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why stop at Aviva? Exploring beyond the familiar could uncover opportunities you never considered. Take action now with these smart screens built for different strategies:

- Spot undervalued gems primed for long-term growth by using our undervalued stocks based on cash flows to target companies with strong underlying cash flows.

- Tap into the hottest trends by finding game-changers in healthcare innovation with our healthcare AI stocks that highlights firms revolutionizing patient care.

- Unlock income potential with shares offering attractive yields by visiting dividend stocks with yields > 3% and add reliable dividend payers to your radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About LSE:AV.

Aviva

Provides various insurance, retirement, and wealth products in the United Kingdom, Ireland, Canada, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives