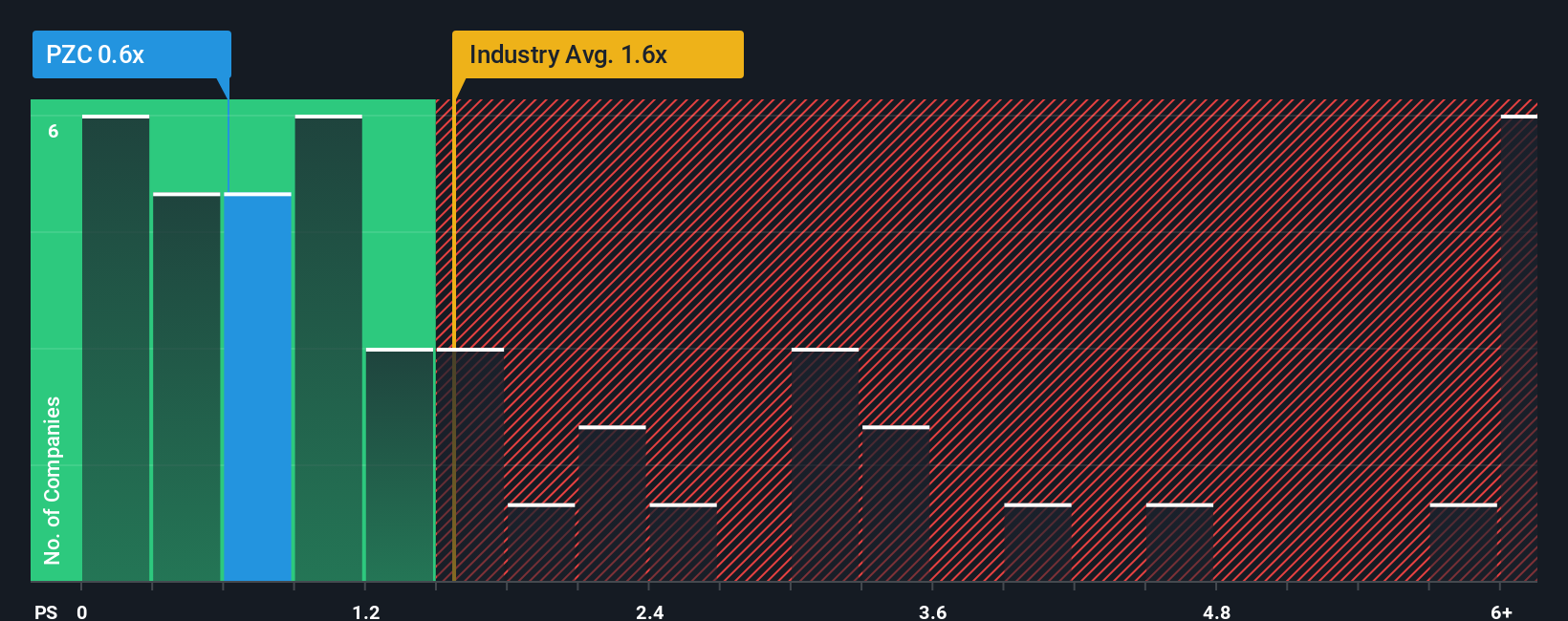

PZ Cussons plc's (LON:PZC) price-to-sales (or "P/S") ratio of 0.6x may look like a very appealing investment opportunity when you consider close to half the companies in the Personal Products industry in the United Kingdom have P/S ratios greater than 3.2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for PZ Cussons

How Has PZ Cussons Performed Recently?

While the industry has experienced revenue growth lately, PZ Cussons' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on PZ Cussons will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as PZ Cussons' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 13% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 3.2% each year as estimated by the three analysts watching the company. With the industry predicted to deliver 1.7% growth per annum, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that PZ Cussons' P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On PZ Cussons' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of PZ Cussons' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

You should always think about risks. Case in point, we've spotted 2 warning signs for PZ Cussons you should be aware of, and 1 of them can't be ignored.

If you're unsure about the strength of PZ Cussons' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:PZC

PZ Cussons

Manufactures, distributes, markets, and sells baby, beauty, and hygiene products in Europe, the Asia Pacific, the Americas, and Africa.

Good value with moderate growth potential.

Market Insights

Community Narratives