Just because a business does not make any money, does not mean that the stock will go down. For example, IQ-AI (LON:IQAI) shareholders have done very well over the last year, with the share price soaring by 129%. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given its strong share price performance, we think it's worthwhile for IQ-AI shareholders to consider whether its cash burn is concerning. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for IQ-AI

When Might IQ-AI Run Out Of Money?

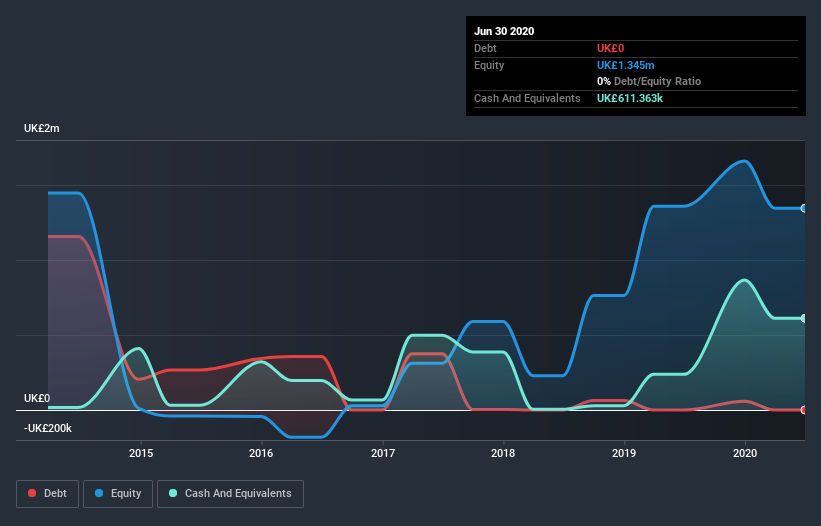

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. When IQ-AI last reported its balance sheet in June 2020, it had zero debt and cash worth UK£611k. In the last year, its cash burn was UK£392k. So it had a cash runway of approximately 19 months from June 2020. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. The image below shows how its cash balance has been changing over the last few years.

How Is IQ-AI's Cash Burn Changing Over Time?

In the last year, IQ-AI did book revenue of UK£242k, but its revenue from operations was less, at just UK£242k. We don't think that's enough operating revenue for us to understand too much from revenue growth rates, since the company is growing off a low base. So we'll focus on the cash burn, today. The 59% reduction in its cash burn over the last twelve months may be good for protecting the balance sheet but it hardly points to imminent growth. Admittedly, we're a bit cautious of IQ-AI due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

How Easily Can IQ-AI Raise Cash?

While we're comforted by the recent reduction evident from our analysis of IQ-AI's cash burn, it is still worth considering how easily the company could raise more funds, if it wanted to accelerate spending to drive growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of UK£15m, IQ-AI's UK£392k in cash burn equates to about 2.6% of its market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

How Risky Is IQ-AI's Cash Burn Situation?

As you can probably tell by now, we're not too worried about IQ-AI's cash burn. For example, we think its cash burn relative to its market cap suggests that the company is on a good path. Its cash runway wasn't quite as good, but was still rather encouraging! Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. On another note, we conducted an in-depth investigation of the company, and identified 7 warning signs for IQ-AI (2 make us uncomfortable!) that you should be aware of before investing here.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you decide to trade IQ-AI, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:IBAI

Imaging Biometrics

Through its subsidiaries, provides clinical treatments to patients in the field of medical imaging diagnostics in the United Kingdom, Switzerland, European Union, and the United States.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives