- United Kingdom

- /

- Professional Services

- /

- LSE:HAS

European Small Caps With Insider Action: Undervalued Picks For May 2025

Reviewed by Simply Wall St

As European markets navigate a landscape marked by easing trade tensions and mixed economic signals, the pan-European STOXX Europe 600 Index has shown resilience, rising for a fourth consecutive week. In this environment, small-cap stocks in Europe present intriguing opportunities for investors, particularly those with insider activity that may signal confidence in their potential. Identifying stocks with strong fundamentals and strategic positioning can be key to capitalizing on these market dynamics.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 11.4x | 0.5x | 38.20% | ★★★★★☆ |

| Savills | 24.6x | 0.5x | 41.18% | ★★★★☆☆ |

| FRP Advisory Group | 12.4x | 2.2x | 14.87% | ★★★★☆☆ |

| AKVA group | 15.2x | 0.7x | 49.12% | ★★★★☆☆ |

| Close Brothers Group | NA | 0.5x | 49.44% | ★★★★☆☆ |

| Eastnine | 17.8x | 8.6x | 40.61% | ★★★★☆☆ |

| Tristel | 30.7x | 4.3x | 17.98% | ★★★☆☆☆ |

| Italmobiliare | 11.2x | 1.5x | -276.14% | ★★★☆☆☆ |

| Arendals Fossekompani | NA | 1.6x | 41.75% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.2x | 49.69% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Tristel (AIM:TSTL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Tristel is a company specializing in infection prevention and contamination control products, primarily serving the healthcare sector with a market cap of £0.25 billion.

Operations: The primary revenue streams are Hospital Medical Device Decontamination (£37.68 million) and Hospital Environmental Surface Disinfection (£3.51 million). The gross profit margin has shown an upward trend over the years, reaching 81.42% by December 2024. Operating expenses have increased alongside revenue growth, with general and administrative expenses being a significant component of the cost structure.

PE: 30.7x

Tristel, a small European company, is navigating the healthcare sector with its innovative disinfectant products. Recent insider confidence was shown through share purchases in March 2025. The company's submission of additional data for FDA approval of Tristel OPH could significantly impact U.S. ophthalmic practices by June 2025. Financially, Tristel reported sales growth to £22.57 million for the half-year ending December 2024, despite a slight dip in net income to £2.73 million from the previous year. With earnings forecasted to grow annually by 19%, and an increased interim dividend to 5.68 pence paid in April 2025, Tristel presents potential growth opportunities amidst its funding challenges relying solely on external borrowing.

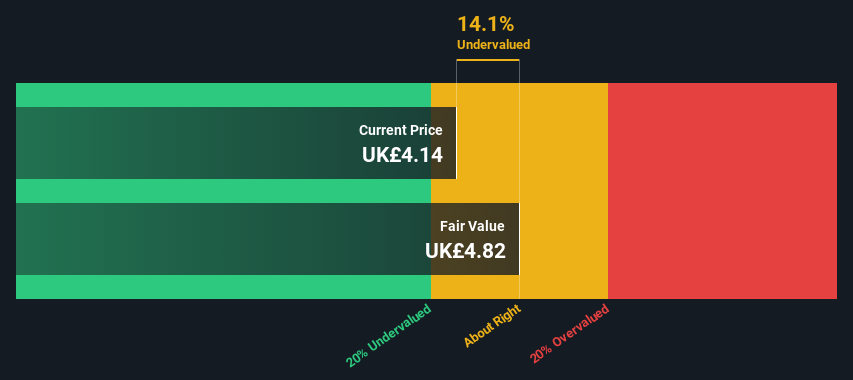

Hays (LSE:HAS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hays is a global recruitment company specializing in qualified, professional, and skilled recruitment services with a market cap of £1.95 billion.

Operations: The company generates revenue primarily from its Qualified, Professional, and Skilled Recruitment segment. Over the periods analyzed, the gross profit margin fluctuated significantly, peaking at 14.34% and declining to 3.03%. Operating expenses include notable allocations for general and administrative purposes as well as depreciation and amortization.

PE: -82.0x

Hays, a prominent player in the recruitment sector, shows potential as an undervalued opportunity among smaller European companies. Despite a decline in sales to £3.37 billion and net income dropping to £3 million for the half-year ending December 2024, earnings are poised for substantial growth at nearly 97% annually. Insider confidence is evident with recent share purchases over several months. While reliant on external borrowing, Hays' strategic focus could enhance future performance amid industry dynamics.

- Unlock comprehensive insights into our analysis of Hays stock in this valuation report.

Gain insights into Hays' past trends and performance with our Past report.

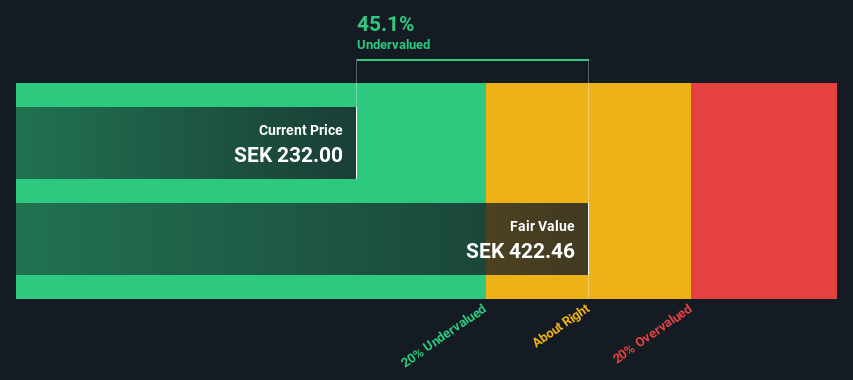

Absolent Air Care Group (OM:ABSO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Absolent Air Care Group specializes in providing air filtration solutions for industrial and commercial kitchen environments, with a market capitalization of approximately SEK 1.13 billion.

Operations: The company generates revenue primarily from its Industrial and Commercial Kitchen segments, with the Industrial segment contributing significantly more. Over recent periods, the gross profit margin has shown fluctuations, reaching 44.10% in September 2023 before slightly decreasing to 43.36% by March 2025. Operating expenses include significant allocations towards sales and marketing as well as general and administrative functions.

PE: 24.8x

Absolent Air Care Group, a small European player, recently reported Q1 sales of SEK 312.76 million, down from the previous year's SEK 357.6 million, with net income also decreasing to SEK 12.85 million from SEK 49.7 million. Despite this dip, they announced a dividend increase to SEK 3.25 per share payable in May, signaling confidence in future prospects. Earnings are projected to grow by an impressive 31% annually, though reliance on external borrowing poses some risk factors for investors considering its potential value play in the market.

- Click to explore a detailed breakdown of our findings in Absolent Air Care Group's valuation report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 60 Undervalued European Small Caps With Insider Buying here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hays might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HAS

Hays

Engages in the provision of recruitment services in Australia, New Zealand, Germany, the United Kingdom, Ireland, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives