- United Kingdom

- /

- Medical Equipment

- /

- AIM:SPEC

INSPECS Group plc (LON:SPEC) Surges 27% Yet Its Low P/S Is No Reason For Excitement

INSPECS Group plc (LON:SPEC) shares have had a really impressive month, gaining 27% after a shaky period beforehand. But the last month did very little to improve the 53% share price decline over the last year.

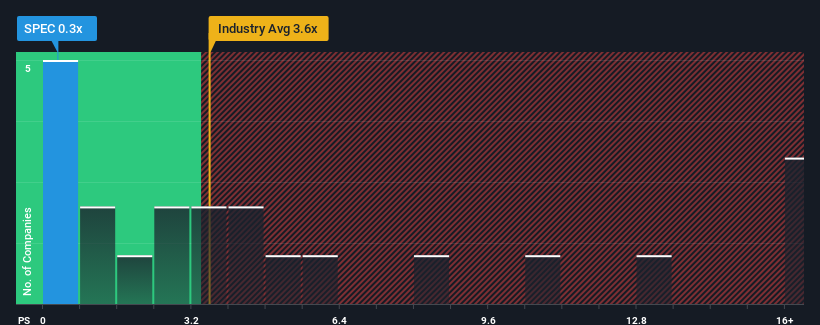

Although its price has surged higher, INSPECS Group's price-to-sales (or "P/S") ratio of 0.3x might still make it look like a strong buy right now compared to the wider Medical Equipment industry in the United Kingdom, where around half of the companies have P/S ratios above 3.6x and even P/S above 9x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for INSPECS Group

How INSPECS Group Has Been Performing

Recent times haven't been great for INSPECS Group as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on INSPECS Group.Is There Any Revenue Growth Forecasted For INSPECS Group?

In order to justify its P/S ratio, INSPECS Group would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The latest three year period has seen an incredible overall rise in revenue, in spite of this mediocre revenue growth of late. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it has slowed to such an extent.

Turning to the outlook, the next three years should generate growth of 4.1% per annum as estimated by the sole analyst watching the company. That's shaping up to be materially lower than the 8.1% per annum growth forecast for the broader industry.

With this in consideration, its clear as to why INSPECS Group's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Even after such a strong price move, INSPECS Group's P/S still trails the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that INSPECS Group maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for INSPECS Group that we have uncovered.

If you're unsure about the strength of INSPECS Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SPEC

INSPECS Group

Designs, produces, sells, markets, and distributes fashion eyewear, lenses, and OEM products in the United Kingdom, Europe, North America, South America, Asia, Africa, and Australia.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives