- United Kingdom

- /

- Healthtech

- /

- AIM:EMIS

I Ran A Stock Scan For Earnings Growth And EMIS Group (LON:EMIS) Passed With Ease

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like EMIS Group (LON:EMIS). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for EMIS Group

How Fast Is EMIS Group Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud EMIS Group's stratospheric annual EPS growth of 55%, compound, over the last three years? While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

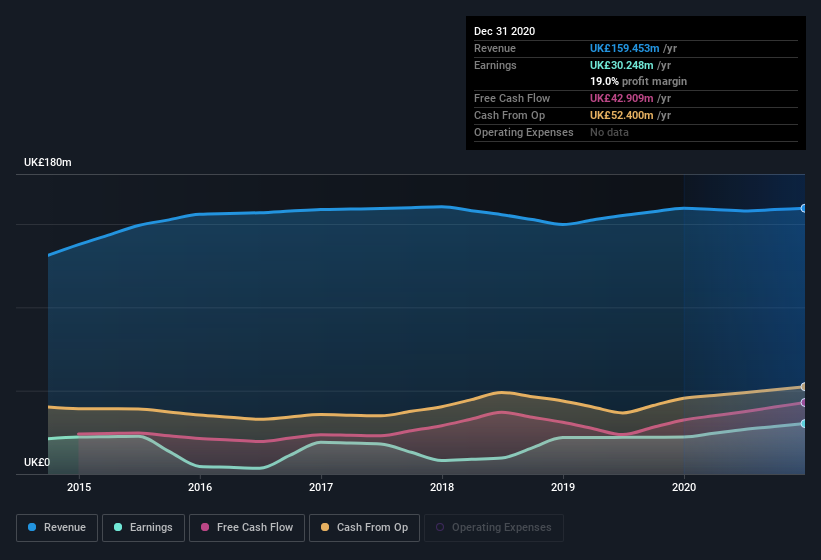

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EMIS Group reported flat revenue and EBIT margins over the last year. That's not bad, but it doesn't point to ongoing future growth, either.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for EMIS Group's future profits.

Are EMIS Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling EMIS Group shares, in the last year. With that in mind, it's heartening that Andrew McKeon, the Senior Independent Non-Executive Director of the company, paid UK£13k for shares at around UK£9.79 each.

Is EMIS Group Worth Keeping An Eye On?

EMIS Group's earnings per share have taken off like a rocket aimed right at the moon. If you're like me, you'll find it hard to ignore that sort of explosive EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If that's the case, you may regret neglecting to put EMIS Group on your watchlist. If you think EMIS Group might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of EMIS Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade EMIS Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EMIS Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:EMIS

EMIS Group

EMIS Group plc, through its subsidiaries, provides connected healthcare software and systems for healthcare professionals in the United Kingdom.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives