Stock Analysis

- United Kingdom

- /

- Real Estate

- /

- AIM:TPFG

UK Growth Companies With High Insider Ownership And Earnings Growth Of At Least 20%

Reviewed by Simply Wall St

As the FTSE 100 shows signs of a rebound following recent losses, and with optimism in European markets, investors are closely monitoring shifts in market dynamics. In this context, growth companies with high insider ownership can be particularly compelling, as they often signal strong confidence from those who know the company best – its own leaders.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124.5% |

| Getech Group (AIM:GTC) | 17.2% | 86.1% |

| Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

| Spectra Systems (AIM:SPSY) | 23.1% | 26.3% |

| Foresight Group Holdings (LSE:FSG) | 31.7% | 30.9% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

| Velocity Composites (AIM:VEL) | 28.5% | 140.5% |

| TEAM (AIM:TEAM) | 25.8% | 58.6% |

| Afentra (AIM:AET) | 38.3% | 99.2% |

We'll examine a selection from our screener results.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, a company engaged in developing, licensing, and supporting software for the healthcare sector primarily in the United States, has a market capitalization of approximately £0.84 billion.

Operations: The company generates its revenue primarily from the healthcare software segment, totaling $180.56 million.

Insider Ownership: 17%

Earnings Growth Forecast: 28.5% p.a.

Craneware, a UK-based company, is poised for notable growth with its revenue expected to increase by 7.3% annually, outpacing the UK market's 3.7%. Earnings are also set to rise significantly, at a rate of 28.5% per year over the next three years. Despite these positive trends in profitability and revenue growth, Craneware's forecasted Return on Equity (ROE) remains modest at 11.2%. Recent activities include presentations at various international conferences and an extension of their buyback plan till July 2024.

- Unlock comprehensive insights into our analysis of Craneware stock in this growth report.

- Our valuation report unveils the possibility Craneware's shares may be trading at a premium.

Property Franchise Group (AIM:TPFG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Property Franchise Group PLC, operating in the United Kingdom, focuses on managing and leasing residential real estate properties with a market capitalization of approximately £269.57 million.

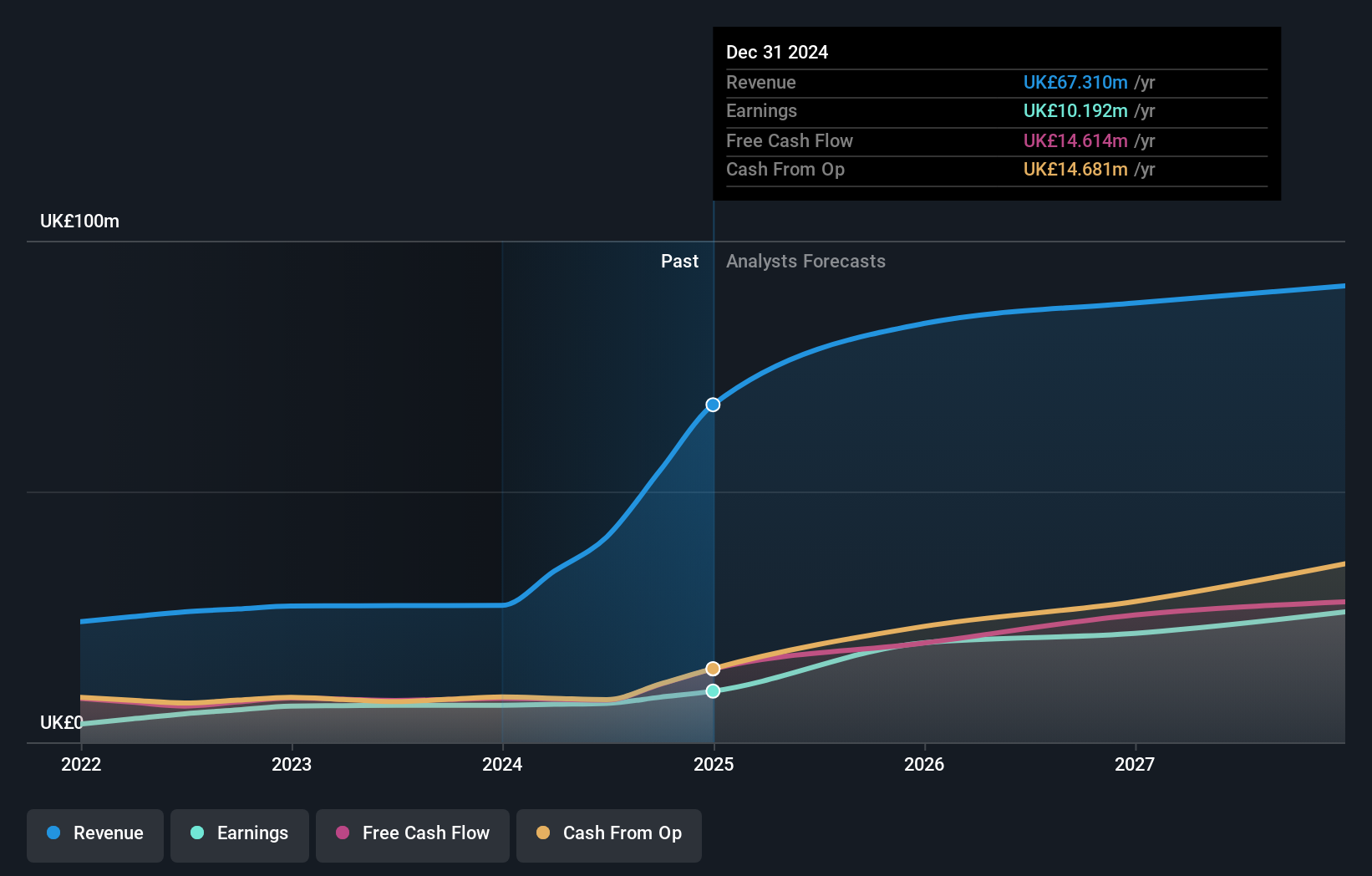

Operations: The company generates revenue from two primary segments: Financial Services (£1.50 million) and Property Franchising (£25.78 million).

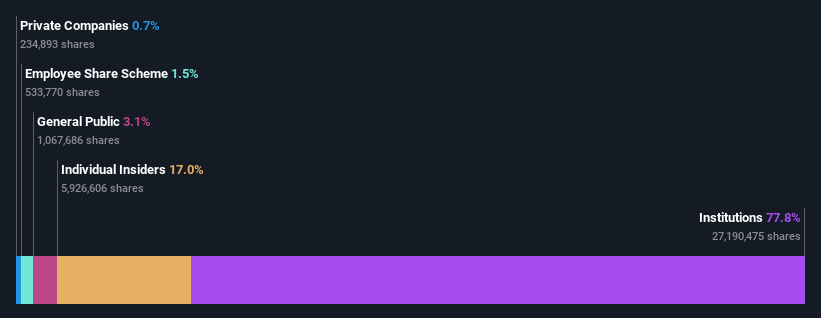

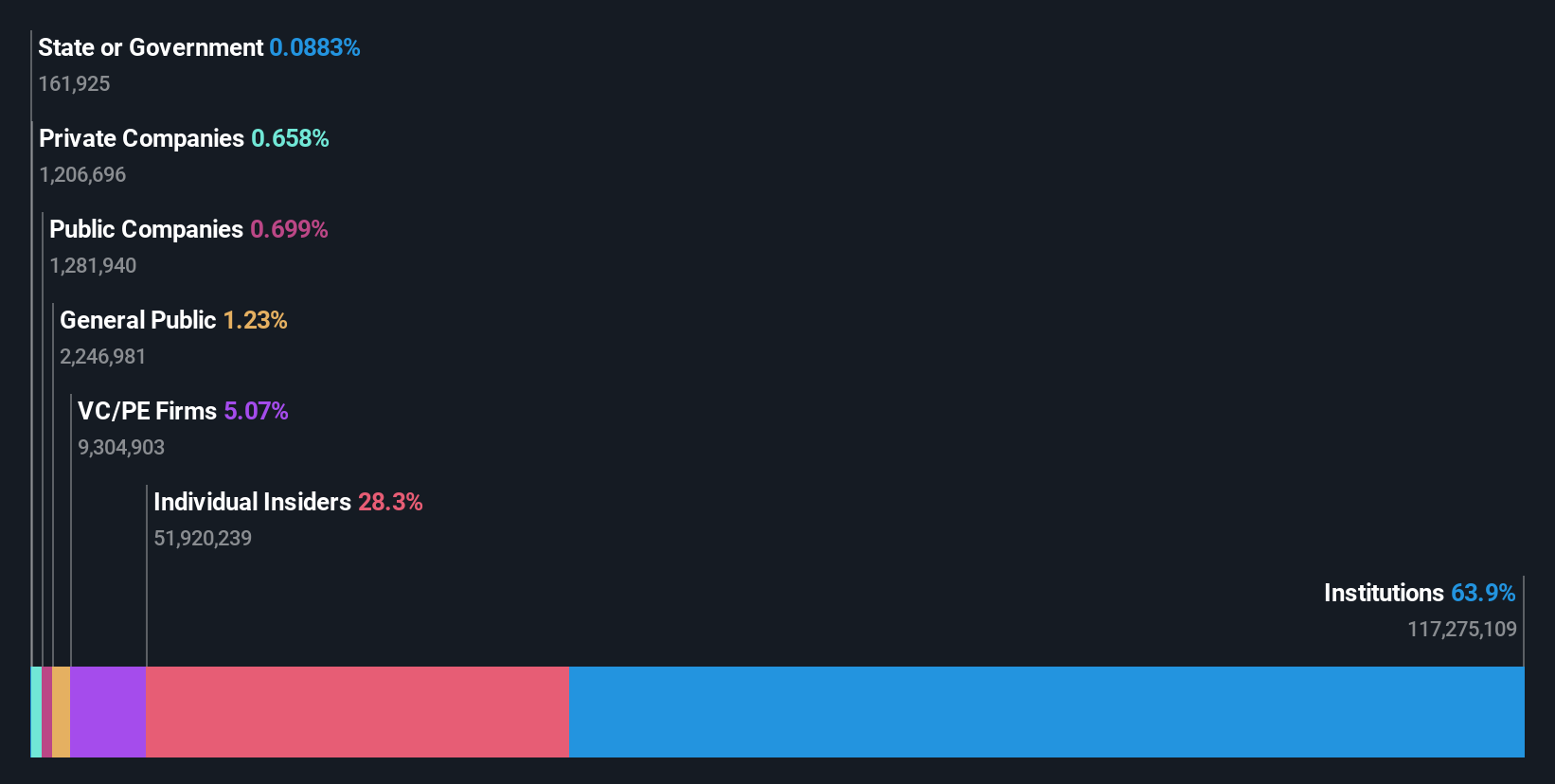

Insider Ownership: 12.7%

Earnings Growth Forecast: 36.7% p.a.

Property Franchise Group PLC, a UK-based entity, has shown moderate growth with a slight increase in earnings by 2.3% over the past year and sales inching from £27.16 million to £27.28 million. Despite trading at 56.2% below its estimated fair value, concerns arise due to substantial shareholder dilution last year and an unstable dividend track record. However, future prospects look brighter with earnings expected to grow significantly at 36.7% annually over the next three years, outstripping the UK market's forecast of 13.3%. Additionally, revenue is projected to surge by 44.7% per year, well above the market average of 3.7%.

- Click here and access our complete growth analysis report to understand the dynamics of Property Franchise Group.

- Our valuation report here indicates Property Franchise Group may be undervalued.

Volex (AIM:VLX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Volex plc is a manufacturer and supplier of power products and cable assemblies, operating across North America, Europe, and Asia, with a market capitalization of approximately £607.14 million.

Operations: The firm operates across three key geographical regions: North America, Europe, and Asia.

Insider Ownership: 26.9%

Earnings Growth Forecast: 20.5% p.a.

Volex plc, a UK-based company, has demonstrated robust earnings growth of 20.7% over the past year with expectations to continue at a rate of 20.5% annually, outpacing the UK market's 13.3%. Despite high levels of debt and shareholder dilution within the last year, revenue forecasts remain strong at an annual increase of 13.3%, surpassing the market's 3.7%. Recent corporate guidance confirmed a significant revenue rise to at least US$900 million for FY2024, slightly ahead of analyst expectations in profit due to strategic acquisitions.

- Delve into the full analysis future growth report here for a deeper understanding of Volex.

- Our expertly prepared valuation report Volex implies its share price may be too high.

Next Steps

- Explore the 67 names from our Fast Growing UK Companies With High Insider Ownership screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Property Franchise Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TPFG

Property Franchise Group

Manages and leases residential real estate properties in the United Kingdom.

Flawless balance sheet with high growth potential and pays a dividend.