- United Kingdom

- /

- Commercial Services

- /

- LSE:MTO

3 UK Stocks Estimated To Be Up To 42.8% Below Intrinsic Value

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index declining due to weak trade data from China, highlighting concerns about global economic recovery. Amidst these fluctuations, identifying undervalued stocks becomes crucial as they may offer potential opportunities for investors looking to navigate through uncertain market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £5.95 | £11.87 | 49.9% |

| Moonpig Group (LSE:MOON) | £2.115 | £4.01 | 47.2% |

| Marlowe (AIM:MRL) | £4.37 | £8.38 | 47.9% |

| LSL Property Services (LSE:LSL) | £3.06 | £5.92 | 48.3% |

| Informa (LSE:INF) | £8.408 | £16.04 | 47.6% |

| Hostelworld Group (LSE:HSW) | £1.295 | £2.56 | 49.5% |

| Franchise Brands (AIM:FRAN) | £1.45 | £2.70 | 46.3% |

| ECO Animal Health Group (AIM:EAH) | £0.69 | £1.33 | 48.2% |

| Burberry Group (LSE:BRBY) | £12.345 | £23.78 | 48.1% |

| Barratt Redrow (LSE:BTRW) | £3.773 | £7.15 | 47.2% |

Here we highlight a subset of our preferred stocks from the screener.

Advanced Medical Solutions Group (AIM:AMS)

Overview: Advanced Medical Solutions Group plc develops, manufactures, and distributes products for the surgical, woundcare, and wound-closure markets globally, with a market cap of £438.95 million.

Operations: The company's revenue is primarily generated from the Surgical segment, which accounts for £135.77 million, and the Woundcare segment, contributing £41.75 million.

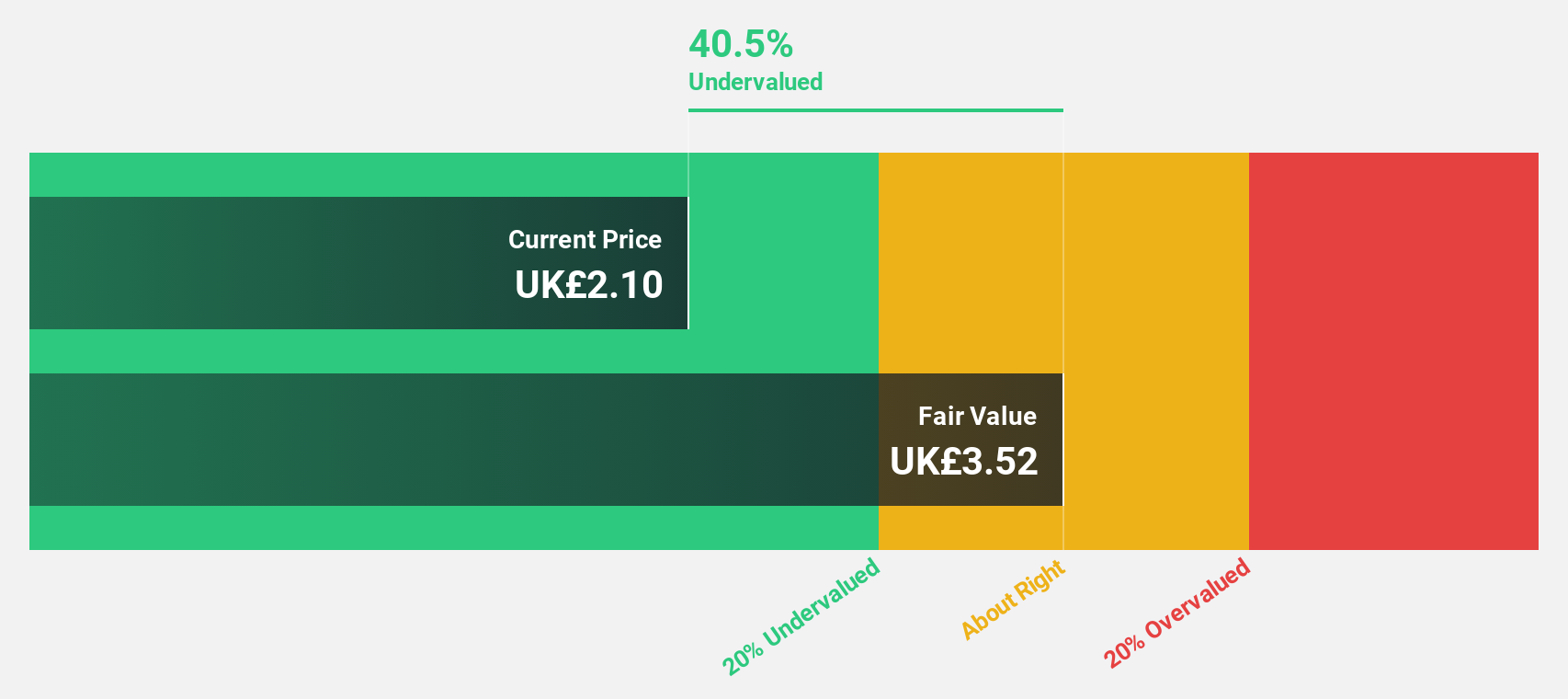

Estimated Discount To Fair Value: 42%

Advanced Medical Solutions Group is trading at £2.04, significantly below its estimated fair value of £3.51, indicating it is undervalued based on discounted cash flow analysis. Analysts forecast earnings growth of 33.1% annually, outpacing the UK market's 14.5%. However, profit margins have declined from 12.6% to 4%, and there has been significant insider selling recently. The appointment of Juliet Thompson as a Non-Executive Director may strengthen governance and strategic oversight in the healthcare sector.

- Our growth report here indicates Advanced Medical Solutions Group may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Advanced Medical Solutions Group.

Hammerson (LSE:HMSO)

Overview: Hammerson is the largest UK-listed company focused on owning and managing prime retail and leisure destinations in the UK, France, and Ireland with a market cap of £1.39 billion.

Operations: The company's revenue segments include £80 million from UK flagship destinations, £55.30 million from France flagship destinations, and £37.70 million from Ireland flagship destinations.

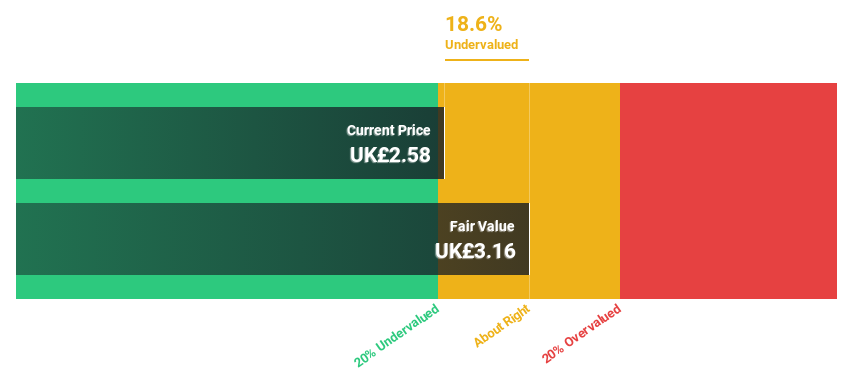

Estimated Discount To Fair Value: 10.2%

Hammerson is trading at £2.9, slightly below its estimated fair value of £3.23, reflecting a modest undervaluation based on cash flow analysis. While earnings have grown 58.1% annually over the past five years and are expected to become profitable in three years, the dividend yield of 5.39% is not well covered by earnings or free cash flows. Recent leadership changes aim to maintain strategic growth without disruption amid ongoing acquisition talks for Brent Cross assets valued at £200 million.

- Insights from our recent growth report point to a promising forecast for Hammerson's business outlook.

- Take a closer look at Hammerson's balance sheet health here in our report.

Mitie Group (LSE:MTO)

Overview: Mitie Group plc, along with its subsidiaries, offers facilities management and professional services both in the United Kingdom and internationally, with a market cap of £1.69 billion.

Operations: The company's revenue is derived from three main segments: Communities (£869.80 million), Business Services (£2.24 billion), and Technical Services (£1.98 billion).

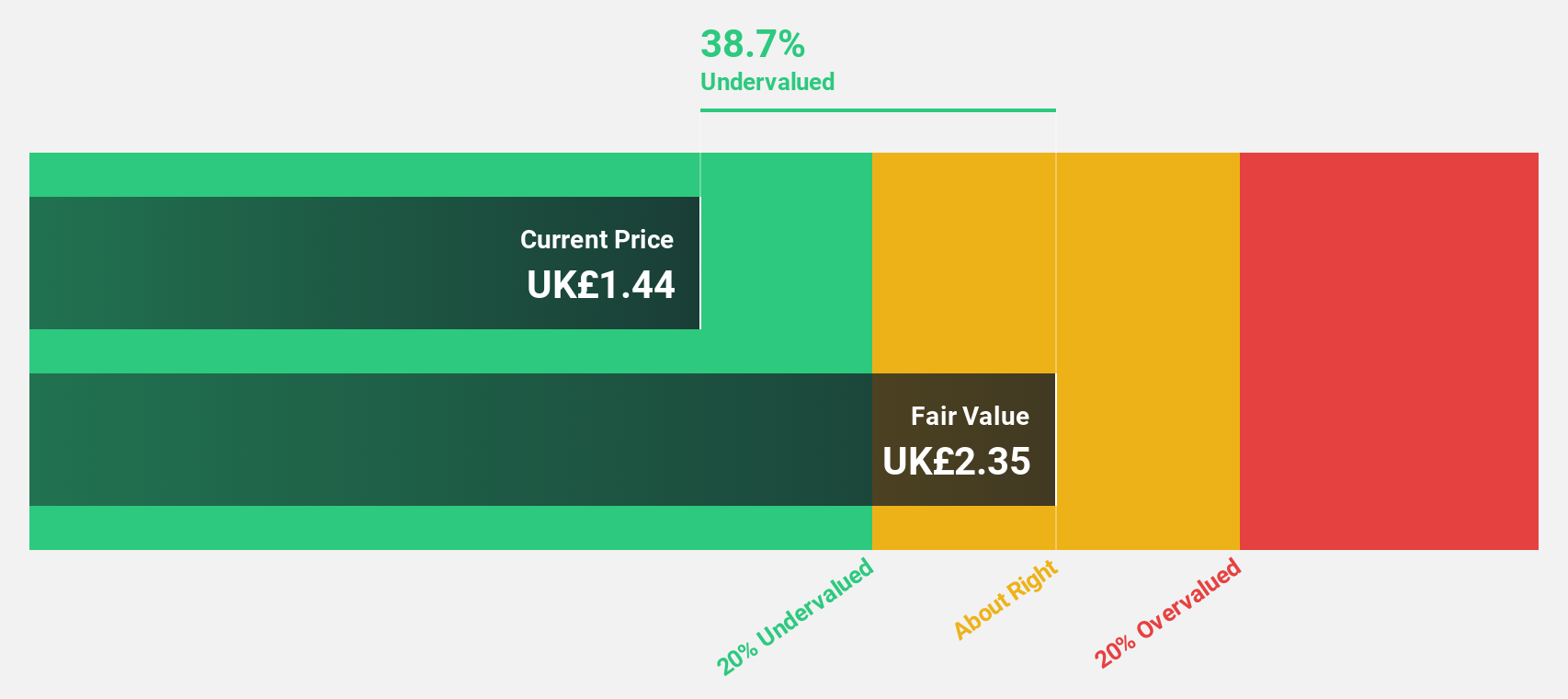

Estimated Discount To Fair Value: 42.8%

Mitie Group is trading at £1.38, significantly below its estimated fair value of £2.42, highlighting potential undervaluation based on cash flows. Earnings are projected to grow at 16% annually, outpacing the UK market's 14.5% growth forecast, though revenue growth remains modest at 5%. Despite a recent dividend increase and ongoing share buyback program totaling £125 million, net income has decreased year-over-year amidst discussions for a possible acquisition of Marlowe plc.

- Our comprehensive growth report raises the possibility that Mitie Group is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Mitie Group.

Turning Ideas Into Actions

- Navigate through the entire inventory of 56 Undervalued UK Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MTO

Mitie Group

Provides facilities management and professional services in the United Kingdom and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives