- United Kingdom

- /

- Food

- /

- LSE:TATE

Tate & Lyle plc's (LON:TATE) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong?

It is hard to get excited after looking at Tate & Lyle's (LON:TATE) recent performance, when its stock has declined 17% over the past three months. But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. Particularly, we will be paying attention to Tate & Lyle's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Tate & Lyle is:

13% = UK£155m ÷ UK£1.2b (Based on the trailing twelve months to September 2024).

The 'return' is the income the business earned over the last year. One way to conceptualize this is that for each £1 of shareholders' capital it has, the company made £0.13 in profit.

View our latest analysis for Tate & Lyle

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Tate & Lyle's Earnings Growth And 13% ROE

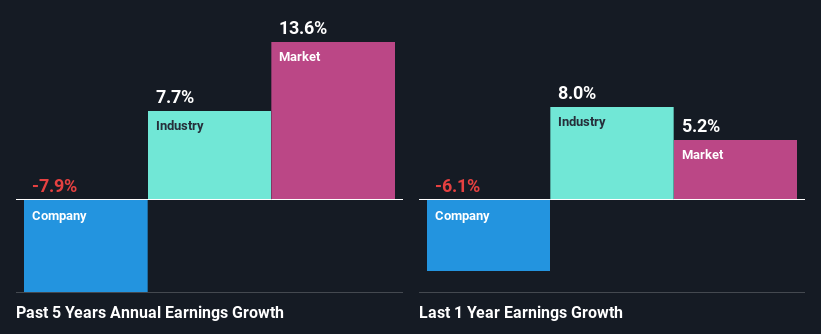

To begin with, Tate & Lyle seems to have a respectable ROE. Further, the company's ROE is similar to the industry average of 12%. For this reason, Tate & Lyle's five year net income decline of 7.9% raises the question as to why the decent ROE didn't translate into growth. We reckon that there could be some other factors at play here that are preventing the company's growth. Such as, the company pays out a huge portion of its earnings as dividends, or is faced with competitive pressures.

However, when we compared Tate & Lyle's growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 7.7% in the same period. This is quite worrisome.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Tate & Lyle's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Tate & Lyle Efficiently Re-investing Its Profits?

Tate & Lyle's declining earnings is not surprising given how the company is spending most of its profits in paying dividends, judging by its three-year median payout ratio of 55% (or a retention ratio of 45%). With only very little left to reinvest into the business, growth in earnings is far from likely. To know the 2 risks we have identified for Tate & Lyle visit our risks dashboard for free.

Additionally, Tate & Lyle has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 35% over the next three years. Regardless, the ROE is not expected to change much for the company despite the lower expected payout ratio.

Conclusion

Overall, we feel that Tate & Lyle certainly does have some positive factors to consider. Although, we are disappointed to see a lack of growth in earnings even in spite of a high ROE. Bear in mind, the company reinvests a small portion of its profits, which means that investors aren't reaping the benefits of the high rate of return. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Valuation is complex, but we're here to simplify it.

Discover if Tate & Lyle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:TATE

Tate & Lyle

Engages in the provision of ingredients and solutions to the food, beverages, and other industries in North America, Asia, Middle East, Africa, Latin America, and Europe.

Reasonable growth potential slight.

Similar Companies

Market Insights

Community Narratives