- United Kingdom

- /

- Food

- /

- LSE:TATE

Tate & Lyle plc (LON:TATE) Analysts Just Slashed This Year's Revenue Estimates By 12%

One thing we could say about the analysts on Tate & Lyle plc (LON:TATE) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

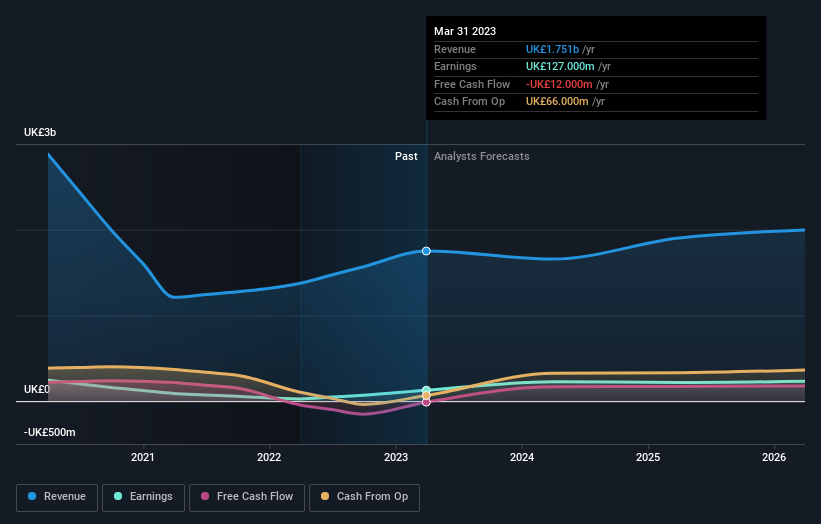

After the downgrade, the consensus from Tate & Lyle's eight analysts is for revenues of UK£1.7b in 2024, which would reflect a noticeable 5.4% decline in sales compared to the last year of performance. Prior to the latest estimates, the analysts were forecasting revenues of UK£1.9b in 2024. It looks like forecasts have become a fair bit less optimistic on Tate & Lyle, given the substantial drop in revenue estimates.

Check out our latest analysis for Tate & Lyle

We'd point out that there was no major changes to their price target of UK£9.07, suggesting the latest estimates were not enough to shift their view on the value of the business. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Tate & Lyle, with the most bullish analyst valuing it at UK£9.75 and the most bearish at UK£8.10 per share. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or that the analysts have a clear view on its prospects.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would also point out that the forecast 5.4% annualised revenue decline to the end of 2024 is better than the historical trend, which saw revenues shrink 17% annually over the past five years Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 4.1% annually. So it's pretty clear that, while it does have declining revenues, the analysts also expect Tate & Lyle to suffer worse than the wider industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Tate & Lyle this year. They're also anticipating slower revenue growth than the wider market. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of Tate & Lyle going forwards.

Worse yet, our risk analysis suggests that Tate & Lyle may find it hard to maintain its dividend following these downgrades. What makes us say that? Learn more by visiting our risks dashboard on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Tate & Lyle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:TATE

Tate & Lyle

Engages in the provision of ingredients and solutions to the food, beverages, and other industries in North America, Asia, Middle East, Africa, Latin America, and Europe.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives