- United Kingdom

- /

- Beverage

- /

- LSE:DGE

Diageo (LSE:DGE): Assessing Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

Diageo (LSE:DGE) shares have seen some movement recently, prompting investors to revisit the fundamentals and consider whether the current valuation reflects future growth prospects. The company’s performance trends are also drawing attention.

See our latest analysis for Diageo.

Diageo’s share price has slipped nearly 30% year-to-date and is down more than 46% in terms of total shareholder return over the past three years, reflecting a stark shift in investor sentiment. While there have been a few positive days recently, the longer-term momentum has faded as markets weigh the company’s ability to regain earnings growth and overcome recent headwinds.

If you’re rethinking your portfolio after moves like this, it could be the perfect time to explore fast growing stocks with high insider ownership.

With Diageo trading well below analyst targets and at a steep discount to intrinsic value, is this a genuine bargain for long-term investors, or is the market simply reflecting tough growth challenges ahead?

Most Popular Narrative: 23.6% Undervalued

Diageo's last close of £17.94 is significantly below the most popular narrative's fair value estimate, suggesting there could be substantial upside if the narrative holds true. The gulf between price and valuation is being driven by strong assumptions about the company’s future earnings power amid ongoing business transformation.

Diageo is intensifying its focus on premiumization and category expansion (notably in tequila and ready-to-drink beverages) to capture rising consumer affluence and elevated brand preferences in both emerging and developed markets. This supports future revenue growth and gross margin expansion. The company is executing a multiyear overhaul to deepen locally tailored, occasion-led marketing and distribution strategies across key regions (Europe, Asia-Pacific, and Africa). This positions itself to leverage demographic shifts such as urbanization and a growing legal drinking-age population, which are expected to drive volume and sales momentum over the long term.

Curious what powerful growth projections underpin this bold fair value? The real narrative hinges on ambitious earnings expansion and margin plans that most investors haven't spotted yet. Find out exactly what future milestones analysts believe Diageo will hit, and how these forecasts could move the share price much higher or not. See the full story behind the numbers now.

Result: Fair Value of £23.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing alcohol consumption trends and tougher regulatory pressures could undermine Diageo’s upbeat forecasts. This situation puts both revenue growth and margin improvement at risk.

Find out about the key risks to this Diageo narrative.

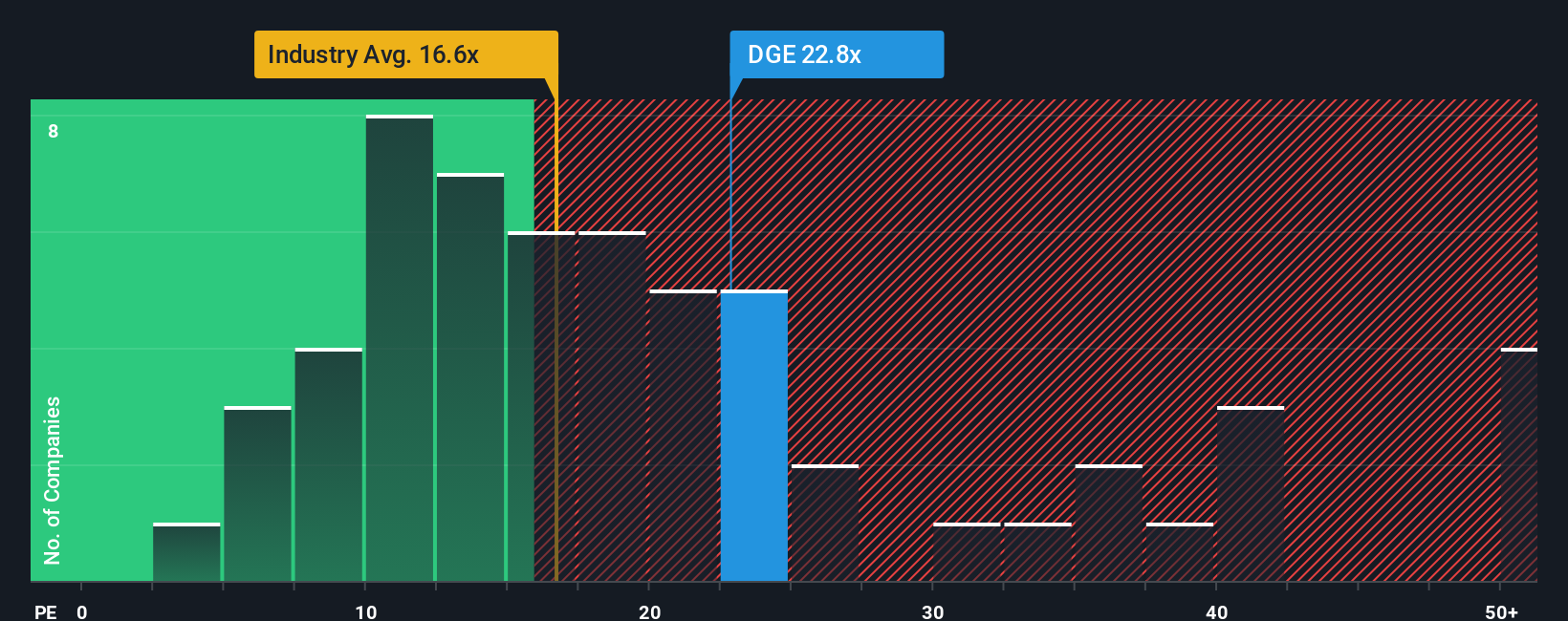

Another View: Market Multiple Comparison

Looking at Diageo through the lens of its price-to-earnings ratio gives a different perspective. The company trades at 22.3 times earnings, higher than both the European beverage sector average of 16.6 and its peer average of 20.3. However, the fair ratio for Diageo is estimated at 26.7. This suggests that while shares appear expensive relative to the sector, the market could move closer to this fair ratio if sentiment improves. Does this mean the current price holds hidden value, or is the premium simply too much risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Diageo Narrative

If you see things differently or want to dig into the details yourself, you can quickly build your own narrative from the data and insights provided. Do it your way.

A great starting point for your Diageo research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize your advantage by leveraging tools that highlight today's most promising stocks and untapped sectors. Sharpen your portfolio and outpace the crowd as these opportunities continually evolve.

- Uncover growth potential in up-and-coming industries by checking out these 25 AI penny stocks at the forefront of AI-driven innovation and transformation.

- Start building a future-proof income stream as you sift through these 16 dividend stocks with yields > 3% boasting yields above 3% and stable payout histories.

- Cement your edge against market volatility by reviewing these 879 undervalued stocks based on cash flows, where strong businesses are trading below their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DGE

Diageo

Engages in the production, marketing, and distribution of alcoholic beverages in North America, Europe, the Asia Pacific, Latin America and Caribbean, and Africa.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives