- United Kingdom

- /

- Beverage

- /

- LSE:CCH

If EPS Growth Is Important To You, Coca-Cola HBC (LON:CCH) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Coca-Cola HBC (LON:CCH). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Coca-Cola HBC with the means to add long-term value to shareholders.

Coca-Cola HBC's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Coca-Cola HBC grew its EPS by 15% per year. That's a pretty good rate, if the company can sustain it.

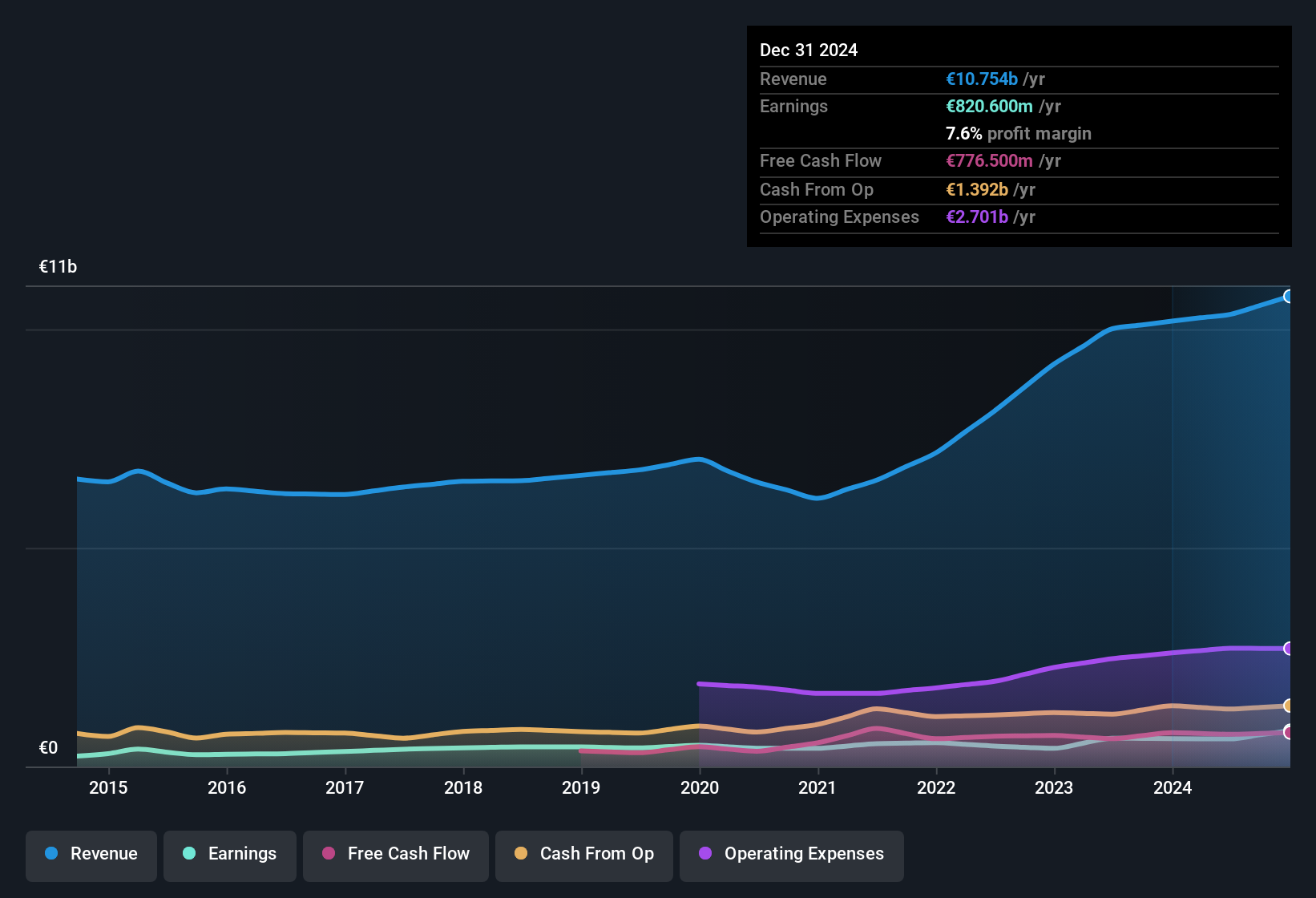

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Coca-Cola HBC achieved similar EBIT margins to last year, revenue grew by a solid 5.6% to €11b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Check out our latest analysis for Coca-Cola HBC

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Coca-Cola HBC.

Are Coca-Cola HBC Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a UK£14b company like Coca-Cola HBC. But we are reassured by the fact they have invested in the company. Indeed, they have a considerable amount of wealth invested in it, currently valued at €255m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Is Coca-Cola HBC Worth Keeping An Eye On?

One positive for Coca-Cola HBC is that it is growing EPS. That's nice to see. To add an extra spark to the fire, significant insider ownership in the company is another highlight. The combination definitely favoured by investors so consider keeping the company on a watchlist. We don't want to rain on the parade too much, but we did also find 1 warning sign for Coca-Cola HBC that you need to be mindful of.

Although Coca-Cola HBC certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of British companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CCH

Coca-Cola HBC

Engages in the production, sale, and distribution of non-alcoholic ready-to-drink beverages under franchise in Switzerland, West Coast of Ireland, Central and Eastern Europe, Nigeria, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success