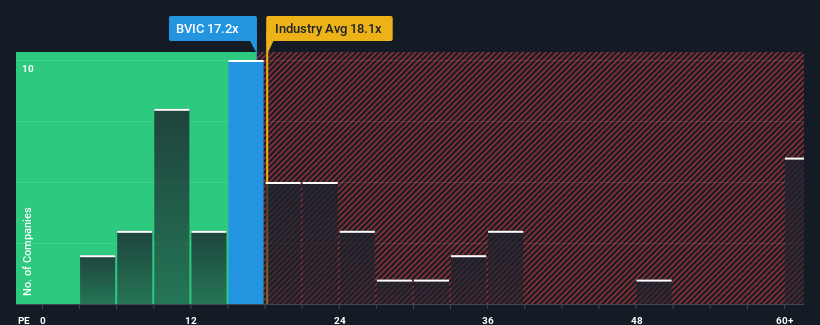

It's not a stretch to say that Britvic plc's (LON:BVIC) price-to-earnings (or "P/E") ratio of 17.2x right now seems quite "middle-of-the-road" compared to the market in the United Kingdom, where the median P/E ratio is around 16x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Britvic has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

See our latest analysis for Britvic

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Britvic would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 8.2%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 41% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 14% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 14% per annum, which is not materially different.

In light of this, it's understandable that Britvic's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Britvic maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Britvic that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BVIC

Carlsberg Britvic

Britvic plc, together with its subsidiaries, manufactures, markets, distributes, and sells soft drinks in the United Kingdom, the Republic of Ireland, France, Brazil, and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success