- United Kingdom

- /

- Oil and Gas

- /

- LSE:SHEL

Is Shell Fairly Priced After Buyback News and 14% Stock Gain?

Reviewed by Bailey Pemberton

- Wondering if Shell is fairly valued right now? You are not alone, especially with ongoing discussions about oil companies and market opportunities.

- Shell’s stock has gained 5.1% over the last month and is up 14.2% in the past year, signaling steady momentum and renewed investor confidence.

- Recent headlines have highlighted Shell’s strategic push into renewable energy and new buyback initiatives, both of which have drawn the attention of market watchers. These developments have contributed to the price movement, sparking debates about long-term growth and risk factors in the changing energy sector.

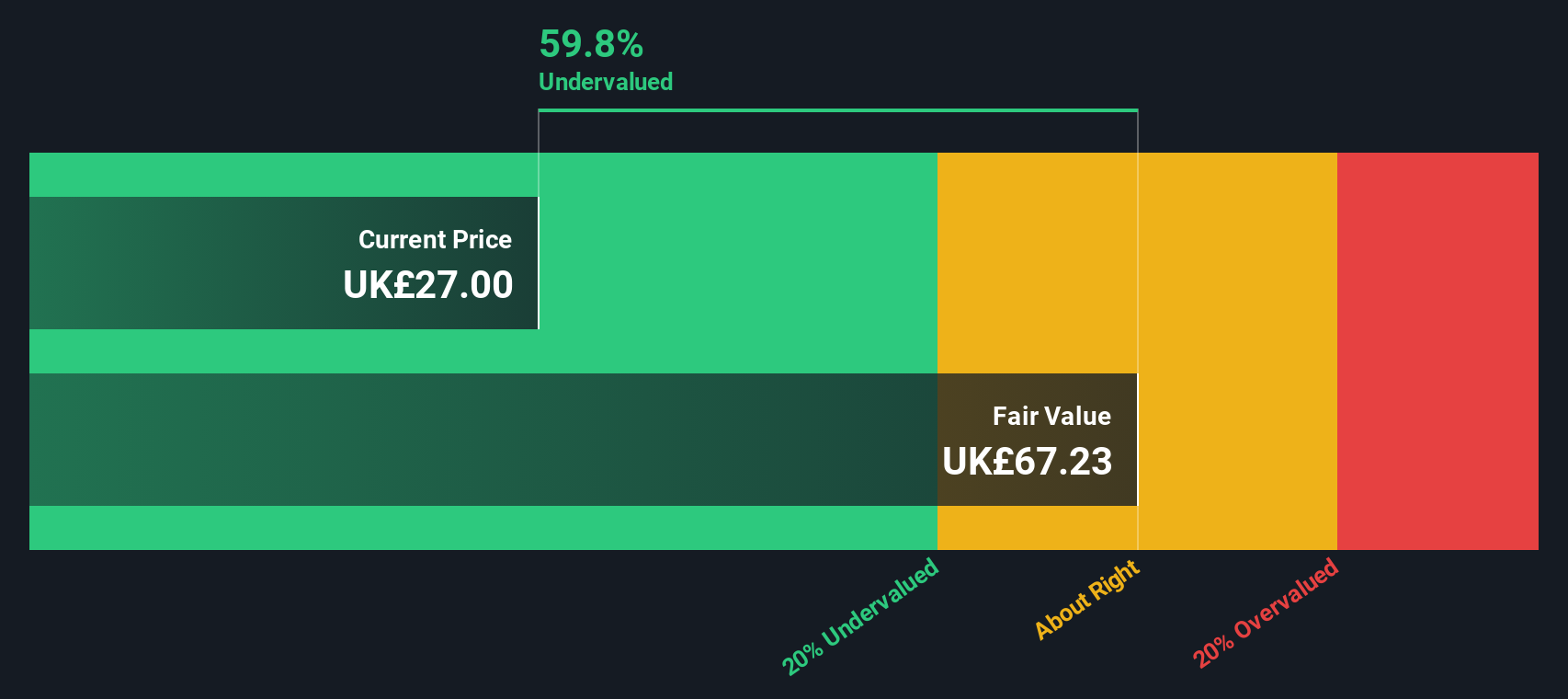

- On our valuation scorecard, Shell currently scores 4 out of 6 in terms of being undervalued. This suggests there is more to consider than just price trends. Next, we will break down the usual methods of valuing the stock and explain why a more detailed approach can sometimes uncover opportunities others overlook.

Find out why Shell's 14.2% return over the last year is lagging behind its peers.

Approach 1: Shell Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by forecasting future cash flows and converting them to today's value. This approach calculates what Shell could be worth based on projected cash generation, rather than relying solely on current market sentiment or recent stock price movements.

Currently, Shell reports Free Cash Flow (FCF) of $27.95 billion, reflecting its strong income from ongoing operations. Analyst estimates extend over the next five years, after which cash flow projections are extrapolated further by Simply Wall St. According to these forecasts, Shell's FCF is expected to reach $24.47 billion by 2035, with projections for each year discounted to reflect today’s dollar value. This step ensures distant future cash flows have a diminishing impact on the intrinsic value as uncertainty rises with time.

The DCF calculation gives Shell an intrinsic fair value of $58.49 per share. Recent trading shows a significant discount of 51.4 percent. This implies that, based on cash flow fundamentals, Shell may be notably undervalued compared to its underlying worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Shell is undervalued by 51.4%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

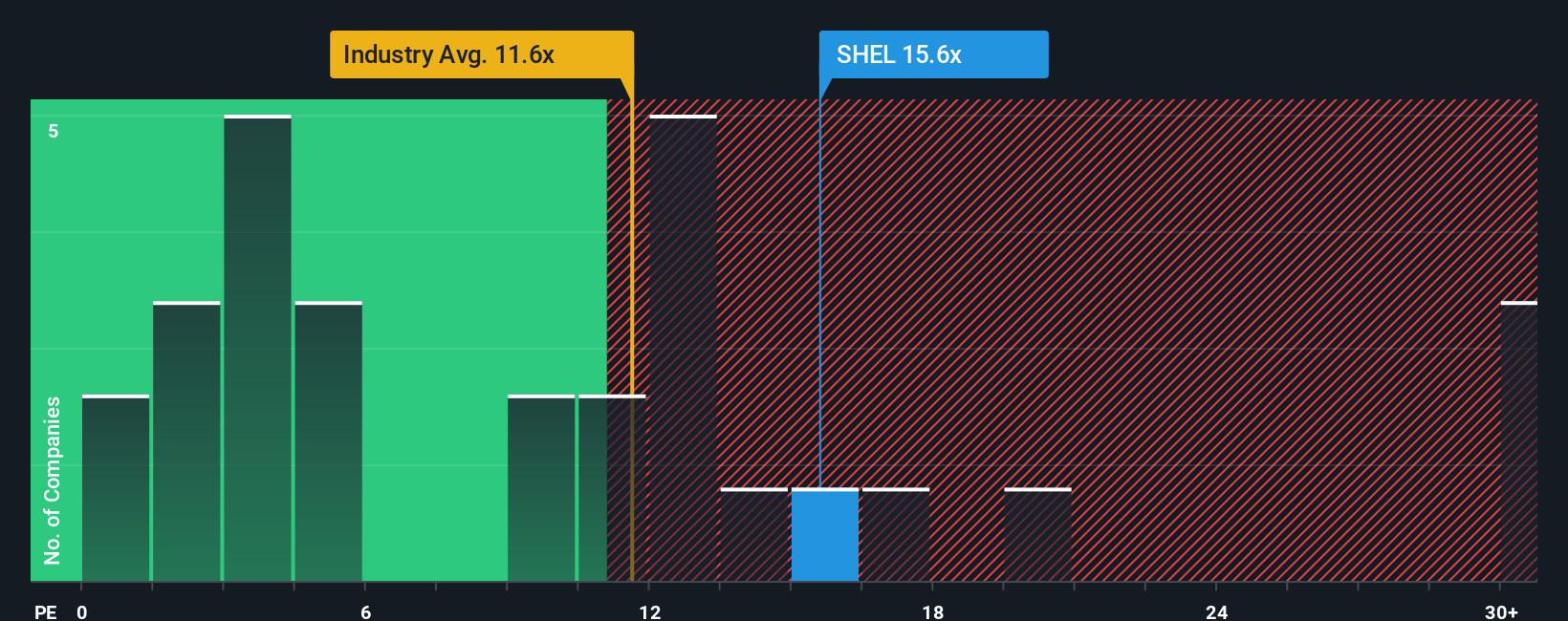

Approach 2: Shell Price vs Earnings (PE)

The price-to-earnings (PE) ratio is a popular metric for valuing profitable companies like Shell because it directly compares a company’s current share price to its earnings. This makes it especially useful where consistent profits are being generated, allowing investors to gauge how much they are paying for each pound of earnings.

Growth expectations and risk both play a big role in what is considered a “normal” or “fair” PE ratio. Investors are often willing to pay a higher multiple for companies expected to grow faster or take on less risk, while mature or more volatile businesses tend to trade at lower PE ratios.

Shell currently trades on a PE ratio of 14.76x. For context, this is slightly above the Oil and Gas industry average of 13.25x but below the peer average of 15.89x. Simply Wall St’s proprietary Fair Ratio, an enhanced PE multiple that incorporates Shell’s earnings growth outlook, profit margins, risk factors, industry dynamics, and market cap, stands at 18.02x.

Unlike standard industry and peer benchmarks, the Fair Ratio provides a more tailored measure as it numerically factors in all relevant company-specific strengths and risks. This helps avoid misleading comparisons, ensuring investors get a more accurate read on Shell’s value in its unique context.

With Shell’s current PE ratio well below the Fair Ratio, the stock currently appears undervalued when judged through this lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Shell Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a powerful, easy-to-use tool that takes you beyond the numbers and puts your story at the center of your investment decisions.

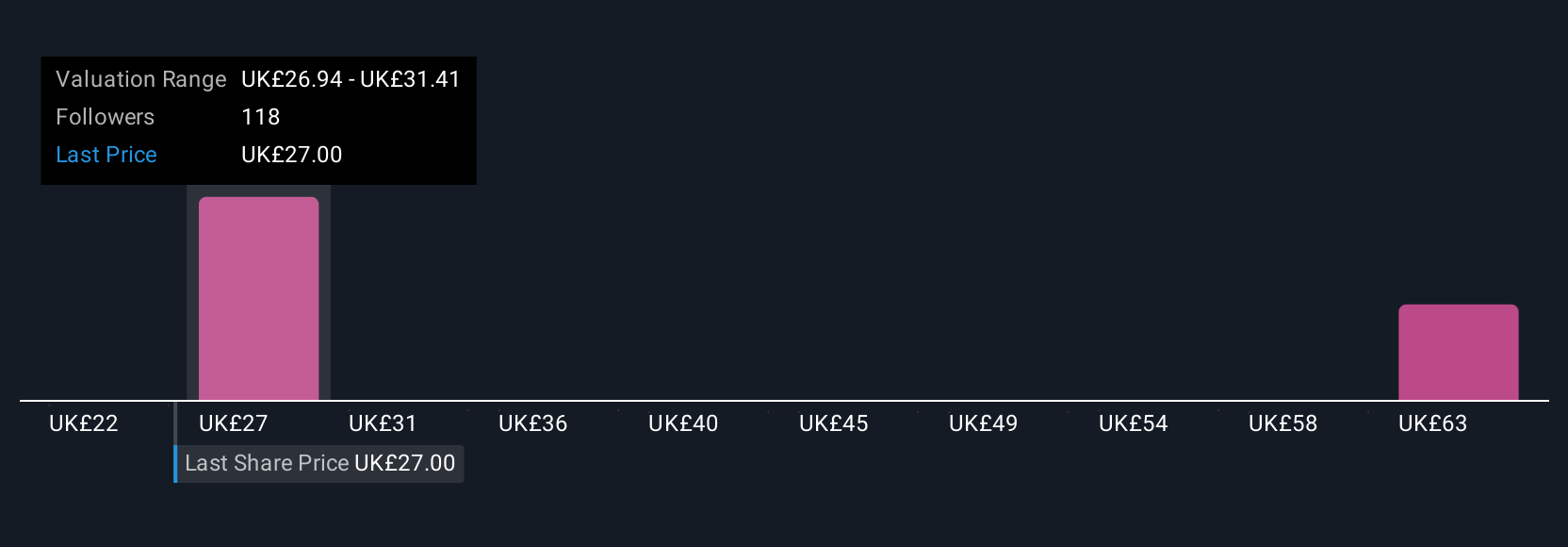

A Narrative is simply your own perspective on a company, where you build a reasoned story and connect it to your forecasts about Shell’s future revenue, earnings, and profit margins. Narratives bridge the gap between a company’s qualitative prospects and the financial forecast, letting you see how your assumptions shape the estimated fair value and how that compares to today’s price.

Using Simply Wall St's Community page, you can explore Narratives from millions of investors or create your own story for Shell in a few minutes. This helps you to quickly adjust your expectations and rethink your buy or sell decision as the facts change, because Narratives update automatically whenever new news or results come in.

For example, some investors are optimistic, forecasting Shell’s earnings to reach $27.3 billion and setting a fair value as high as £39.36, while more cautious opinions see earnings at $14.2 billion and a fair value as low as £27.06. This shows just how dynamic and personal investing can be when Narratives drive your analysis.

Do you think there's more to the story for Shell? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SHEL

Shell

Operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and other Americas.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives