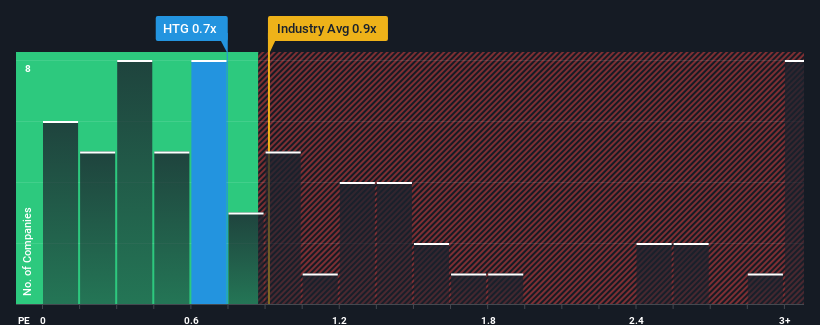

There wouldn't be many who think Hunting PLC's (LON:HTG) price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S for the Energy Services industry in the United Kingdom is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Hunting

How Has Hunting Performed Recently?

Recent times have been advantageous for Hunting as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Hunting will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Hunting?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hunting's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 41% gain to the company's top line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 9.2% per year over the next three years. With the industry predicted to deliver 9.7% growth per annum, the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Hunting's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Hunting's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that Hunting maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Having said that, be aware Hunting is showing 2 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hunting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:HTG

Hunting

Manufactures components, technology systems, and precision parts worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives