- United Kingdom

- /

- Oil and Gas

- /

- LSE:HBR

Fewer Investors Than Expected Jumping On Harbour Energy plc (LON:HBR)

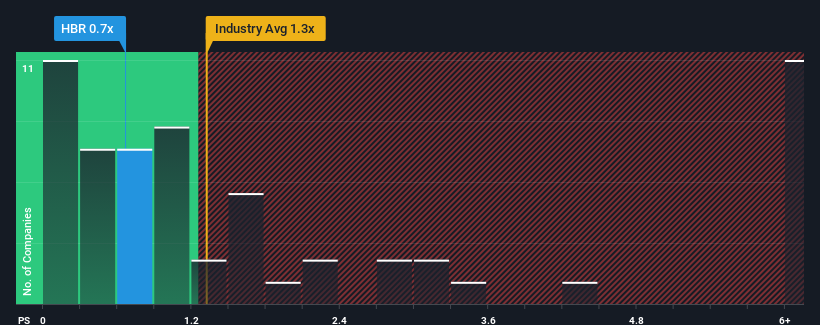

With a price-to-sales (or "P/S") ratio of 0.7x Harbour Energy plc (LON:HBR) may be sending bullish signals at the moment, given that almost half of all the Oil and Gas companies in the United Kingdom have P/S ratios greater than 1.3x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Harbour Energy

What Does Harbour Energy's Recent Performance Look Like?

Recent times have been pleasing for Harbour Energy as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Harbour Energy's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Harbour Energy?

In order to justify its P/S ratio, Harbour Energy would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 66% last year. The strong recent performance means it was also able to grow revenue by 79% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain somewhat buoyant, growing by 3.3% each year during the coming three years according to the six analysts following the company. While this isn't a particularly impressive figure, it should be noted that the the industry is expected to decline by 0.7% each year.

With this in consideration, we find it intriguing that Harbour Energy's P/S falls short of its industry peers. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Harbour Energy's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Harbour Energy currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Harbour Energy that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Harbour Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:HBR

Harbour Energy

Engages in the acquisition, exploration, development, and production of oil and gas reserves in Norway, the United Kingdom, Germany, Mexico, Argentina, North Africa, and Southeast Asia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives