Stock Analysis

- United Kingdom

- /

- Oil and Gas

- /

- LSE:GENL

Even after rising 15% this past week, Genel Energy (LON:GENL) shareholders are still down 32% over the past five years

This week we saw the Genel Energy plc (LON:GENL) share price climb by 15%. But that doesn't change the fact that the returns over the last five years have been less than pleasing. You would have done a lot better buying an index fund, since the stock has dropped 54% in that half decade.

While the last five years has been tough for Genel Energy shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for Genel Energy

Given that Genel Energy didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, Genel Energy saw its revenue increase by 0.4% per year. That's not a very high growth rate considering it doesn't make profits. This lacklustre growth has no doubt fueled the loss of 9% per year, in that time. We want to see an acceleration of revenue growth (or profits) before showing much interest in this one. However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

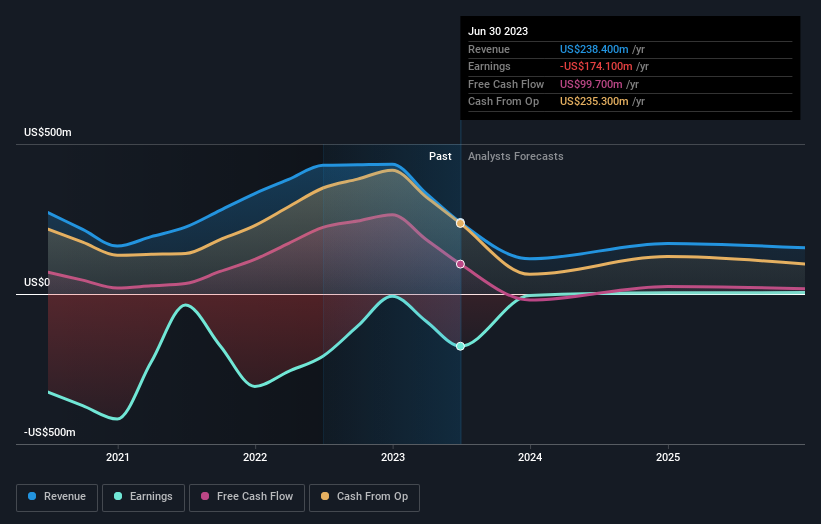

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling Genel Energy stock, you should check out this free report showing analyst profit forecasts.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Genel Energy's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Genel Energy's TSR of was a loss of 32% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We regret to report that Genel Energy shareholders are down 24% for the year. Unfortunately, that's worse than the broader market decline of 0.5%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Genel Energy is showing 1 warning sign in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Genel Energy is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:GENL

Genel Energy

Through its subsidiaries, operates as an independent oil and gas exploration and production company.

Reasonable growth potential with adequate balance sheet.