Stock Analysis

- United Kingdom

- /

- Oil and Gas

- /

- LSE:ENOG

UK Growth Companies With High Insider Ownership To Watch In July 2024

Reviewed by Simply Wall St

The United Kingdom market has shown stability over the last week and a notable increase of 8.7% over the past 12 months, with earnings expected to grow by 13% annually. In such an environment, growth companies with high insider ownership can be particularly interesting as this often indicates that those who know the company best are confident in its future prospects.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 36.8% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124.5% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 46.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

| Helios Underwriting (AIM:HUW) | 23.1% | 14.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 38.6% | 117.8% |

| Velocity Composites (AIM:VEL) | 27.8% | 173.3% |

| Judges Scientific (AIM:JDG) | 11.5% | 25.3% |

| Hochschild Mining (LSE:HOC) | 38.4% | 42.6% |

Let's review some notable picks from our screened stocks.

Energean (LSE:ENOG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energean plc is an oil and gas company focused on exploration, production, and development, with a market capitalization of approximately £1.93 billion.

Operations: The company generates its revenue primarily from the exploration and production of oil and gas, totaling approximately $1.42 billion.

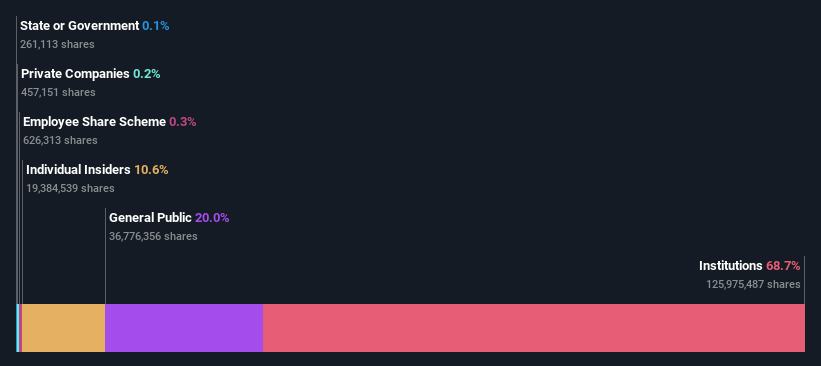

Insider Ownership: 10.6%

Earnings Growth Forecast: 15.6% p.a.

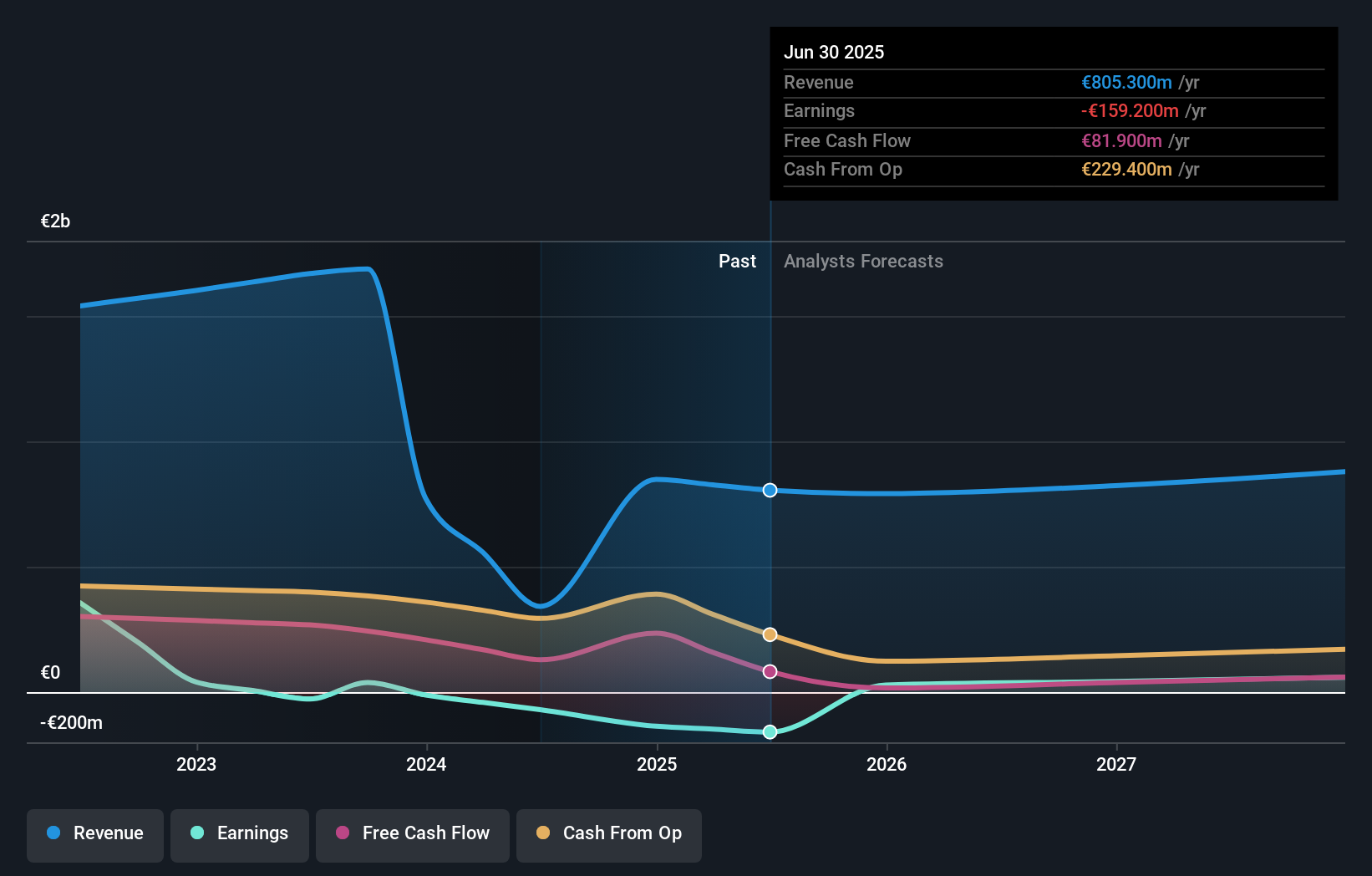

Energean plc, a growth company with high insider ownership in the UK, is set to outpace the market with its revenue and earnings forecasted to grow at 11% and 15.6% per year respectively. Despite trading at a significant discount to fair value and expected price target increases of 33.1%, concerns include substantial debt levels, shareholder dilution over the past year, and dividends that are not well-covered by earnings or cash flows. Recent production increases and dividend declarations underscore its operational momentum.

- Click here to discover the nuances of Energean with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Energean is priced lower than what may be justified by its financials.

Playtech (LSE:PTEC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Playtech plc is a technology company specializing in providing gambling software, services, content, and platform technologies across the globe, with a market capitalization of approximately £1.67 billion.

Operations: The company generates revenue primarily through its B2B gaming services, which contributed €684.10 million, and its direct-to-consumer operations, totaling €1.04 billion across various segments.

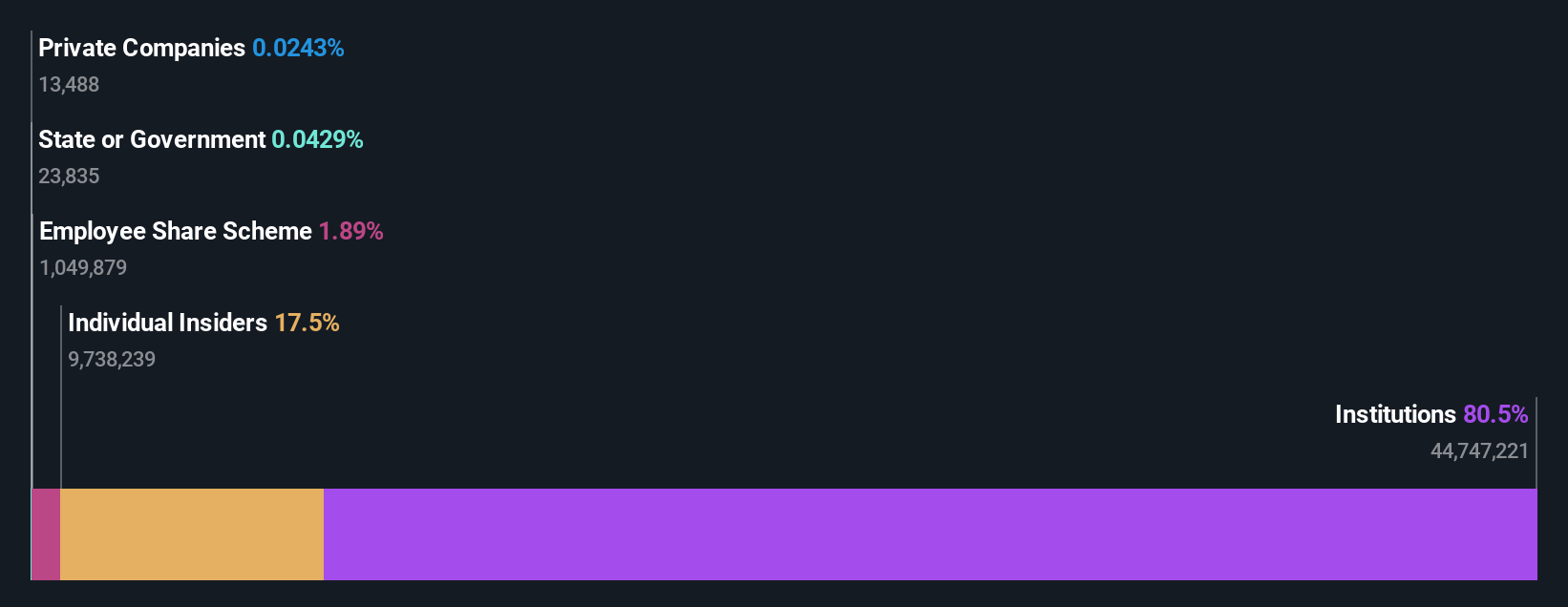

Insider Ownership: 13.5%

Earnings Growth Forecast: 20.6% p.a.

Playtech, a UK-based growth company with high insider ownership, is poised for substantial earnings growth, forecasted at 20.62% annually. Despite trading 50.2% below its estimated fair value and anticipated price increases of 28.7%, challenges include lower-than-benchmark future Return on Equity at just 8.9%. Recently, Playtech expanded its strategic partnership with MGM Resorts to deliver live casino content from Las Vegas, enhancing its product offerings and market reach while restructuring board committees to streamline governance.

- Dive into the specifics of Playtech here with our thorough growth forecast report.

- Our valuation report here indicates Playtech may be undervalued.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates as a diversified financial services provider offering banking, leasing, insurance, brokerage, and card processing solutions in Georgia, Azerbaijan, and Uzbekistan with a market capitalization of approximately £1.63 billion.

Operations: The company's revenue is generated from banking, leasing, insurance, brokerage, and card processing services across Georgia, Azerbaijan, and Uzbekistan.

Insider Ownership: 18%

Earnings Growth Forecast: 15.2% p.a.

TBC Bank Group, a UK-based entity, demonstrates robust growth with revenue and earnings forecast to outpace the UK market significantly. Recent strategic financial activities include a $300 million fixed-income offering and aggressive share repurchases totaling GEL 75 million aimed at capital structure optimization. However, concerns persist due to its high bad loans ratio at 2.1% and unstable dividend track record, juxtaposed against a backdrop of high insider ownership which aligns management with shareholder interests.

- Get an in-depth perspective on TBC Bank Group's performance by reading our analyst estimates report here.

- The analysis detailed in our TBC Bank Group valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Investigate our full lineup of 62 Fast Growing UK Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Energean is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ENOG

Energean

Engages in the exploration, production, and development of oil and gas.

Solid track record and good value.