Stock Analysis

- United Kingdom

- /

- Real Estate

- /

- LSE:SRE

Exploring Undervalued Small Caps With Insider Buying In July 2024

Reviewed by Simply Wall St

As global markets exhibit a notably broad advance, with small-cap stocks like those in the Russell 2000 Index showing significant gains, investors are keenly observing shifts in economic indicators and market sentiment. This environment may present opportunities to explore undervalued small caps, particularly those with recent insider buying activity, as they could be poised for potential growth amidst current market dynamics.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanover Bancorp | 8.7x | 2.0x | 47.42% | ★★★★★☆ |

| Primaris Real Estate Investment Trust | 11.7x | 3.0x | 34.48% | ★★★★★☆ |

| Titan Machinery | 4.0x | 0.1x | 23.49% | ★★★★★☆ |

| Nexus Industrial REIT | 2.5x | 3.1x | 18.23% | ★★★★☆☆ |

| Calfrac Well Services | 2.3x | 0.2x | 26.74% | ★★★★☆☆ |

| Guardian Capital Group | 10.4x | 4.0x | 31.99% | ★★★★☆☆ |

| CVS Group | 21.0x | 1.2x | 41.46% | ★★★★☆☆ |

| Westshore Terminals Investment | 14.3x | 3.9x | 0.92% | ★★★☆☆☆ |

| Russel Metals | 9.2x | 0.5x | -7.56% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

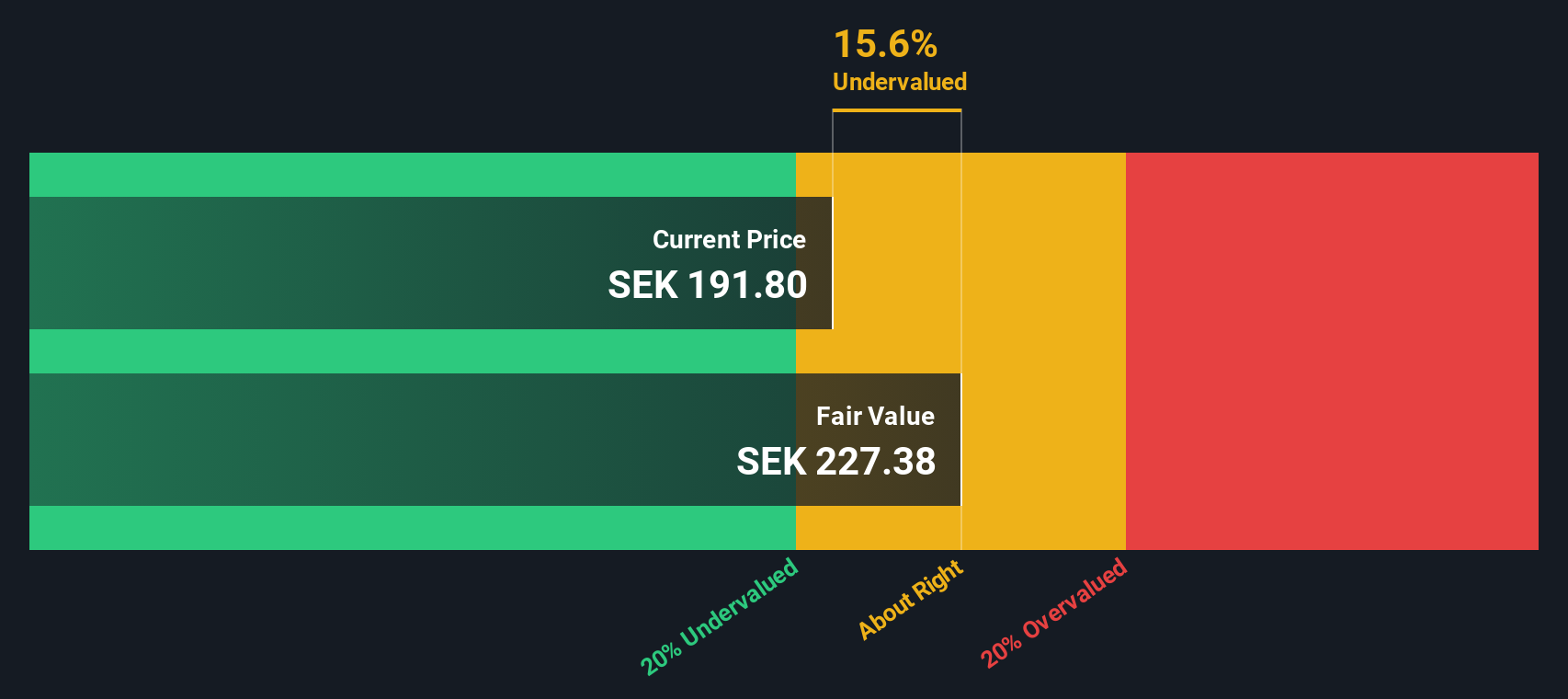

Sirius Real Estate (LSE:SRE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sirius Real Estate operates in the property investment sector, managing a portfolio with a market cap of approximately €1.29 billion.

Operations: From the financial data provided, Property Investment is a significant revenue stream for the company, generating €289.40 million. The gross profit margin has shown variability but remains substantial, highlighting effective cost management relative to revenue generated from property investments.

PE: 16.1x

Recently, Sirius Real Estate demonstrated insider confidence with Craig Hoskins purchasing 218,283 shares, signaling strong belief in the company's prospects. This move complements their strategic expansion, evidenced by a successful £152.5 million equity offering aimed at funding acquisitions that bolster their presence in Germany and the U.K. Financially, Sirius reported a robust increase in annual sales to €288.8 million and net income of €107.8 million for the year ended March 31, 2024. These figures reflect not only growth but also resilience and adaptability in operational performance.

Hertz Global Holdings (NasdaqGS:HTZ)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hertz Global Holdings operates as a vehicle rental company primarily through its segments in the Americas and International markets, with a market capitalization of approximately $2.34 billion.

Operations: Americas RAC and International RAC generated revenues of $7.73 billion and $1.67 billion respectively, with a notable gross profit margin of 25.16% in the most recent quarter, reflecting a diverse geographical revenue stream. The company's cost of goods sold (COGS) was $6.91 billion for the same period, underscoring significant operational costs associated with its revenue generation activities.

PE: 5.6x

Amidst a turbulent market, Hertz Global Holdings has shown signs of potential underestimation by investors. Despite a significant drop in net profit margin from 20.5% to 2.5% over the past year, recent leadership enhancements aim to fortify operations and profitability. Notably, the company's inclusion in the Russell 2000 Index underscores its small-scale yet significant presence in the industry. Insider confidence is evident as they recently purchased shares, signaling belief in the company’s strategic direction and long-term value despite current financial strains and high volatility in share price.

- Delve into the full analysis valuation report here for a deeper understanding of Hertz Global Holdings.

Assess Hertz Global Holdings' past performance with our detailed historical performance reports.

AddLife (OM:ALIF B)

Simply Wall St Value Rating: ★★★★★☆

Overview: AddLife is a company specializing in life science products and services, primarily focusing on laboratory technology and medical technology, with a market capitalization of approximately SEK 19.24 billion.

Operations: Labtech and Medtech segments generate substantial revenue, with Labtech contributing SEK 3.61 billion and Medtech SEK 6.20 billion. The gross profit margin has shown a slight increase over recent periods, reaching approximately 37.17% by the end of the last reported period in 2024.

PE: 235.8x

AddLife, a firm with a modest market cap, recently showcased robust sales growth in its latest earnings report. With second-quarter sales climbing to SEK 2,554 million from SEK 2,365 million the previous year and net income doubling to SEK 72 million, the company demonstrates strong revenue momentum. Despite this progress, its net profit margin has dipped year over year from 4.8% to 0.8%, signaling potential challenges in profitability management. Insider confidence is evident as they recently purchased shares, underscoring their belief in the company's future prospects despite current financial nuances.

- Navigate through the intricacies of AddLife with our comprehensive valuation report here.

Evaluate AddLife's historical performance by accessing our past performance report.

Next Steps

- Reveal the 224 hidden gems among our Undervalued Small Caps With Insider Buying screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Sirius Real Estate is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SRE

Sirius Real Estate

A real estate company, engages in the investment, development, and operation of commercial and industrial properties in Germany and the United Kingdom.

Established dividend payer with proven track record.