Stock Analysis

- United Kingdom

- /

- Healthtech

- /

- AIM:CRW

UK Growth Companies With High Insider Ownership And Up To 29% Earnings Growth

Reviewed by Simply Wall St

The United Kingdom stock market has shown a steady performance, remaining flat in the last week but gaining 4.4% over the past year with earnings expected to grow by 13% annually. In this context, companies with high insider ownership and strong earnings growth potential stand out as particularly compelling considerations for investors looking to leverage current market conditions.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 34.1% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 120.1% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 74.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

| Helios Underwriting (AIM:HUW) | 23.1% | 14.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 38.6% | 117.8% |

| Velocity Composites (AIM:VEL) | 27.8% | 173.3% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Hochschild Mining (LSE:HOC) | 38.4% | 42.6% |

Here's a peek at a few of the choices from the screener.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

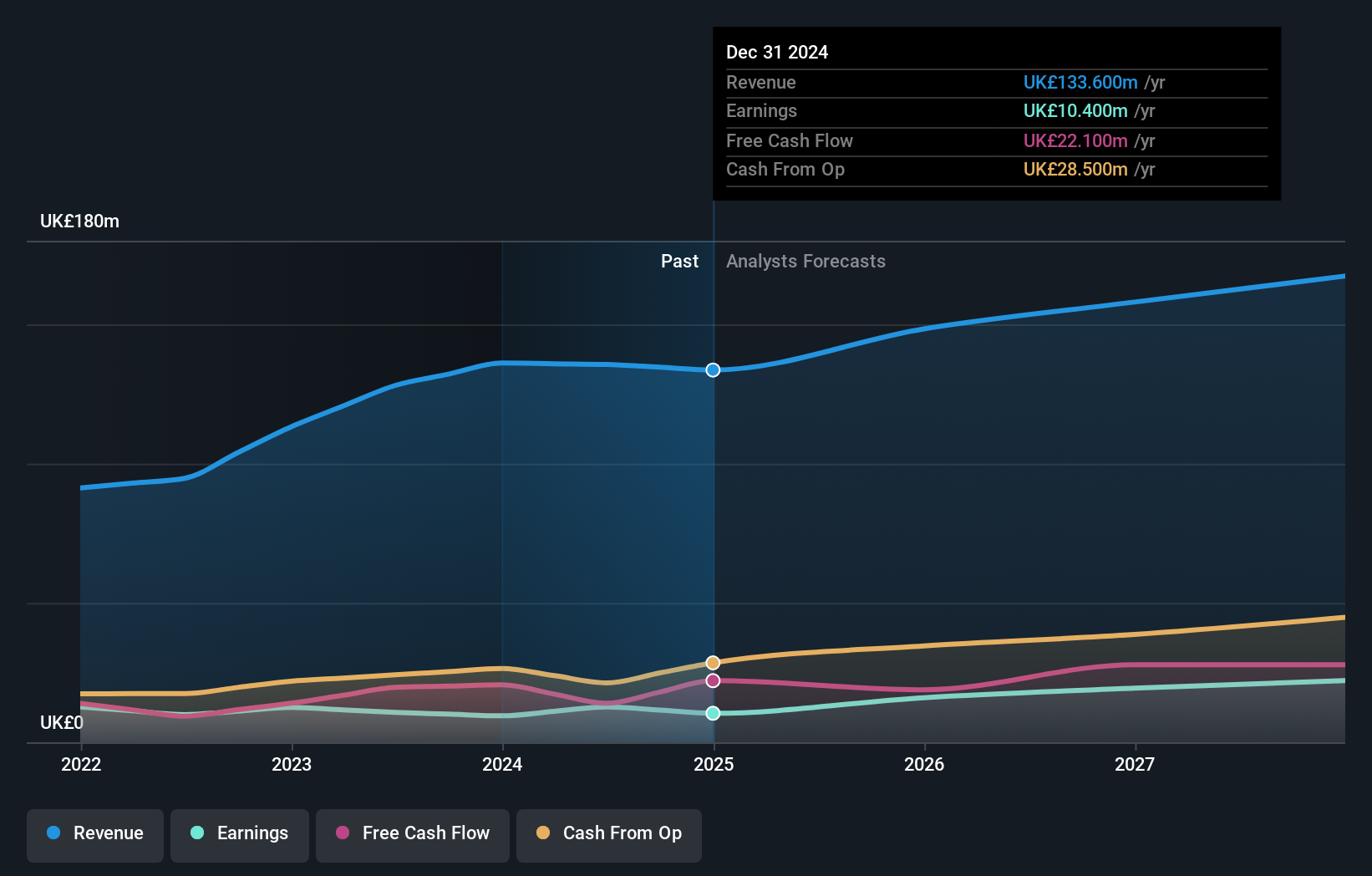

Overview: Craneware plc operates in the healthcare industry in the United States, focusing on developing, licensing, and supporting computer software, with a market capitalization of approximately £863.35 million.

Operations: The company generates its revenue primarily through its healthcare software segment, which amounted to $180.56 million.

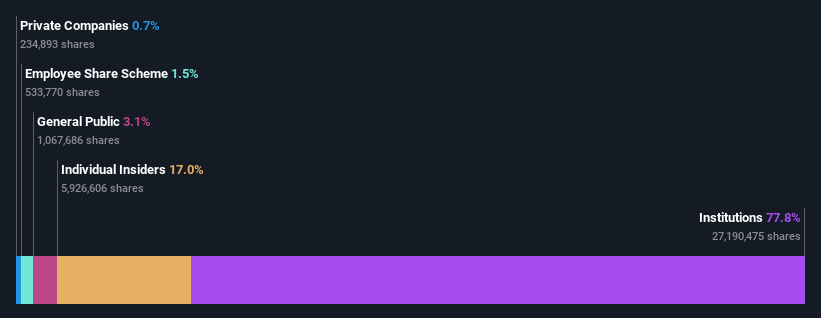

Insider Ownership: 17%

Earnings Growth Forecast: 29.4% p.a.

Craneware, a UK-based growth company with high insider ownership, is poised for robust expansion with earnings expected to surge by 29.39% annually. Despite a relatively low forecasted return on equity of 11.2%, the firm's revenue growth at 6.7% per year outpaces the UK market average of 3.5%. A recent strategic collaboration with Microsoft could further enhance its offerings and market reach, leveraging advanced AI and cloud technologies to deliver significant healthcare industry improvements.

- Dive into the specifics of Craneware here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Craneware is trading beyond its estimated value.

Judges Scientific (AIM:JDG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Judges Scientific plc is a company that designs, manufactures, and sells scientific instruments, with a market capitalization of approximately £763.75 million.

Operations: The firm generates its revenue primarily from two segments: Vacuum (£63.60 million) and Materials Sciences (£72.50 million).

Insider Ownership: 11.5%

Earnings Growth Forecast: 25.3% p.a.

Judges Scientific, a UK growth company with high insider ownership, faces mixed financial dynamics. Recent bylaws and dividend increases reflect active governance and shareholder return focus. Despite a profit margin decline to 7% from last year's 11%, Judges Scientific anticipates significant earnings growth at 25.32% annually over the next three years, outpacing the UK market forecast of 12.6%. However, concerns include high debt levels and recent substantial insider selling, which may raise caution among investors.

- Unlock comprehensive insights into our analysis of Judges Scientific stock in this growth report.

- The analysis detailed in our Judges Scientific valuation report hints at an inflated share price compared to its estimated value.

Energean (LSE:ENOG)

Simply Wall St Growth Rating: ★★★★☆☆

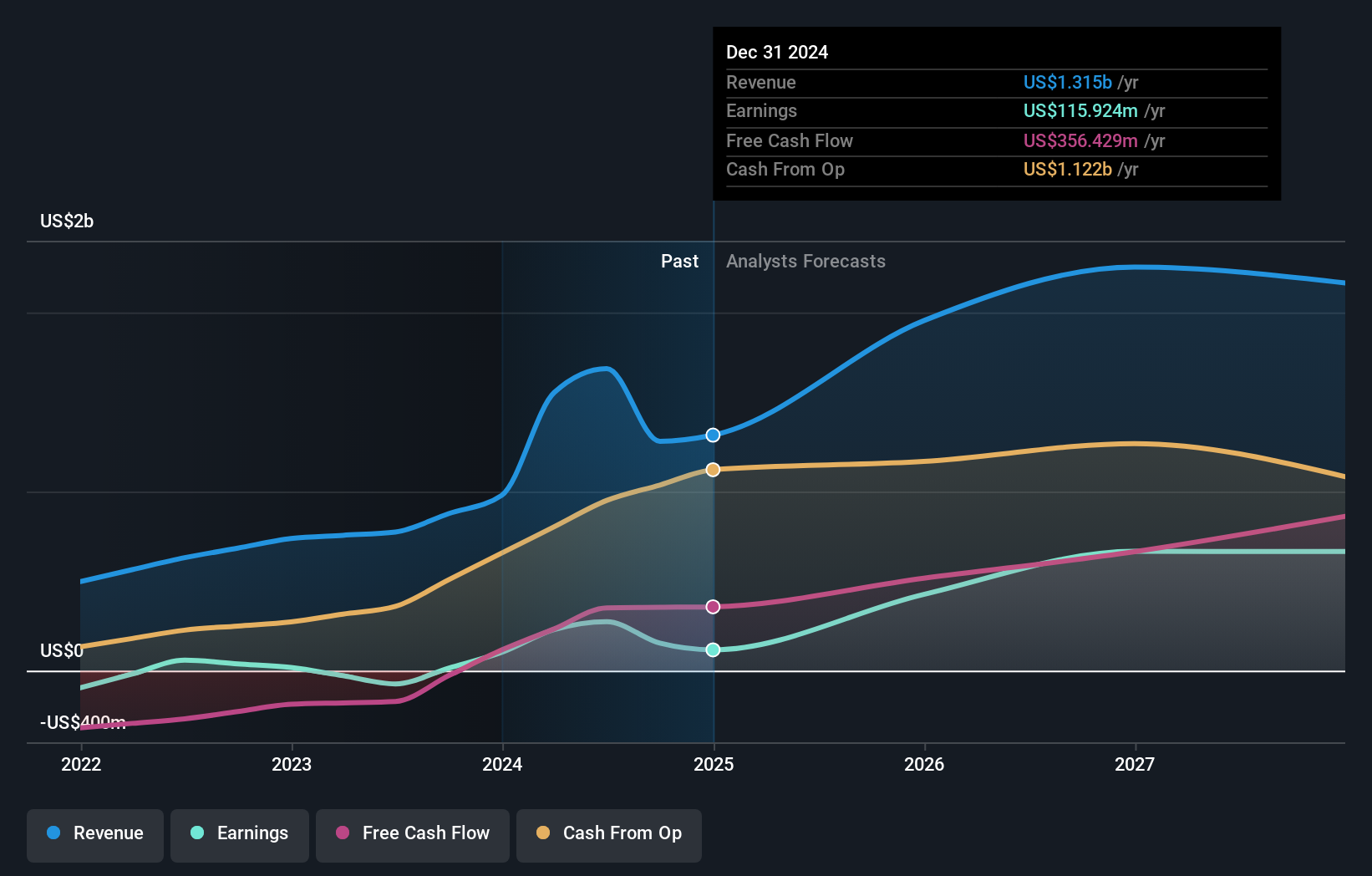

Overview: Energean plc is an oil and gas exploration, production, and development company with a market capitalization of approximately £1.94 billion.

Operations: The company generates revenue primarily from its oil and gas exploration and production activities, totaling approximately $1.42 billion.

Insider Ownership: 10.6%

Earnings Growth Forecast: 14.6% p.a.

Energean, a UK-based growth company with significant insider ownership, is navigating mixed financial waters. While its revenue growth at 11.1% annually surpasses the UK market average of 3.5%, its earnings are set to expand by 14.62% per year, slightly above the market's 12.6%. Despite a substantial earnings increase last year (970.8%), concerns linger over high debt levels and poor dividend coverage (8.77%). Recent corporate activities include declaring a quarterly dividend and providing upbeat production guidance for 2024.

- Get an in-depth perspective on Energean's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Energean's share price might be on the cheaper side.

Where To Now?

- Unlock our comprehensive list of 61 Fast Growing UK Companies With High Insider Ownership by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Craneware is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CRW

Craneware

Develops, licenses, and supports computer software for the healthcare industry in the United States.

Reasonable growth potential with proven track record.