- United Kingdom

- /

- Commercial Services

- /

- AIM:FRAN

August 2024 UK Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has remained flat, yet it is up 9.7% over the past year with earnings forecast to grow by 14% annually. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Filtronic (AIM:FTC) | 28.6% | 33.5% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 74.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

| Helios Underwriting (AIM:HUW) | 23.9% | 14.7% |

| Foresight Group Holdings (LSE:FSG) | 31.9% | 27.9% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Velocity Composites (AIM:VEL) | 27.6% | 188.7% |

| Judges Scientific (AIM:JDG) | 11.9% | 27.5% |

| Hochschild Mining (LSE:HOC) | 38.4% | 57.3% |

We'll examine a selection from our screener results.

Franchise Brands (AIM:FRAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Franchise Brands plc, with a market cap of £359.45 million, operates in franchising and related activities across the United Kingdom, North America, and Europe through its subsidiaries.

Operations: The company's revenue segments (in millions of £) are Azura: 0.75, Pirtek: 41.95, B2C Division: 6.11, Water & Waste: 48.88, and Filta International: 27.12.

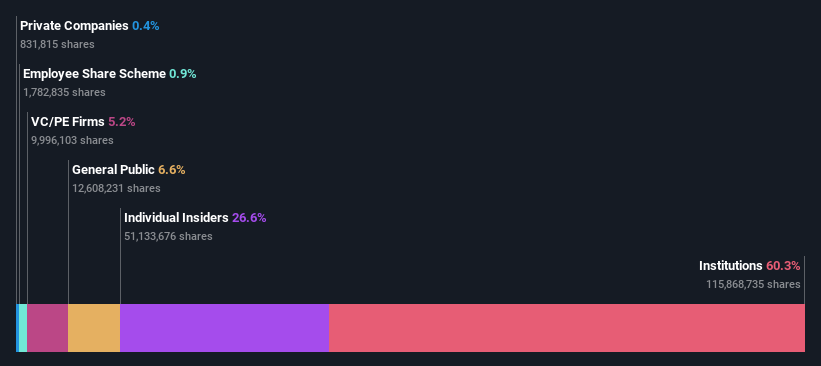

Insider Ownership: 26.6%

Return On Equity Forecast: N/A (2026 estimate)

Franchise Brands, a growth company with high insider ownership in the UK, has experienced significant executive changes recently, including new appointments to its board and management. Despite a drop in net income to £3.04 million for 2023 from £8.13 million the previous year, the company's revenue surged to £121.27 million from £69.84 million. Insiders have been actively buying shares over the past three months, indicating confidence in its forecasted annual earnings growth of 40.7%.

- Click here to discover the nuances of Franchise Brands with our detailed analytical future growth report.

- The analysis detailed in our Franchise Brands valuation report hints at an deflated share price compared to its estimated value.

Energean (LSE:ENOG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energean plc is involved in the exploration, production, and development of oil and gas, with a market cap of £1.79 billion.

Operations: Energean's revenue primarily comes from its oil and gas exploration and production segment, which generated $1.42 billion.

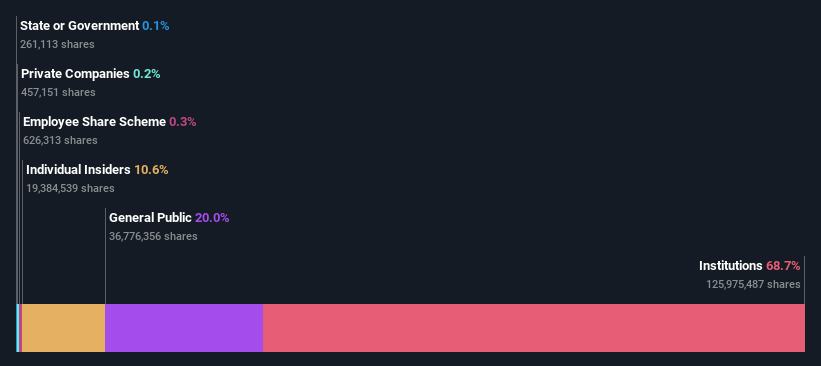

Insider Ownership: 10.6%

Return On Equity Forecast: 45% (2026 estimate)

Energean, characterized by high insider ownership, has recently expanded its operations with the start-up of the Cassiopea field offshore Italy and the Katlan development project in Israel. Despite a significant earnings growth of 970.8% over the past year, Energean faces challenges such as high debt levels and unsustainable dividends. However, analysts forecast a 14.6% annual earnings growth and a potential stock price rise of 39.2%, supported by substantial insider buying in recent months.

- Dive into the specifics of Energean here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of Energean shares in the market.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC, with a market cap of £1.71 billion, offers banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan through its subsidiaries.

Operations: The company's revenue segments include Uzbekistan operations, which generated GEL 236.42 million, and segment adjustments amounting to GEL 2.13 billion.

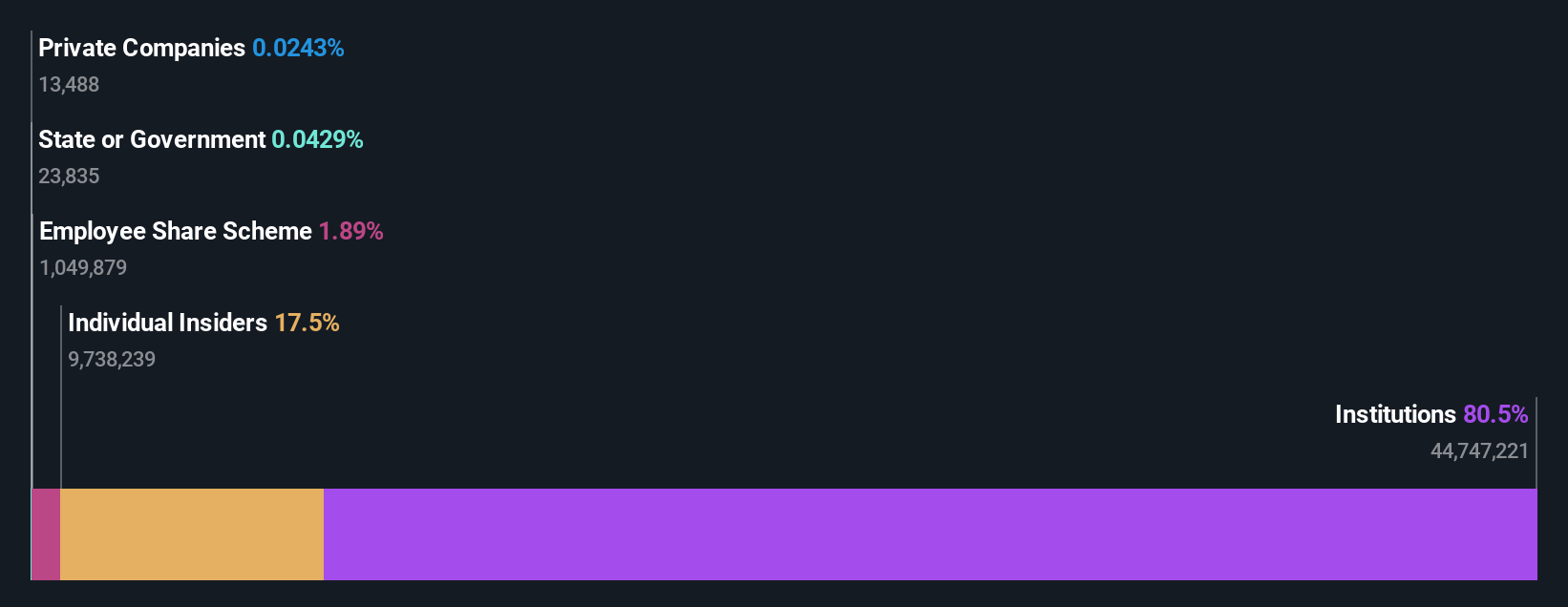

Insider Ownership: 17.6%

Return On Equity Forecast: 25% (2027 estimate)

TBC Bank Group, with significant insider ownership, has shown robust performance with net income rising to GEL 617.4 million for H1 2024 from GEL 537.46 million a year ago. Despite a history of shareholder dilution and an unstable dividend track record, its revenue is forecast to grow at 18.9% annually, outpacing the UK market's growth rate of 3.7%. Additionally, TBCG trades at nearly half its estimated fair value and maintains a low bad loan allowance of 76%.

- Click to explore a detailed breakdown of our findings in TBC Bank Group's earnings growth report.

- The valuation report we've compiled suggests that TBC Bank Group's current price could be quite moderate.

Seize The Opportunity

- Reveal the 67 hidden gems among our Fast Growing UK Companies With High Insider Ownership screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FRAN

Franchise Brands

Through its subsidiaries, engages in franchising and related activities in the United Kingdom, North America, and rest of Europe.

Reasonable growth potential and fair value.