- United Kingdom

- /

- Infrastructure

- /

- LSE:OCN

Undiscovered Gems in the United Kingdom for August 2024

Reviewed by Simply Wall St

The United Kingdom market has stayed flat over the past 7 days but is up 9.7% over the past year, with earnings forecast to grow by 14% annually. In this climate, identifying good stocks often involves finding those with strong growth potential and solid fundamentals that have yet to capture widespread attention.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| FW Thorpe | 3.34% | 11.37% | 9.41% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Griffin Mining (AIM:GFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Griffin Mining Limited is a mining and investment company focused on the exploration, development, and operation of mineral properties with a market cap of £251.14 million.

Operations: Griffin Mining generates revenue primarily from its Caijiaying Zinc Gold Mine, which reported $146.02 million in revenue. The company's market cap stands at £251.14 million.

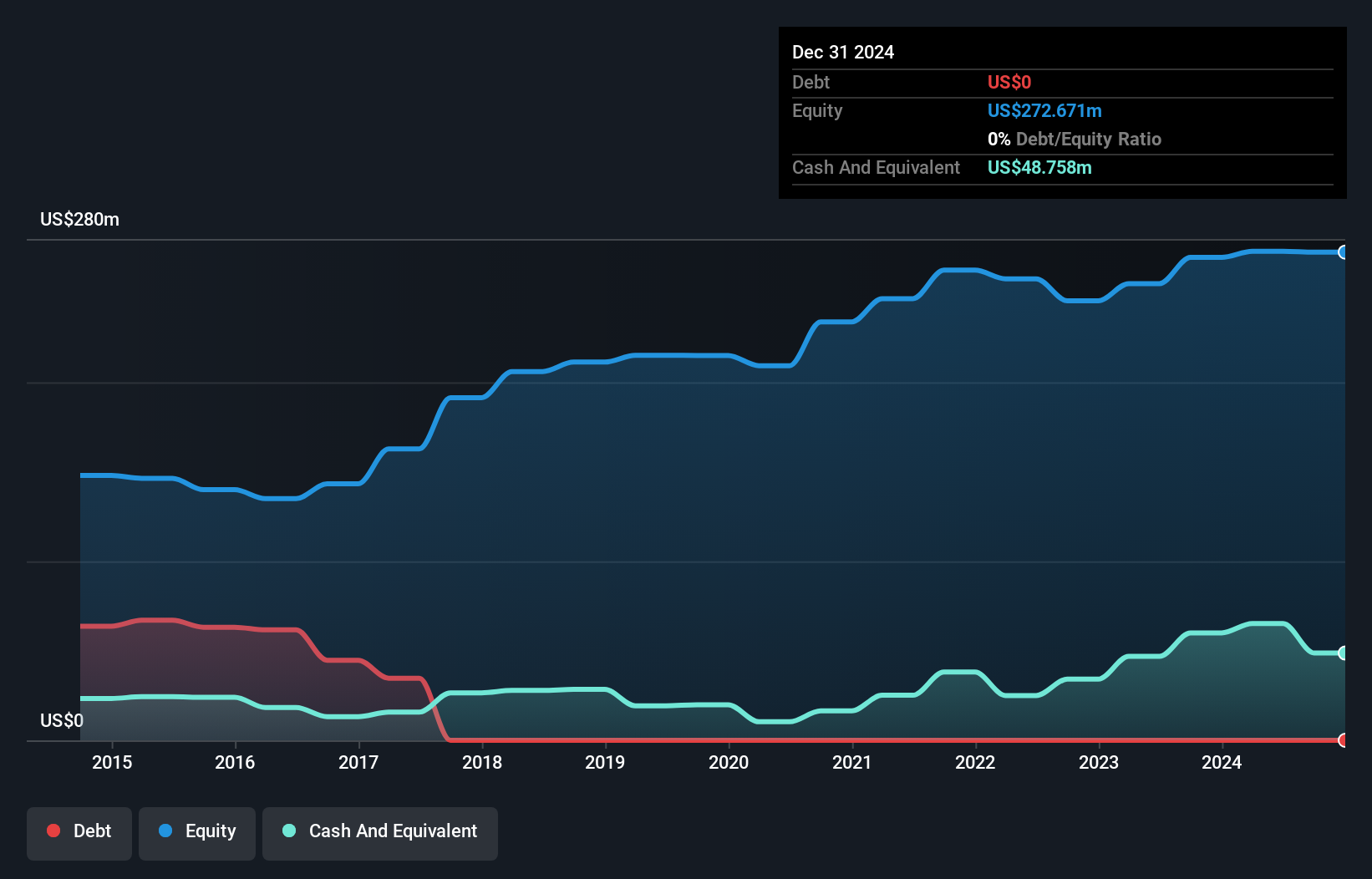

Griffin Mining has shown impressive performance, with earnings growing by 97.8% over the past year, significantly outpacing the Metals and Mining industry growth of 7.6%. The company is debt-free and trades at 68.9% below its estimated fair value, indicating potential undervaluation. Recent production results for Q2 2024 highlight increased ore mined to 429,448 tonnes from last year's 366,762 tonnes and a notable rise in gold production to 6,037 ounces from 3,237 ounces previously.

- Navigate through the intricacies of Griffin Mining with our comprehensive health report here.

Assess Griffin Mining's past performance with our detailed historical performance reports.

Kitwave Group (AIM:KITW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kitwave Group plc operates as a wholesale distributor in the United Kingdom with a market cap of £232.07 million.

Operations: Kitwave Group plc generates revenue from three primary segments: Ambient (£225.98 million), Foodservice (£191.60 million), and Frozen & Chilled (£229.17 million).

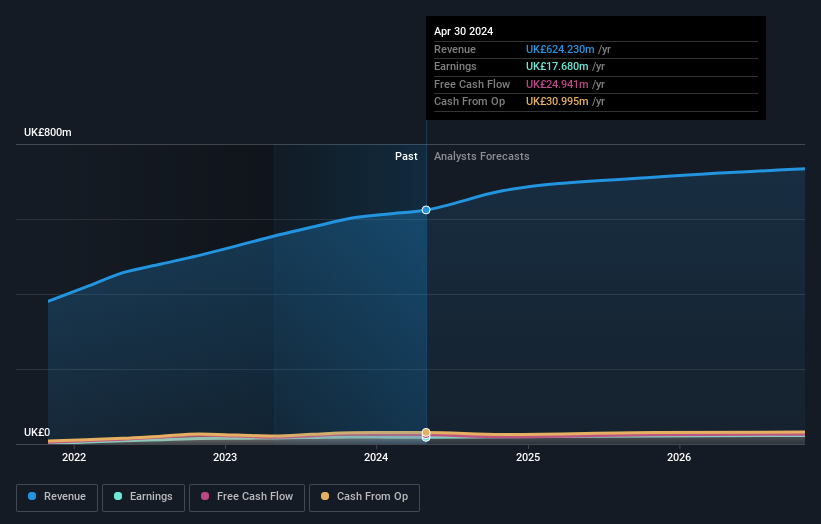

Kitwave Group, a small cap in the UK, reported half-year sales of £296.96 million, up from £274.95 million last year. Net income dropped to £5.08 million from £6.36 million previously, with basic earnings per share at £0.073 compared to last year's £0.091. Trading at 63% below its estimated fair value and with interest payments well covered by EBIT (5.7x), Kitwave's debt level remains high with a net debt to equity ratio of 56.6%.

- Click here to discover the nuances of Kitwave Group with our detailed analytical health report.

Review our historical performance report to gain insights into Kitwave Group's's past performance.

Ocean Wilsons Holdings (LSE:OCN)

Simply Wall St Value Rating: ★★★★★★

Overview: Ocean Wilsons Holdings Limited, an investment holding company with a market cap of £518.07M, provides maritime and logistics services in Brazil.

Operations: The company generates revenue primarily from its maritime services in Brazil, amounting to $519.35 million.

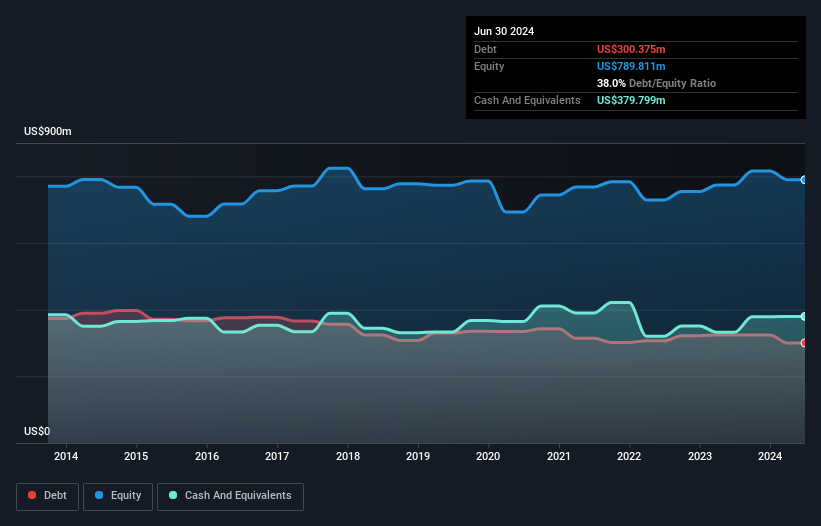

Ocean Wilsons Holdings, a UK-based company, has shown solid financial performance with a 32.7% earnings growth over the past year, surpassing the Infrastructure industry’s 20.5%. Their price-to-earnings ratio stands at 11.1x, notably lower than the UK market average of 17x. Recently, OCN reported a significant one-off gain of $28.8M impacting its financial results to June 30, 2024. Additionally, discussions are ongoing regarding the potential sale of its subsidiary Wilson Sons S.A., which could influence future valuations and strategic direction for Ocean Wilsons Holdings.

- Unlock comprehensive insights into our analysis of Ocean Wilsons Holdings stock in this health report.

Understand Ocean Wilsons Holdings' track record by examining our Past report.

Seize The Opportunity

- Gain an insight into the universe of 80 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OCN

Ocean Wilsons Holdings

An investment holding company, offers maritime and logistics services in Brazil.

Flawless balance sheet established dividend payer.