- United Kingdom

- /

- Oil and Gas

- /

- LSE:BP.

BP (LSE:BP.)—Exploring the Latest Valuation After Recent Momentum Shift

Reviewed by Simply Wall St

BP (LSE:BP.) shares have seen modest swings recently, with the stock returning 3% over the past month and up 7% in the past 3 months. Investors continue to track developments in the global energy sector for cues on future performance.

See our latest analysis for BP.

After a strong start to the year, BP’s 1-year total shareholder return stands at 22%, handily outpacing its recent share price gains. Momentum has been building, supported by upbeat sector sentiment and a string of positive earnings surprises. This suggests the market is warming up to BP’s growth story.

If BP’s shift in momentum has you rethinking your watchlist, now’s the perfect time to discover fast growing stocks with high insider ownership

But with BP trading just below analyst targets despite robust returns and accelerating earnings, the question arises: is there untapped value here, or has the market already factored in the company’s future growth prospects?

Most Popular Narrative: 3.9% Undervalued

BP’s last close of £4.53 sits just below the narrative fair value estimate of £4.72 per share. The latest consensus sees the market not fully capturing BP’s improving earnings potential and sector positioning.

Focused project execution, cost reduction, and technological innovation are set to enhance BP's margins and cash flow while positioning it for persistent global energy demand growth. Strategic asset optimization and strong trading performance support stable, high-margin earnings and resilience amid sector and regulatory shifts.

Want to see what’s powering this shift in sentiment? The most popular narrative leans heavily on bold assumptions around BP’s rapidly rising profit margins and a dramatic surge in earnings. But what’s the key number that unlocks this valuation jump? Unlock the details behind the forecast that sets BP apart from its sector peers.

Result: Fair Value of £4.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing capital misallocation in new energy projects and operational weaknesses in downstream segments could challenge BP’s margin improvement and long-term profitability narrative.

Find out about the key risks to this BP narrative.

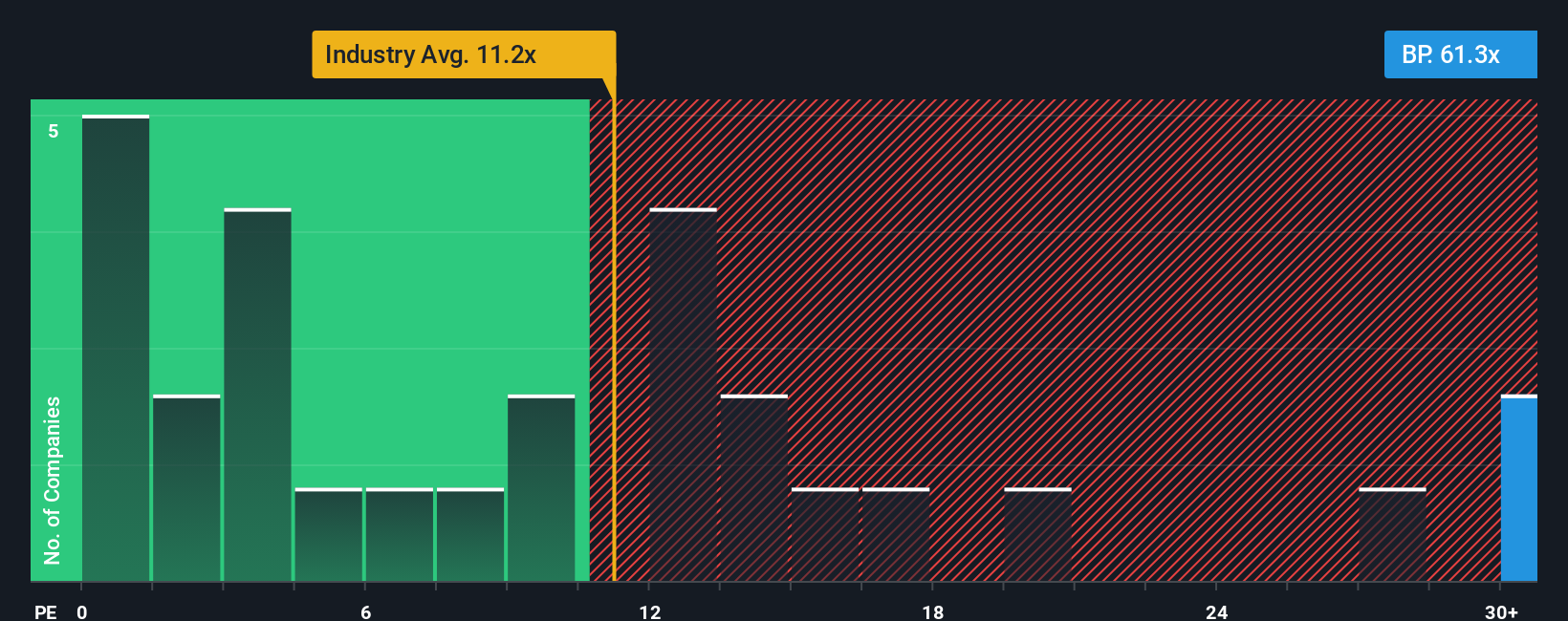

Another View: Price-To-Earnings Ratio Signals Caution

Taking a look through another lens, BP’s shares are trading at a price-to-earnings ratio of 60, far higher than the industry average of 10.1 and peers at 11.4. This steep premium, especially compared to the fair ratio of 20.7, suggests valuation risk is outpacing sector norms. Is the market overlooking something, or is confidence overextended?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BP Narrative

If you see things differently or want to dig into the numbers yourself, shaping your own narrative only takes a few minutes. Do it your way

A great starting point for your BP research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize the chance to uncover tomorrow’s winners. Staying ahead means knowing where to look. These hand-picked strategies could uncover your next standout opportunity:

- Spot generous income potential by tapping into these 16 dividend stocks with yields > 3% with the highest yields and a track record of rewarding shareholders.

- Get ahead of the technological curve as you back visionaries transforming medicine, automation, and diagnostics. Start your search with these 30 healthcare AI stocks.

- Capitalize on untapped value by targeting these 926 undervalued stocks based on cash flows showing promising fundamentals and attractive prices, poised for strong returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BP.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives