- United Kingdom

- /

- Energy Services

- /

- AIM:POS

Plexus Holdings plc's (LON:POS) Shares Climb 26% But Its Business Is Yet to Catch Up

Despite an already strong run, Plexus Holdings plc (LON:POS) shares have been powering on, with a gain of 26% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 35% in the last twelve months.

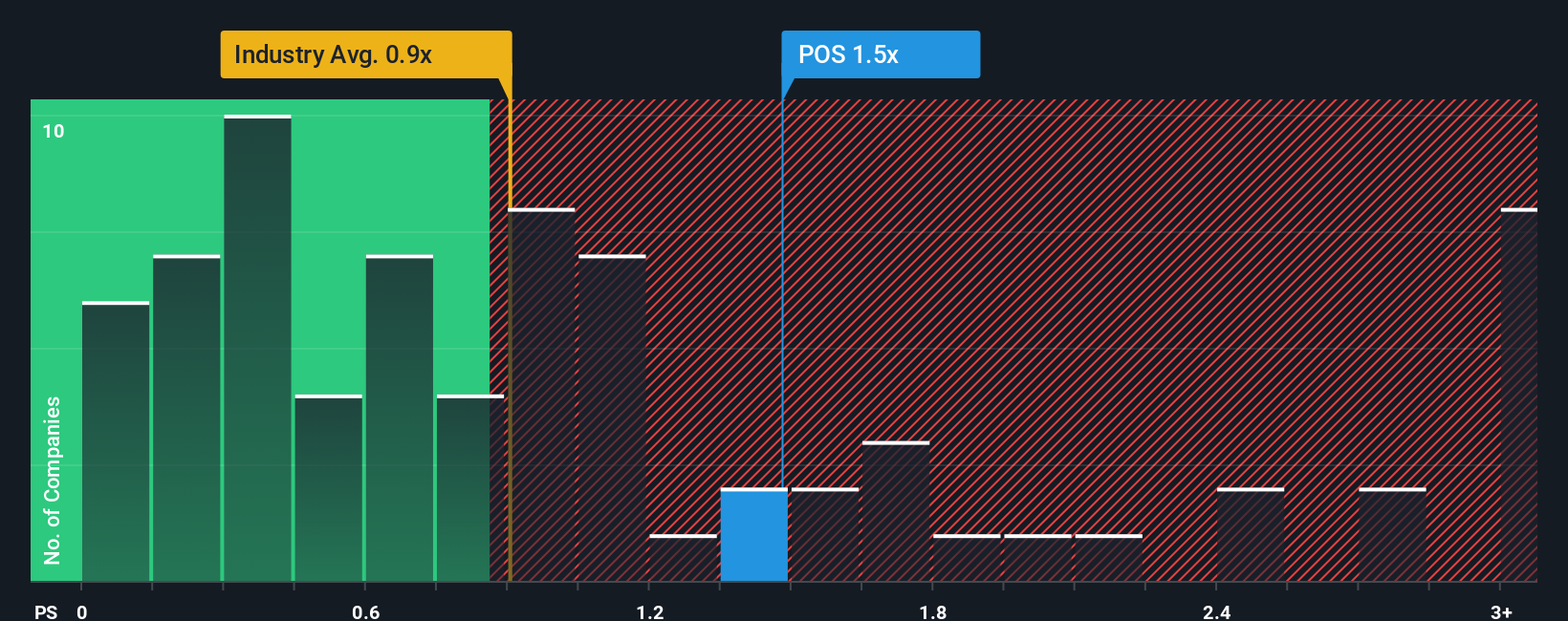

Since its price has surged higher, given close to half the companies operating in the United Kingdom's Energy Services industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider Plexus Holdings as a stock to potentially avoid with its 1.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Plexus Holdings

How Has Plexus Holdings Performed Recently?

Recent times have been advantageous for Plexus Holdings as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Plexus Holdings.Is There Enough Revenue Growth Forecasted For Plexus Holdings?

The only time you'd be truly comfortable seeing a P/S as high as Plexus Holdings' is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 79%. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 33% during the coming year according to the one analyst following the company. With the industry predicted to deliver 3.8% growth, that's a disappointing outcome.

With this information, we find it concerning that Plexus Holdings is trading at a P/S higher than the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Final Word

Plexus Holdings' P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Plexus Holdings' analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. At these price levels, investors should remain cautious, particularly if things don't improve.

You should always think about risks. Case in point, we've spotted 3 warning signs for Plexus Holdings you should be aware of, and 1 of them makes us a bit uncomfortable.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:POS

Plexus Holdings

Provides equipment and services for the oil and gas drilling industry in the United Kingdom, the United States, and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives