- United Kingdom

- /

- Oil and Gas

- /

- AIM:NWF

Investors Who Bought NWF Group (LON:NWF) Shares A Year Ago Are Now Up 23%

If you want to compound wealth in the stock market, you can do so by buying an index fund. But investors can boost returns by picking market-beating companies to own shares in. To wit, the NWF Group plc (LON:NWF) share price is 23% higher than it was a year ago, much better than the market decline of around 9.6% (not including dividends) in the same period. That's a solid performance by our standards! Looking back further, the share price is 22% higher than it was three years ago.

Check out our latest analysis for NWF Group

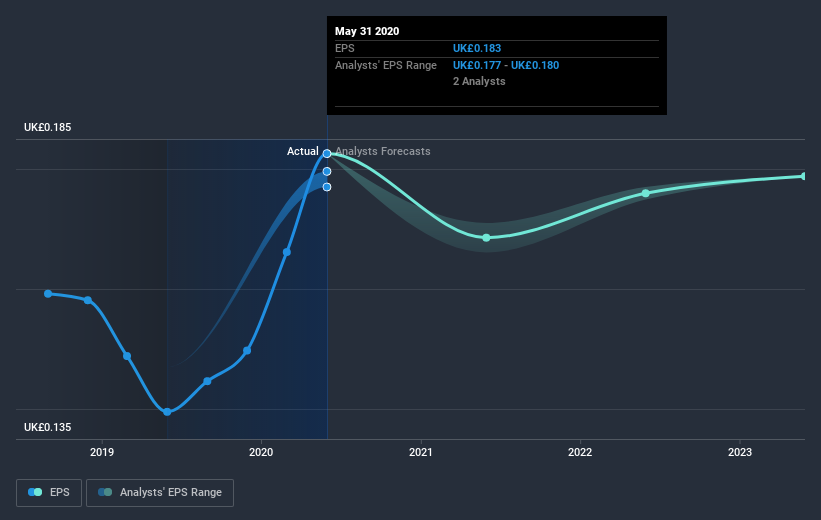

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year NWF Group grew its earnings per share (EPS) by 31%. This EPS growth is significantly higher than the 23% increase in the share price. So it seems like the market has cooled on NWF Group, despite the growth. Interesting. This cautious sentiment is reflected in its (fairly low) P/E ratio of 10.52.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that NWF Group has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for NWF Group the TSR over the last year was 28%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that NWF Group has rewarded shareholders with a total shareholder return of 28% in the last twelve months. And that does include the dividend. That gain is better than the annual TSR over five years, which is 6%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand NWF Group better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with NWF Group .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade NWF Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NWF Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:NWF

NWF Group

Engages in the sale and distribution of fuel oils in the United Kingdom.

6 star dividend payer with excellent balance sheet.

Market Insights

Community Narratives