- United Kingdom

- /

- Diversified Financial

- /

- LSE:PAG

Top UK Dividend Stocks To Consider In May 2025

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices experience downward pressure due to weak trade data from China, investors in the UK market are closely monitoring global economic cues. In such uncertain times, dividend stocks can offer a measure of stability by providing regular income streams, making them an attractive option for those looking to navigate volatile market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 6.45% | ★★★★★★ |

| Man Group (LSE:EMG) | 7.29% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.01% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.22% | ★★★★★☆ |

| Treatt (LSE:TET) | 3.20% | ★★★★★☆ |

| DCC (LSE:DCC) | 4.21% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.10% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.79% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.58% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.08% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top UK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

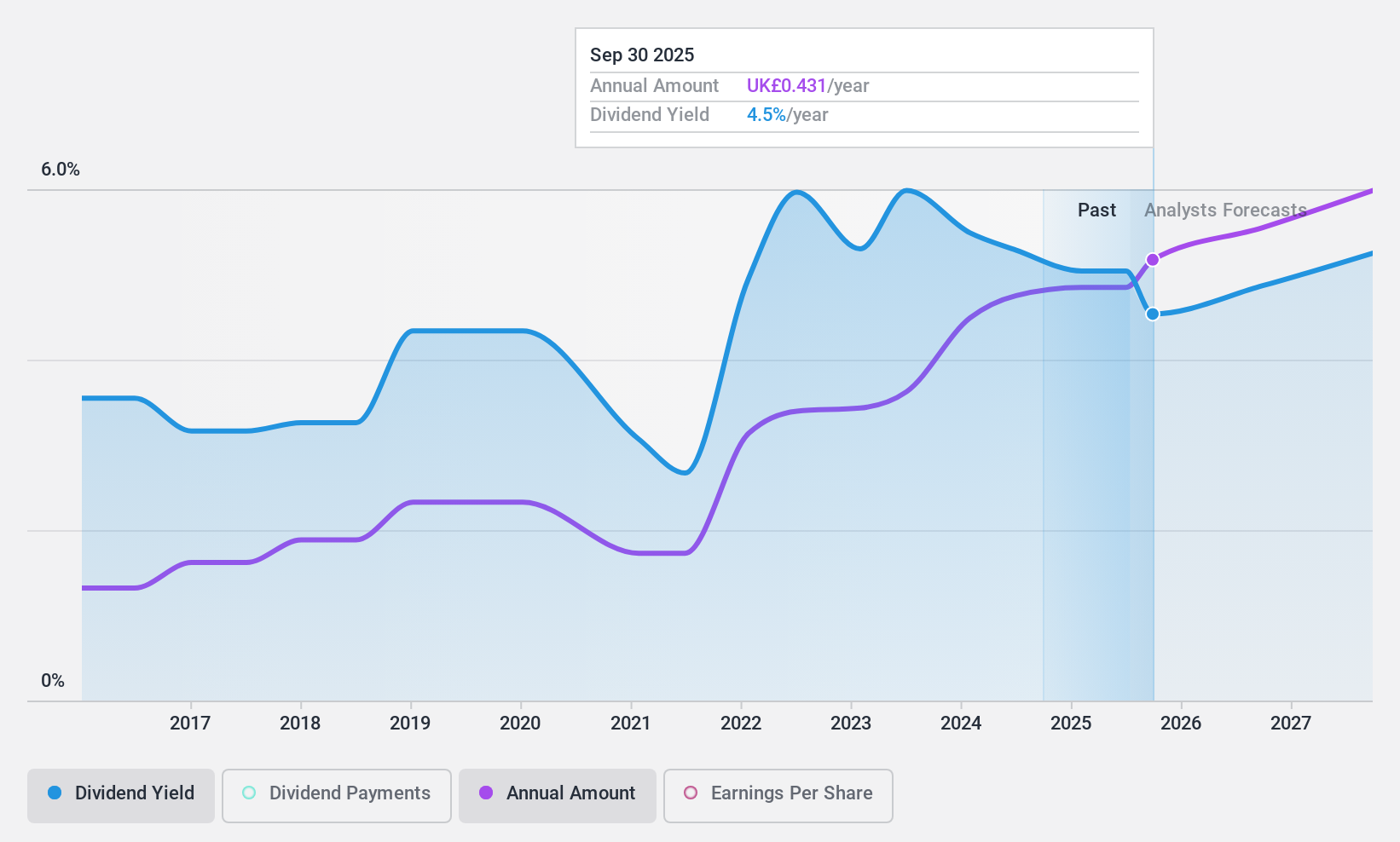

Hargreaves Services (AIM:HSP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hargreaves Services Plc offers environmental and industrial services across the United Kingdom, Europe, Hong Kong, and internationally with a market cap of £207.25 million.

Operations: Hargreaves Services Plc generates revenue primarily from its Services segment, amounting to £219.11 million, and Hargreaves Land segment, contributing £10.54 million.

Dividend Yield: 5.9%

Hargreaves Services has shown earnings growth of 15% over the past year, but its dividend payments are not well covered by cash flows, with a high cash payout ratio of 108.7%. Despite an attractive dividend yield of 5.89%, placing it in the top 25% in the UK market, dividends have been volatile and unreliable over the past decade. The current payout ratio is sustainable at 81%, though one-off items affect earnings quality.

- Get an in-depth perspective on Hargreaves Services' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Hargreaves Services shares in the market.

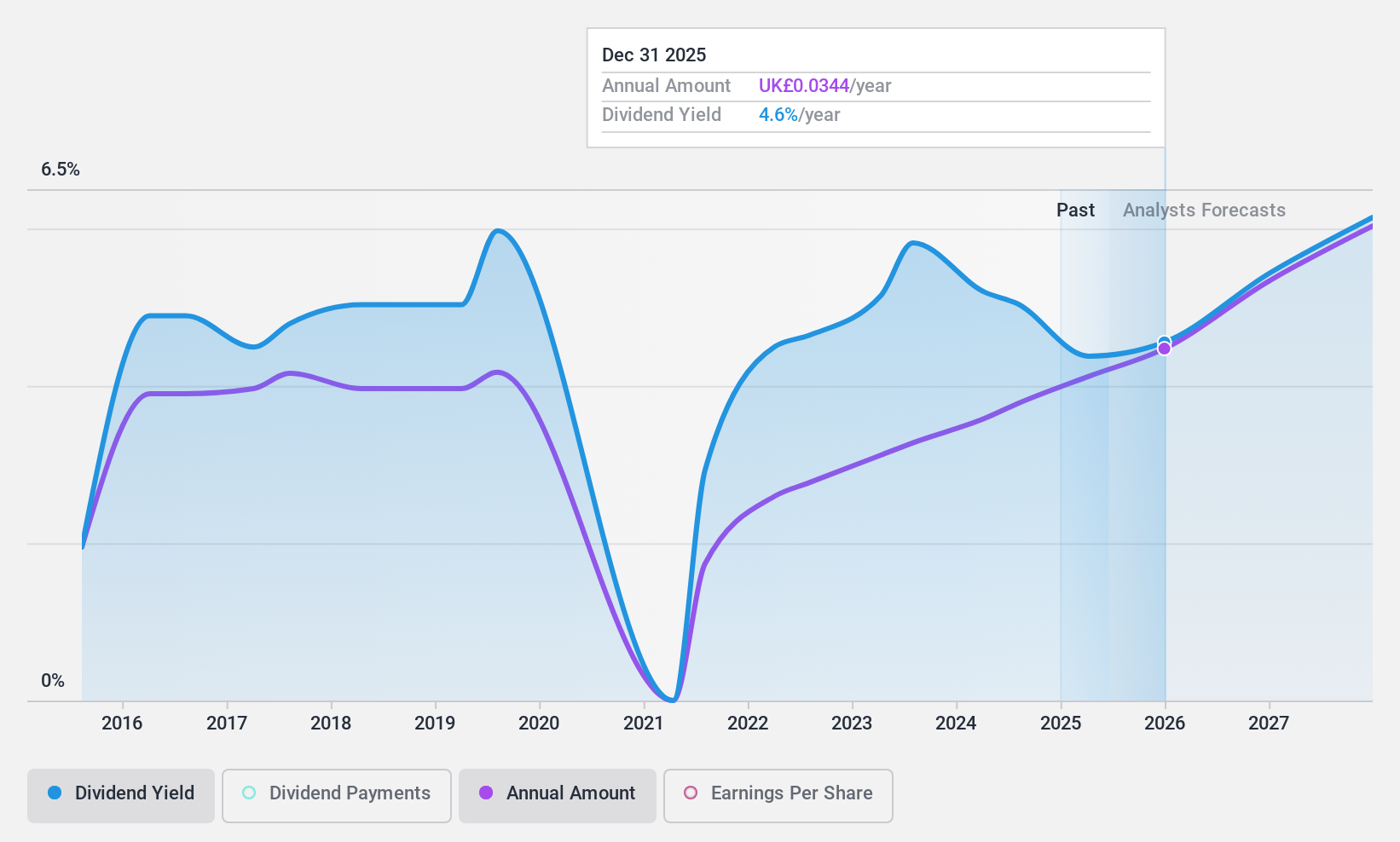

Lloyds Banking Group (LSE:LLOY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lloyds Banking Group plc, with a market cap of £43.77 billion, offers a variety of banking and financial products and services in the United Kingdom and internationally through its subsidiaries.

Operations: Lloyds Banking Group generates its revenue through diverse banking and financial services offered both domestically in the United Kingdom and internationally.

Dividend Yield: 4.3%

Lloyds Banking Group's dividend yield of 4.32% is lower than the UK's top payers, but dividends are covered by earnings with a payout ratio of 50.6%. The company has increased dividends over the past decade, though payments have been volatile and unreliable. Recent initiatives include a £300 million share buyback and strategic AI advancements with Google Cloud to enhance services, potentially impacting future profitability and dividend stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Lloyds Banking Group.

- Our valuation report unveils the possibility Lloyds Banking Group's shares may be trading at a premium.

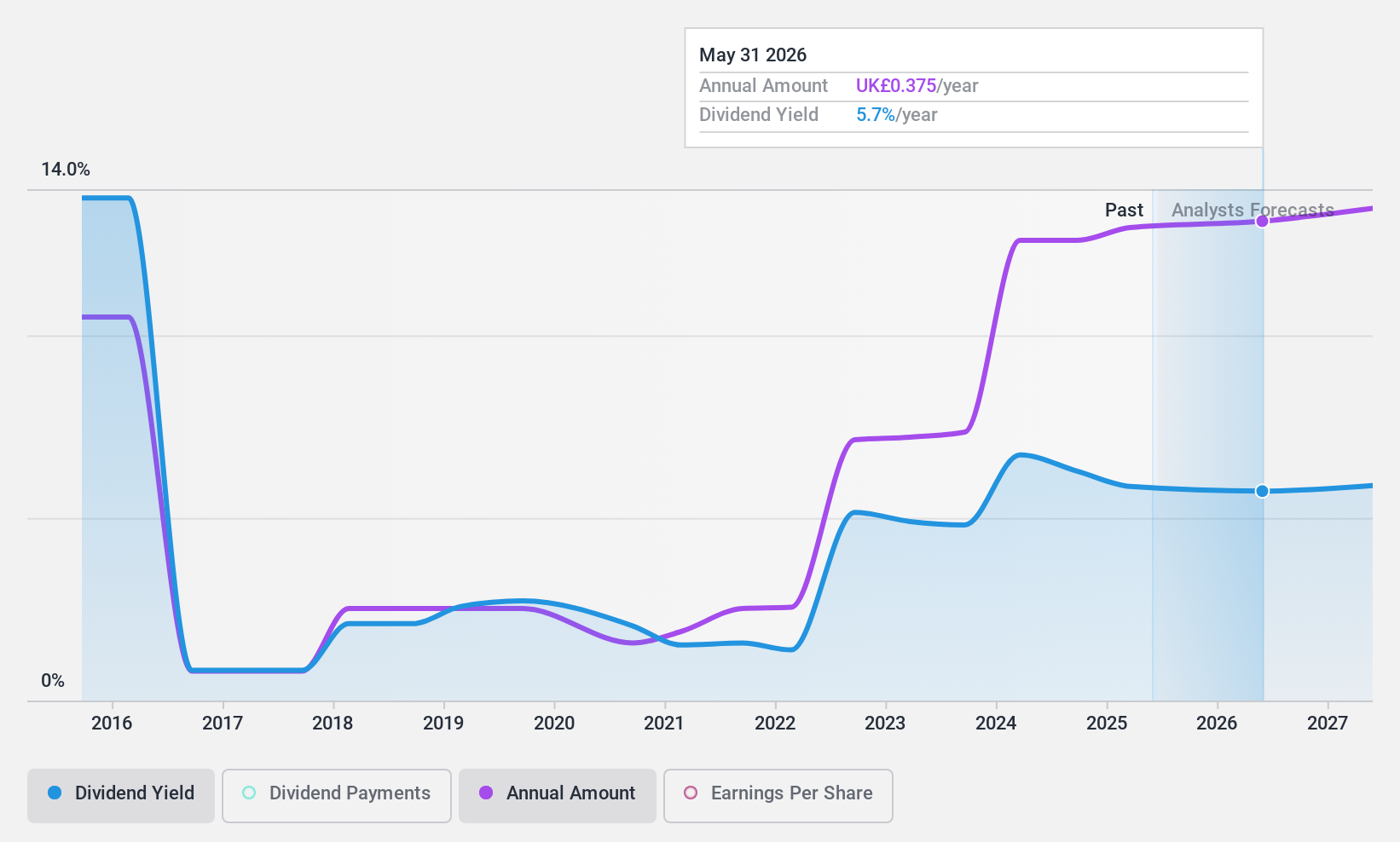

Paragon Banking Group (LSE:PAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Paragon Banking Group PLC offers financial products and services in the United Kingdom, with a market cap of £1.75 billion.

Operations: Paragon Banking Group PLC generates revenue through its Mortgage Lending segment, which accounts for £280.50 million, and its Commercial Lending segment, contributing £115.20 million.

Dividend Yield: 4.5%

Paragon Banking Group's dividend yield of 4.51% is below the UK's top payers, yet dividends are well-covered by earnings and cash flows, with payout ratios of 45.6% and 3.6%, respectively. Despite a history of volatility, recent shareholder approval for a final dividend indicates potential stability. The stock trades at good value compared to peers but has seen significant insider selling recently. Leadership changes include appointing Marius Van Niekerk as Secretary in April 2025.

- Take a closer look at Paragon Banking Group's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Paragon Banking Group is trading behind its estimated value.

Turning Ideas Into Actions

- Reveal the 58 hidden gems among our Top UK Dividend Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PAG

Paragon Banking Group

Provides financial products and services in the United Kingdom.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives