- United Kingdom

- /

- Oil and Gas

- /

- AIM:CASP

Caspian Sunrise plc's (LON:CASP) 26% Share Price Plunge Could Signal Some Risk

To the annoyance of some shareholders, Caspian Sunrise plc (LON:CASP) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The last month has meant the stock is now only up 9.5% during the last year.

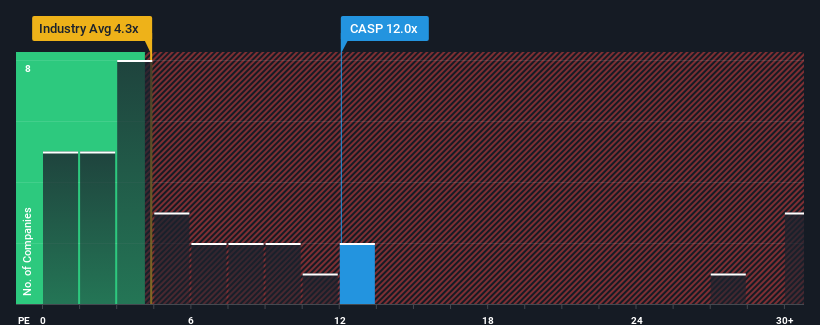

In spite of the heavy fall in price, it's still not a stretch to say that Caspian Sunrise's price-to-earnings (or "P/E") ratio of 12x right now seems quite "middle-of-the-road" compared to the market in the United Kingdom, where the median P/E ratio is around 14x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

It looks like earnings growth has deserted Caspian Sunrise recently, which is not something to boast about. One possibility is that the P/E is moderate because investors think this benign earnings growth rate might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Caspian Sunrise

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Caspian Sunrise's to be considered reasonable.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 6.7% shows it's noticeably less attractive on an annualised basis.

With this information, we find it interesting that Caspian Sunrise is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Bottom Line On Caspian Sunrise's P/E

Following Caspian Sunrise's share price tumble, its P/E is now hanging on to the median market P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Caspian Sunrise currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 2 warning signs for Caspian Sunrise (1 is potentially serious!) that we have uncovered.

If you're unsure about the strength of Caspian Sunrise's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CASP

Moderate risk with mediocre balance sheet.

Market Insights

Community Narratives